Maintaining targets in forex can be daunting, particularly in the fast-paced H4 timeframe. But with the right strategy and unwavering discipline, you can navigate these challenges and elevate your trading performance. Here’s a comprehensive guide to help you conquer this aspect of forex trading.

Image: blog.hsb.co.id

Defining Target Maintenance

Target maintenance refers to the ability to hold onto profits once you’ve reached your desired level. In the H4 timeframe, where market movements can be significant, maintaining targets requires a proactive approach. This involves constant monitoring of the market, adjusting positions as needed, and implementing risk management techniques to preserve your gains.

Strategies for Success

1. Position Sizing: Manage risk by adjusting the size of your positions based on market conditions. Avoid over-leveraging, and maintain a balance between reward and potential loss.

2. Entry and Exit Timing: Identify optimal entry and exit points using technical indicators like moving averages and support and resistance levels. Time your entries for favorable market conditions, and exit wisely to secure your profits.

3. Stop Loss and Take Profit Orders: Protect your trades by setting stop-loss and take-profit levels. These orders automatically close your positions when certain price triggers are met.

Case Study

For instance, let’s assume you open a long position in the EUR/USD pair with a target price of 1.1500 in the H4 timeframe. As the market rallies, your position moves towards profitability. By monitoring market movements and adjusting your position size if necessary, you manage to maintain your gains. Once the price reaches your target, you exit the trade and secure your profits.

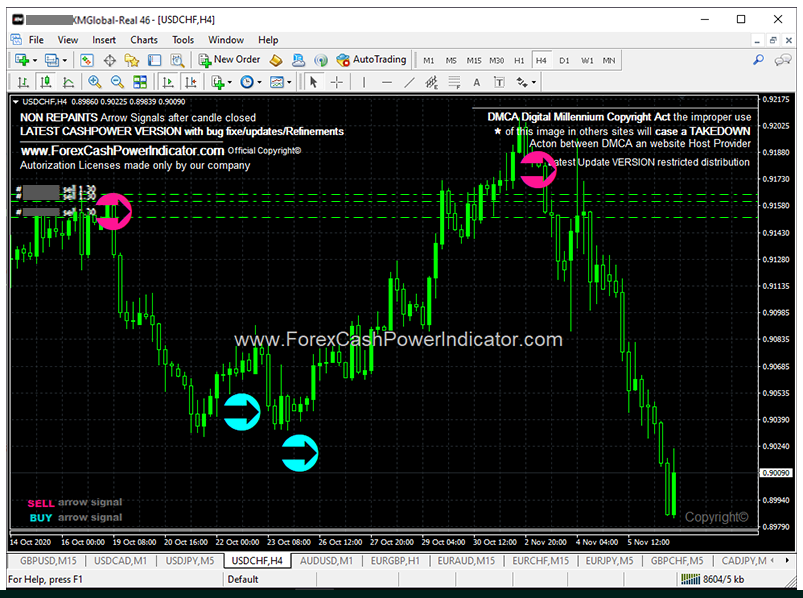

Image: forexcashpowerindicatornonrepaint.blogspot.com

Expert Insights

1. Patience and Discipline: Maintaining targets requires patience and unwavering discipline. Avoid the temptation to close positions prematurely out of fear or greed; instead, stick to your trading plan.

2. Monitor and Adjust: Constantly monitor market conditions and adjust your positions accordingly. Don’t hesitate to take partial profits or move your stop-loss levels to protect your gains.

FAQs

- Q: How should I set up my stop-loss orders?

A: Place your stop-loss orders below significant support levels or above resistance points to limit potential losses.

- Q: What are common mistakes in target maintenance?

A: Over-leveraging, premature profit-taking, and ignoring market trends can hinder target maintenance.

- Q: How can I improve my target maintenance skills?

A: Gain experience through demo trading, develop a trading plan, and seek guidance from experienced mentors.

In Forex How To Maintain The Targets In H4 Timeframe

Call to Action

Mastering target maintenance in the H4 timeframe is crucial for successful forex trading. By implementing the strategies outlined in this article, you can elevate your trading performance, safeguard your profits, and achieve your financial goals. Embrace the challenges, remain disciplined, and unleash your potential in the fast-paced world of H4 trading.

Are you ready to elevate your Forex trading skills and conquer the H4 timeframe challenges? Share your thoughts and experiences in the comments section below.