Introduction

Image: www.shaalaa.com

In today’s interconnected global economy, the import-export sector plays a pivotal role in shaping a nation’s economic health and overall development. For India, with its vast and diverse economy, maintaining a robust foreign exchange (forex) scenario is crucial for ensuring sustainable growth, stabilizing the currency, and fostering international trade. This comprehensive article delves into the intricate dynamics of India’s forex scenario in its import-export trade, exploring the historical context, key factors, and emerging trends that shape this critical realm.

Historical Context and Evolution

India’s forex scenario has evolved significantly over the years, reflecting the country’s economic liberalization policies and increasing integration into the global marketplace. In the pre-liberalization era, India’s forex reserves were tightly controlled by the government, leading to a shortage of foreign exchange for businesses and individuals. However, the economic reforms initiated in the early 1990s deregulated the forex market and introduced a market-determined exchange rate, allowing businesses to import and export more freely and expanding India’s participation in international trade.

Key Factors Shaping India’s Forex Scenario

Numerous factors interact to shape India’s forex scenario in the import-export trade, including:

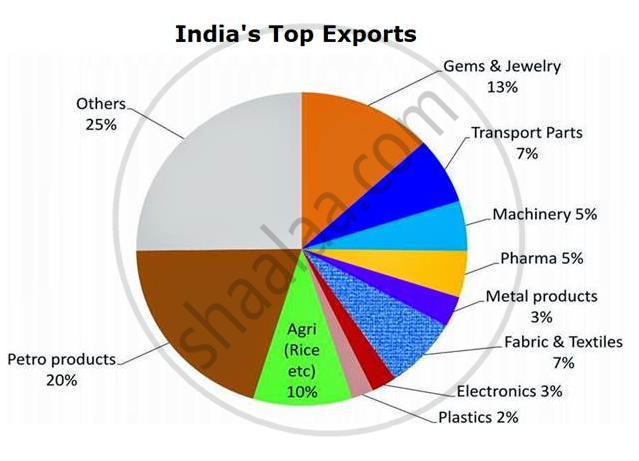

- Trade Balance: The trade balance, which measures the difference between exports and imports, is a key determinant of India’s forex position. A sustained trade deficit, where imports exceed exports, can put pressure on the Indian rupee and deplete forex reserves.

- Remittances: India receives a substantial amount of remittances from its citizens working abroad, which contribute to the country’s forex earnings. These remittances help offset the trade deficit and stabilize the exchange rate.

- Foreign Direct Investment (FDI): FDI, also known as foreign investment, plays a significant role in boosting India’s forex reserves. When foreign investors bring capital into India for investment, it increases the supply of foreign currencies in the market.

- Exchange Rate: The value of the Indian rupee against other currencies, or the exchange rate, directly impacts import and export activities. A weaker rupee makes Indian exports more competitive in international markets, while a stronger rupee favors imports.

Emerging Trends and Current Scenario

In recent years, India’s forex scenario in the import-export trade has been characterized by several notable trends:

- Rising Import Dependence: India’s import dependency has increased due to factors such as industrialization, urbanization, and increased consumption of foreign goods and services. This has put pressure on the forex reserves.

- Depreciating Rupee: In recent months, the Indian rupee has experienced a depreciation trend against major currencies, primarily due to global economic uncertainty and the impact of the COVID-19 pandemic.

- Growing Forex Reserves: Despite these challenges, India’s forex reserves have remained relatively robust, thanks to continued inflows of remittances and FDI. The Reserve Bank of India (RBI) takes measures to manage the forex reserves to maintain stability in the exchange rate.

Policy Implications and Future Outlook

The dynamics of India’s forex scenario in the import-export trade hold several policy implications for policymakers:

- Managing Trade Balance: The government can implement policies to promote exports and reduce non-essential imports to address the trade deficit.

- Encouraging Remittances and FDI: Measures to encourage remittances and FDI can help boost forex earnings and support the rupee.

- Exchange Rate Management: The RBI plays a crucial role in managing the exchange rate through interventions in the forex market to maintain stability and prevent sharp fluctuations.

Conclusion

Understanding India’s forex scenario in the import-export trade is essential for comprehending the country’s economic health and international standing. By balancing various factors and implementing prudent policies, India can navigate the challenges of a dynamic global economy and continue to reap the benefits of international trade. As India’s economic aspirations grow, managing its forex scenario will remain a critical aspect of fostering sustainable growth and maintaining financial stability.

Image: www.studypool.com

Import Export India’S Forex Scenario Ppt