Introduction

Navigating foreign currency markets can be a daunting task for travelers, especially considering the fluctuations and variations in exchange rates. ICICI Bank, one of India’s leading private sector banks, offers competitive forex conversion rates and a wide range of services to meet the diverse needs of its customers. This article delves into the intricacies of ICICI Bank’s forex conversion rates, providing a comprehensive guide to help travelers make informed decisions and maximize their currency exchange value.

Image: www.goodreturns.in

Understanding Forex Conversion Rates

Forex conversion rates represent the value of one currency against another at a specific point in time. They are influenced by numerous factors, including economic indicators, political stability, interest rates, and supply and demand. ICICI Bank’s forex conversion rates are based on the prevailing interbank rates and are adjusted dynamically to reflect market conditions.

Benefits of Using ICICI Bank Forex Services

ICICI Bank oferece uma gama de benefícios para os clientes que utilizam os seus serviços forex:

- Competitive rates: ICICI Bank provides some of the most competitive forex conversion rates in the market, ensuring that travelers get the best value for their money.

- Transparency: All forex conversion rates are clearly displayed on the bank’s website and branches, offering transparency and eliminating hidden charges.

- Convenience: Travelers can access forex services through various channels, including online, branches, and ATMs.

- Wide range of currencies: ICICI Bank offers a comprehensive range of currencies, catering to travelers’ needs worldwide.

- Real-time updates: Forex conversion rates are updated in real-time, ensuring that customers get the latest and most accurate rates.

Types of Forex Services Offered by ICICI Bank

ICICI Bank offers a comprehensive suite of forex services tailored to meet the varied requirements of travelers:

- Currency exchange: Customers can exchange foreign currency for Indian rupees and vice versa at ICICI Bank branches.

- Travel cards: ICICI Bank Travel Cards are prepaid cards that can be loaded with foreign currency and used for purchases and withdrawals abroad.

- Forex remittance: Travelers can send money abroad through ICICI Bank’s forex remittance services, which offer competitive rates and reliable delivery.

- Online forex marketplace: The bank’s online forex marketplace allows customers to compare rates and book foreign currency transactions from the comfort of their homes.

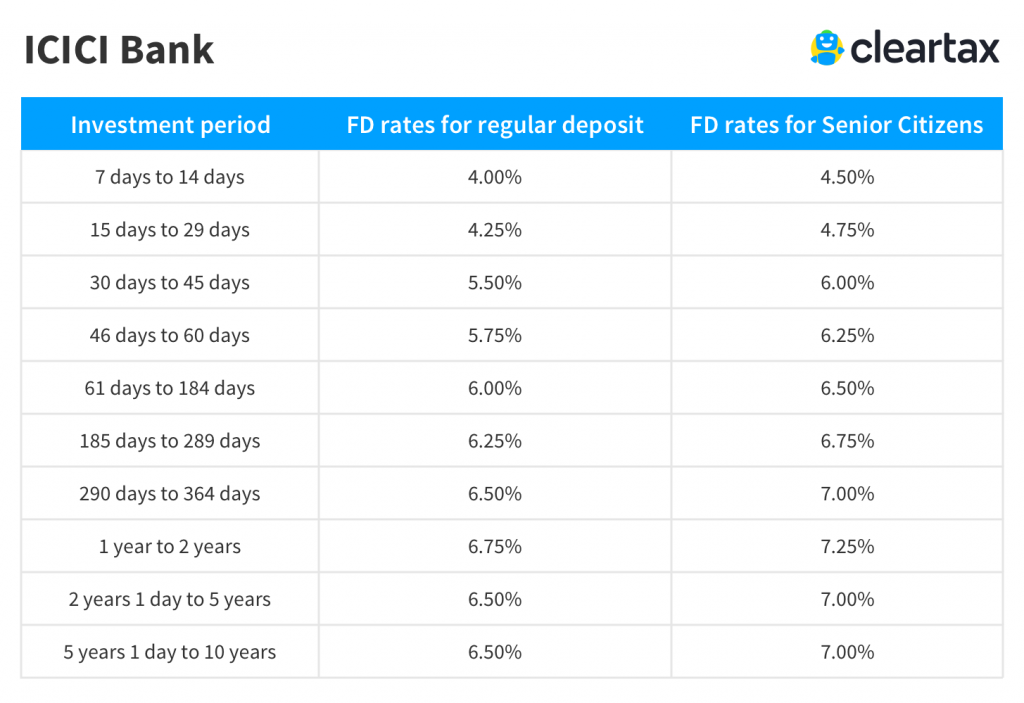

Image: cleartax.in

Tips for Maximizing Forex Value

Para aproveitar ao máximo as taxas de câmbio do ICICI Bank, os viajantes devem considerar as seguintes dicas:

- Monitor market trends: Keeping an eye on currency fluctuations can help travelers identify the most favorable time to exchange currency.

- Shop around: Comparing rates from different banks can ensure that travelers get the best possible deal.

- Consider using a travel card: Travel cards can provide convenience, security, and competitive exchange rates.

- Avoid exchanging large amounts of currency at the airport: Airport exchange rates are often less favorable than those offered by banks.

- Be aware of hidden charges: Some providers may charge additional fees for currency exchange services, so it is important to inquire about all costs upfront.

Icici Bank Forex Conversion Rates

Conclusion

ICICI Bank’s forex conversion rates offer a reliable and convenient way for travelers to exchange currency. With competitive rates, a wide range of services, and a commitment to transparency, ICICI Bank empowers travelers to make informed decisions and optimize their currency exchange value. By leveraging the bank’s expertise and following these tips, travelers can ensure they have the necessary financial resources to make their journeys seamless and enjoyable.