In the world of finance, where risk and reward intertwine, the foreign exchange market, also known as forex, stands as a global behemoth. Its allure lies in the possibility of substantial profits, yet it is also fraught with potential pitfalls. For the uninitiated, navigating this complex landscape can be a daunting task. But fear not, intrepid explorer, for this guide will equip you with the knowledge and insights to embark on a journey into the fascinating domain of forex trading.

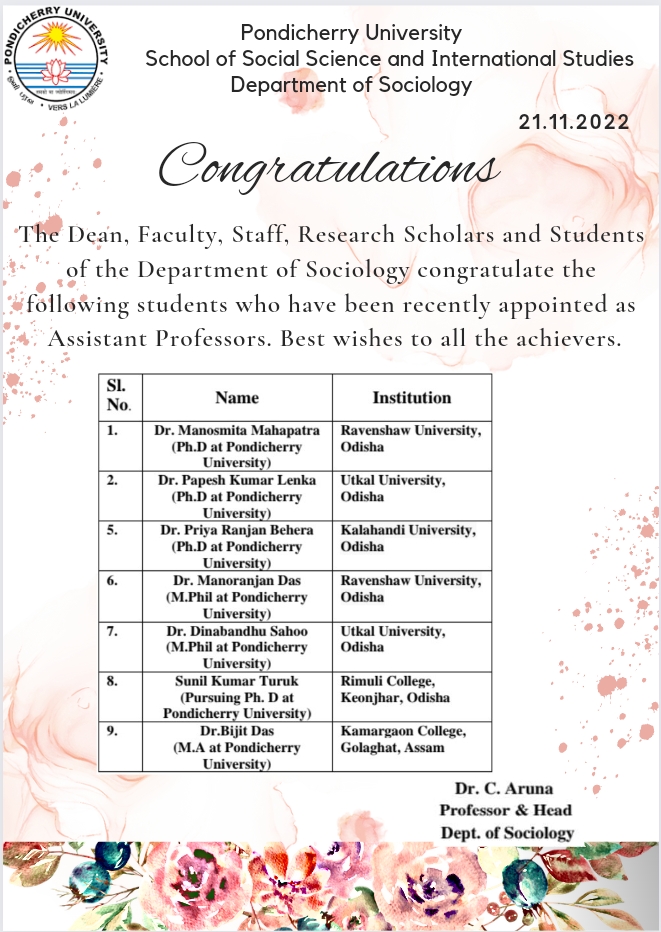

Image: www.pondiuni.edu.in

Forecasting the fluctuations of currency values is the essence of forex. Currencies are traded in pairs, and it is the relative value between these pairings that determines profit or loss. Forex trading is a global phenomenon, with traders hailing from all corners of the world, resulting in a market that operates 24 hours a day, 5 days a week. This perpetual activity is what gives forex its unparalleled liquidity, allowing traders to enter and exit positions with ease.

Unveiling the Inner Workings of Forex

The foundational principles of forex are anchored in the concept of supply and demand. When the demand for a particular currency outstrips the supply, its value rises against its counterpart. Conversely, when supply overwhelms demand, the currency’s value depreciates. A plethora of factors can influence supply and demand dynamics, from political events and economic data to geopolitical shifts and natural disasters.

For the aspiring forex trader, it is crucial to comprehend the different types of orders at their disposal. Market orders execute trades at the prevailing market price, while limit orders allow traders to specify the price at which they wish to buy or sell. Stop-loss orders are another invaluable tool, protecting traders from excessive losses by automatically closing positions when the market price reaches a predefined level.

Empowering Traders with Technical and Fundamental Analysis

Technical analysis stands as a cornerstone of forex trading, empowering traders with the ability to decipher market trends and patterns. By examining historical price data, traders can identify support and resistance levels, which often serve as crucial turning points in price action. Technical indicators, such as moving averages, Bollinger Bands, and relative strength index, provide further insights into market momentum and potential trade opportunities.

Fundamental analysis, on the other hand, delves into the underlying economic factors that drive currency values. Economic indicators, such as inflation, interest rates, and GDP growth, provide valuable information about a country’s financial health and its currency’s outlook. By combining technical and fundamental analysis, traders can enhance their understanding of market dynamics and make informed trading decisions.

Hedging Risks and Maximizing Returns

Risk management is paramount in the forex arena. Employing strategies such as diversification and position sizing can help traders mitigate potential losses. Leverage, while offering the potential for increased profits, also magnifies risks and should be used judiciously.

To maximize returns, traders must become adept at identifying and exploiting market inefficiencies. This can involve employing arbitrage strategies, where traders simultaneously buy and sell the same currency pair on different exchanges to capitalize on price disparities. Carry trading, which involves borrowing a currency with a low interest rate and investing in a currency with a higher interest rate, is another popular strategy for generating profits from forex.

Image: www.researchvessels.org

Http Www.Pondiuni.Edu.In Storage Dde Downloads Ibiv_forex.Pdf

Forging Your Path as a Forex Trader

Embarking on a forex trading journey requires careful preparation and a commitment to continuous learning. Practice on a demo account before venturing into the live market, and seek guidance from experienced traders or educational resources. Develop a robust trading plan that aligns with your risk tolerance and financial goals.

Remember, the forex market is a dynamic and ever-changing landscape. Continuous research and adaptation are essential to staying ahead of the curve. Stay abreast of market news and geopolitical events, and be prepared to adjust your strategies as needed. By embracing these principles and cultivating a disciplined approach, you can increase your chances of success in the exhilarating world of forex trading.