In a bold attempt to curb black money and illegal transactions, the Reserve Bank of India (RBI) announced a demonetization drive on November 8, 2016. Overnight, high-value currency notes (500 and 1000 INR) were declared illegal tender, creating unprecedented challenges for the foreign exchange market.

Image: timesofindia.indiatimes.com

Impact on Forex Trading

The ban on 500 and 1000 INR notes significantly impacted forex liquidity, disrupting transactions and creating volatility in exchange rates. With these notes constituting a significant portion of physical currency in circulation, businesses and individuals faced challenges in accessing foreign exchange.

Cash-dependent foreign exchange dealers faced an immediate decline in business volume. Forex transactions that previously relied on physical currency exchange faced delays and increased costs. This, in turn, led to wider bid-ask spreads and a rise in transaction expenses.

Adapting to the New Normal

In response to the drastic change, forex dealers and intermediaries adopted innovative strategies to maintain liquidity and facilitate transactions. Electronic payments gained prominence, with players turning to digital platforms for currency exchange and transfer. Payment gateways and mobile wallets saw a surge in demand as alternatives to physical currency exchange.

Long-Term Implications

The demonetization drive has sparked a shift towards digital and electronic payments. The accelerated adoption of these alternative methods is expected to leave a lasting impact on the forex market in India. The increased transparency and traceability associated with digital payment platforms can potentially reduce opportunities for illegal transactions.

Benefits for the Forex Industry

While the ban presented challenges in the short term, it also initiated a paradigm shift in the forex market. By promoting digital payments and reducing reliance on physical cash, the demonetization has opened up new avenues for innovation.

The transition to electronic platforms has enhanced efficiency and reduced transaction costs for foreign exchange dealers. This can translate into increased accessibility and affordability of forex transactions for businesses and individuals alike.

Conclusion

The ban on 500 and 1000 INR notes was a watershed moment for the Indian forex market. While it initially disrupted trading activities, it has also spurred a shift towards electronic payments and brought about a wave of innovation. The forex industry in India is adapting to the new normal, embracing digitalization and exploring new opportunities. The long-term impact of the demonetization drive is yet to be fully realized, but its potential to transform the forex market for the better is undeniable.

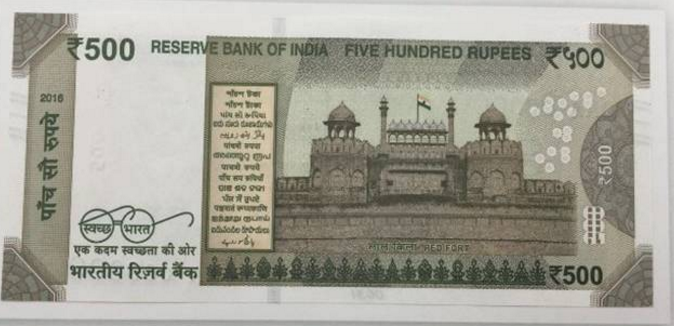

Image: www.allonmoney.com

Impact Of Ban On 500 Rs On Forex