In the realm of financial trading, having access to reliable and effective market indicators is paramount for making informed decisions. MetaTrader 5 (MT5), a popular trading platform, offers a wide array of technical indicators designed to help traders identify potential opportunities in the markets. In this comprehensive guide, we will delve into the best indicators on MT5, empowering you with the knowledge and tools to enhance your trading strategies.

Image: www.chinettiforex.com

A Gateway to Market Insights

Technical indicators are mathematical tools that analyze historical market data to predict future price movements. They help traders identify trends, reversals, overbought or oversold conditions, and various other market characteristics. By incorporating these indicators into your trading platform, you can gain valuable insights that can significantly improve your chances of success.

MT5 boasts an impressive collection of over 30 built-in indicators, ranging from simple trend followers to advanced oscillators and volume-based indicators. Each indicator offers unique insights into the market, allowing you to tailor your trading strategies to specific market conditions and your risk tolerance.

Unveiling the Most Effective MT5 Indicators

With so many indicators available, choosing the right ones can be overwhelming. To assist you, we have compiled a list of the best indicators on MT5, combining proven reliability with practical applications:

Trend Indicators

Moving Average (MA): A classic trend indicator that smooths out price data to reveal the underlying trend. Ideal for identifying long-term trends and potential reversals.

Exponential Moving Average (EMA): A variation of the MA that gives more weight to recent prices. Faster and more responsive than the MA, it helps detect trend changes early on.

Ichimoku Cloud: A comprehensive indicator that combines multiple trend and momentum indicators, providing a clear visual representation of market conditions and potential trading opportunities.

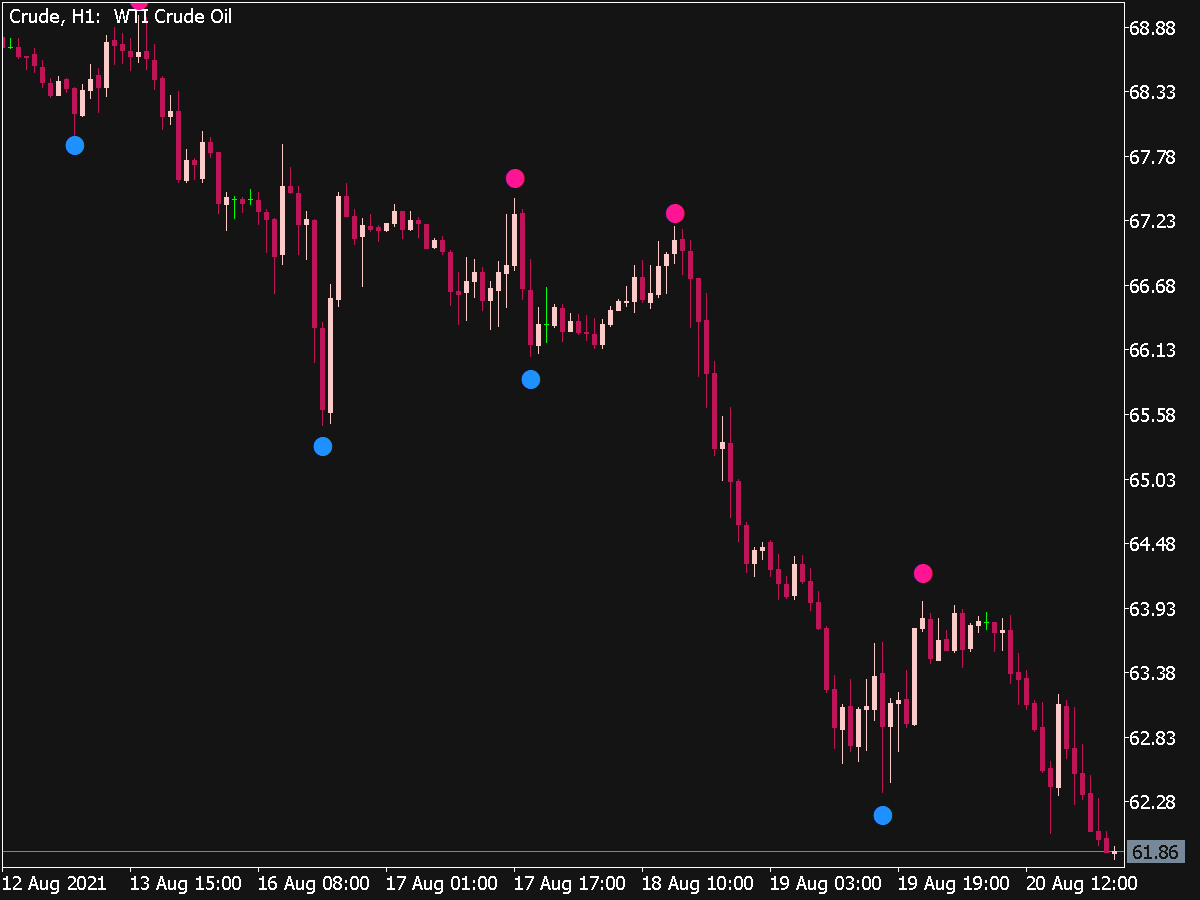

Image: www.best-metatrader-indicators.com

Momentum Indicators

Relative Strength Index (RSI): Measures the speed and magnitude of price changes to identify overbought or oversold conditions. Signals potential trend reversals and momentum shifts.

Stochastics Oscillator: Similar to the RSI, it compares the closing price to a specific price range. Indicates overbought/oversold levels and potential trend changes.

Volatility Indicators

Bollinger Bands: Create a volatility envelope around the price. When prices trade outside the bands, it can indicate a potential trend reversal or a breakout.

Average True Range (ATR): Measures volatility by calculating the true range of price movements over a specified period. Helps determine stop-loss levels and assess market risk.

Volume-Based Indicators

Volume Profile: Plots the volume of trades at each price level, revealing areas of support and resistance. Identifies potential trading zones and market liquidity.

On Balance Volume (OBV): A cumulative indicator that measures the momentum of volume flow. Indicates potential trend changes and areas of accumulation/distribution.

Expert Insights and Actionable Tips

To make the most of these indicators, it’s crucial to understand their limitations and use them in conjunction with other technical analysis tools. Experts recommend the following:

- Combine multiple indicators: Use different types of indicators to gain a comprehensive view of the market.

- Consider market context: Indicators should be interpreted in the context of the overall market trend, time frame, and news events.

- Set realistic expectations: Indicators are not perfect predictors, so don’t rely solely on them.

Best Indicators On Mt5

https://youtube.com/watch?v=OK2WOen-bdM

Embracing the Power of Knowledge

Equipping yourself with the right tools is essential for successful trading. By mastering the best indicators on MT5, you can elevate your trading strategies, make informed decisions, and seize market opportunities with greater confidence. Remember, knowledge is power, and in the financial markets, it’s the foundation for achieving your trading goals.