Introduction: Understanding Foreign Exchange Rates

Foreign exchange (forex) rates play a pivotal role in global finance, facilitating trade and investments across borders. These rates determine the value of one currency relative to another, influencing decisions made by individuals, businesses, and governments alike. In this article, we delve into the world of forex rates, specifically examining the ICICI Bank forex rates as of September 13, 2017.

Image: www.youtube.com

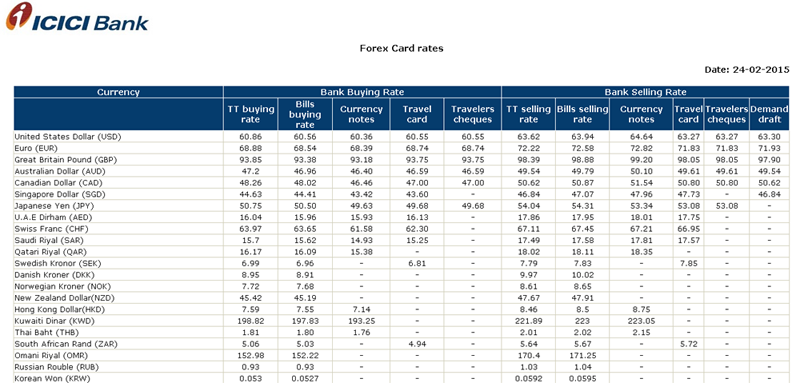

ICICI Bank, one of India’s leading financial institutions, provides a wide range of forex services to its customers. These services include currency exchange, remittances, and international trade finance. Understanding the ICICI forex rates is crucial for anyone considering currency conversions, overseas purchases, or international transactions.

ICICI Forex Rates: September 13, 2017 Snapshot

As of September 13, 2017, ICICI Bank offered the following forex rates for major currency pairs:

| Currency Pair | ICICI Forex Rate (INR) |

|---|---|

| USD/INR | 64.77 |

| GBP/INR | 84.35 |

| EUR/INR | 78.20 |

| CAD/INR | 48.30 |

| AUD/INR | 47.65 |

These rates are indicative and subject to change based on market fluctuations. It’s important to check the latest rates before making any currency transactions.

Factors Influencing Forex Rates

Numerous factors can influence forex rates, making them dynamic and subject to constant shifts. These factors include:

- Economic Performance: The strength of a nation’s economy, as measured by factors like GDP, inflation, and unemployment rates, significantly impacts its currency’s value.

- Interest Rates: Central banks set interest rates to control inflation and influence economic growth. Changes in interest rates can attract or repel foreign investors, affecting currency demand and supply.

- Political Stability: Political events, such as elections, referendums, and geopolitical tensions, can create uncertainty and influence currency values.

- Supply and Demand: The forces of supply and demand play a key role in determining forex rates. Increased demand for a particular currency, relative to its supply, will lead to its appreciation.

- Speculation: Forex trading involves speculation on future movements of currency pairs. Speculation can contribute to rate volatility, particularly in highly traded currencies.

Implications for Individuals and Businesses

Fluctuations in forex rates can have significant implications for individuals and businesses involved in international transactions.

Individuals:

- Travelers: Currency exchange rates affect the purchasing power of travelers overseas. Fluctuations can impact the cost of travel and accommodations.

- Importers and Exporters: Individuals engaged in international trade need to monitor forex rates to manage their costs and pricing strategies.

- Overseas Investors: Forex rates impact the value of investments made in foreign markets.

Businesses:

- MNCs: Multinational companies with operations in multiple countries face currency exchange risks. Fluctuating rates can affect revenue, expenses, and profits.

- Exporters and Importers: Businesses involved in international trade must hedge against forex risks to mitigate the potential financial impact of currency fluctuations.

- Foreign Direct Investments (FDIs): Forex rates influence the cost of foreign direct investments and returns on investments made abroad.

Image: omosajuze.web.fc2.com

ICICI Forex Services

ICICI Bank provides a comprehensive suite of forex services to meet the needs of its customers:

- Currency Exchange: ICICI offers competitive exchange rates for major global currencies, making it convenient for travelers, investors, and businesses.

- Remittances: ICICI facilitates fast and secure money transfers to over 200 countries, enabling individuals to send and receive funds internationally.

- International Trade Finance: The bank provides financing and risk management solutions for businesses engaged in international trade.

Icici Forex Rates 13 09 2017

Conclusion

Understanding forex rates is essential for those involved in cross-border trade, travel, or investments. By studying the ICICI forex rates on September 13, 2017, as analyzed in this article, individuals and businesses can make informed decisions and mitigate potential risks associated with currency fluctuations. ICICI Bank’s robust forex services empower customers to participate in global markets confidently.