The ebb and flow of exchange rates are intricate, molded by a symphony of economic factors. Among these conductors, foreign exchange (forex) reserves stand out as a maestro, swaying the value of currencies with their potent influence.

Image: www.rba.gov.au

Forex Reserves: The Currency’s Guardian

Forex reserves, the war chest of a nation’s currency, are a stockpile of foreign currencies, gold, or other financial assets. They serve as a buffer against external shocks, providing stability and liquidity to the economy.

The Balancing Act

When forex reserves are ample, a country is better equipped to manage balance of payments imbalances and maintain the stability of its currency. By intervening in the foreign exchange market, central banks can buy or sell reserves to manage exchange rates and curb excessive fluctuations.

Conversely, dwindling reserves raise concerns. They may indicate economic weakness or a loss of confidence in the currency, leading to depreciation and reduced purchasing power for imports.

Key Determinants

The size of forex reserves is influenced by various factors, including a country’s current account balance, trade policy, foreign direct investment, and central bank policy. A strong current account surplus, for instance, replenishes reserves, while a persistent deficit can deplete them.

Image: forexspringboard.com

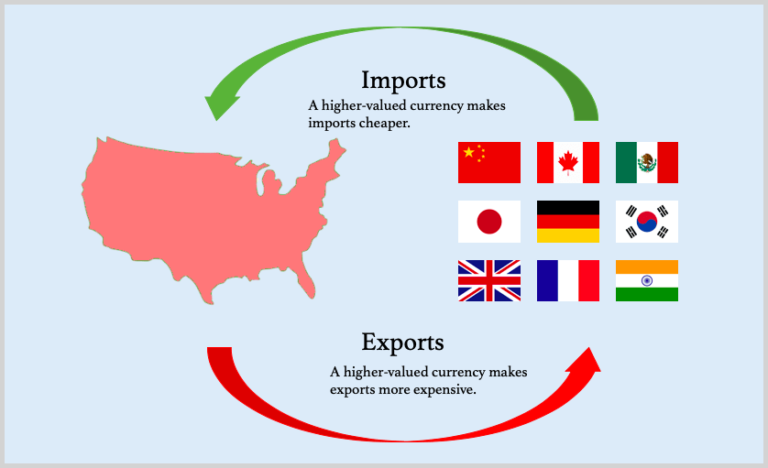

Influence on Exchange Rates

Forex reserves exert a substantial impact on exchange rates through several mechanisms:

Intervention Mechanism

Central banks can intervene in the foreign exchange market by buying or selling reserves to influence exchange rates. By purchasing their own currency, they can strengthen it, while selling reserves leads to depreciation.

Confidence Channel

Ample forex reserves inspire confidence in the economy and its currency. This can attract foreign investments, which increases demand for the currency and appreciates its value.

Currency Speculation

Forex reserves can influence the behavior of currency speculators. Large reserves may deter speculation and minimize exchange rate volatility, as speculators are less likely to bet against a currency with robust backing.

Tips for Managing Forex Reserves

Central banks and policymakers肩负着 the judicious management of forex reserves. Here are some vital tips:

Diversify the Portfolio

Diversifying forex reserves across multiple currencies reduces exposure to individual currency risks and enhances portfolio stability.

Adequate but Not Excessive

Maintaining adequate forex reserves is crucial. Excessive reserves, however, tie up resources and can lead to opportunity costs.

Monitor Currency Dynamics

Constant monitoring of exchange rate dynamics, economic indicators, and global trends allow policymakers to make informed decisions regarding reserve management.

Frequently Asked Questions

Q: What factors can deplete forex reserves?

A: Persistent current account deficits, portfolio outflows, capital flight, and foreign debt repayments.

Q: Can forex reserves be used for domestic spending?

A: No, forex reserves are typically not used for domestic spending. They are primarily held to manage exchange rates, maintain financial stability, and supplement foreign exchange earnings.

Conclusion

Forex reserves play a pivotal role in managing exchange rates and fostering economic stability. Their impact is felt far and wide, affecting trade, investment, and the purchasing power of a nation’s currency. Understanding the intricate relationship between forex reserves and exchange rates empowers policymakers and market participants alike to navigate the dynamic world of currencies.

Impact Of Forex Reserve On Exchange Rate

Are you ready to dive deeper into the world of forex reserves and their impact on exchange rates? Explore our extensive library of resources and connect with experts in the field to expand your knowledge and refine your insights.