As we approach the weekend’s twilight hours, forex traders find themselves at a crossroads. The markets close on Friday evening and reopen on Sunday night, leaving Saturday as a day of suspended animation. Some traders view this respite as a welcome opportunity for respite, while others see it as a tantalizing chance to capitalize on the unique dynamics of the weekend market.

Image: tradingsitus.blogspot.com

Saturday’s forex trading scene is a vastly different beast from its weekday counterpart. The absence of major news announcements and economic data releases creates a calm unlike any other day of the week. The market often drifts aimlessly, with relatively low volatility and volume. It’s a time where patience and discipline can pay off handsomely for those willing to navigate the quiet waters.

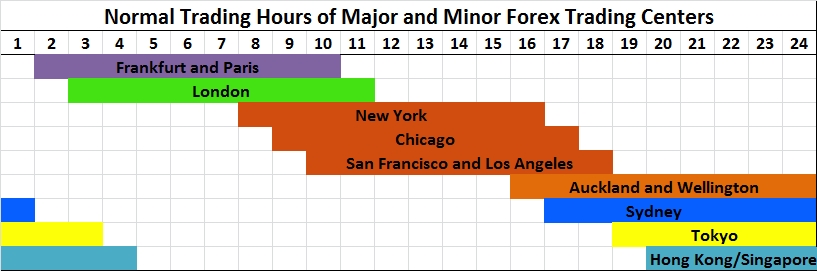

For the uninitiated, weekend forex trading may seem like an oxymoron. After all, the currency markets are typically associated with the hustle and bustle of weekdays, when the world’s financial centers hum with activity. However, the ability to trade currencies over the weekend has become an increasingly popular option in recent years, especially with the advent of online trading platforms.

While the weekend forex market may lack the intensity of weekdays, it presents its own unique set of challenges and opportunities. One of the biggest challenges is the reduced liquidity, which can make it difficult to execute trades quickly and efficiently. However, this reduced liquidity can also be an advantage, as it can lead to wider spreads and potentially greater profits.

Another challenge is the lack of news and economic data releases over the weekend. This can make it difficult to make informed trading decisions, as there are no fresh catalysts to drive the market. However, this lack of news can also be a blessing in disguise, as it can reduce the volatility and make it easier to spot potential trading opportunities.

If you’re considering venturing into weekend forex trading, it’s important to do so with a clear understanding of the risks and rewards involved. Volatility can be unpredictable, and liquidity can be thin, which can lead to large losses if you’re not careful. It’s essential to have a solid trading strategy that takes into account the unique characteristics of the weekend market.

Despite the challenges, weekend forex trading can be a lucrative endeavor for those who are willing to put in the time and effort to learn its nuances. With patience, discipline, and a sound trading strategy, you can harness the power of the weekend market to your advantage.

Image: barungerticara.blogspot.com

I Forex Trading Timing Foe Saturday

Unveiling the Secrets: A Pro’s Guide to Saturday Forex Trading

For those who dare to venture into the enigmatic world of weekend forex trading, the following insights from seasoned veterans can serve as your guiding light:

-

Embrace the Calm: Resist the urge to overtrade during the weekend lull. Instead, use this time to observe the market’s behavior and identify potential trading opportunities.

-

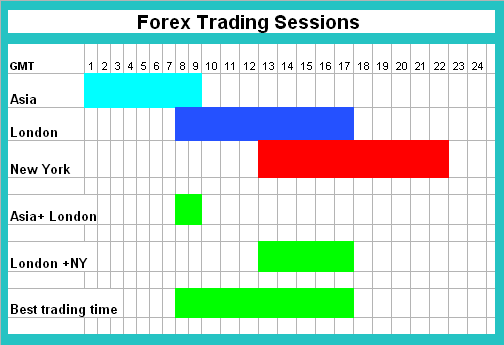

Seek Liquidity Havens: Look for currency pairs with relatively high liquidity, such as EUR/USD, GBP/USD, and USD/JPY. This will ensure that you can execute your trades quickly and efficiently.

-

Trade the Ranges: Weekend markets often trade within well-defined ranges. Identify these ranges and place your orders accordingly. Breakouts can provide significant profit potential.

-

Use Technical Indicators Sparingly: With limited news and data, technical indicators may not be as reliable over the weekend. Focus on price action and support and resistance levels.

-

Manage Risk Prudently: Weekend volatility can be unpredictable. Use stop-loss orders to protect your profits and limit your potential losses.

Remember, the weekend forex market is not for the faint of heart. It’s a time to test your patience and discipline. By embracing the unique challenges and opportunities it presents, you can unlock the potential for profitable trading even when the rest of the world is taking a break.