Introduction

Navigating a foreign land is a thrilling experience, but it can also raise practical concerns, like accessing your finances. If you’re traveling on a business trip or an extended vacation, withdrawing money from your company-issued forex card becomes essential. Understanding the process and nuances can make your financial management seamless, ensuring you have cash at your fingertips throughout your journey.

Image: www.youtube.com

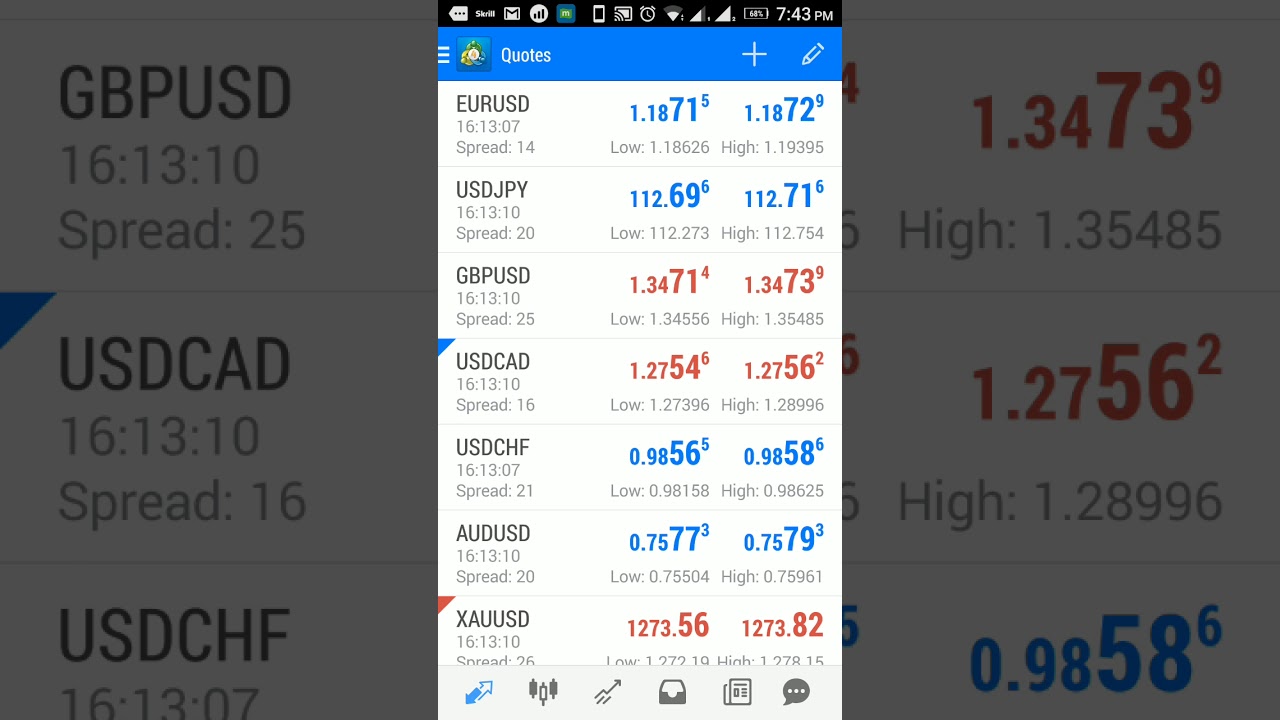

A forex card, also known as a travel card, is designed for international transactions. It allows you to store multiple currencies, making it a convenient and secure way to manage your expenses abroad. However, withdrawing cash from a forex card requires specific steps, and these may vary depending on the card issuer and the destination country. Dive into this comprehensive guide to learn how to withdraw money from your forex card with ease and confidence.

Step-by-Step Guide

1. Locate an ATM

To withdraw cash, you need to find an ATM that accepts your forex card. Look for ATMs affiliated with the card issuer’s network, such as Visa, Mastercard, or UnionPay. These ATMs are commonly found at airports, banks, and shopping malls in most cities.

2. Insert Your Card and Enter PIN

Once you’ve found an ATM, insert your forex card and enter your PIN. The PIN should have been provided to you by the card issuer. Ensure you enter the correct PIN to avoid blocking your card.

3. Select “Withdrawal” Option

The ATM screen will display various options. Select the “Withdrawal” option to initiate the cash withdrawal process.

4. Choose Withdrawal Amount

Enter the amount of cash you wish to withdraw. The ATM may have withdrawal limits, so check if the amount you want exceeds the limit. It’s advisable to withdraw only the cash you need to avoid carrying large amounts.

5. Confirm Withdrawal

Review the withdrawal details on the screen, including the amount and any applicable fees. Once you confirm the withdrawal, the ATM will dispense the cash.

6. Collect Your Cash and Receipt

Take the cash from the ATM and keep it securely. Request a receipt to keep track of your withdrawals and for any future reference or dispute resolution.

Tips for Withdrawing Cash from Forex Card

- Check withdrawal fees: Forex cards typically charge transaction fees for withdrawals. These fees can vary depending on the card issuer and the ATM location. It’s wise to compare fees before selecting an ATM to minimize expenses.

- Be aware of exchange rates: The exchange rate used for your withdrawal will determine the amount of local currency you receive. Check the exchange rates offered by the ATM before completing the transaction to make an informed decision.

- Withdraw in local currency: It’s generally more cost-effective to withdraw in the local currency instead of your home currency, as you avoid double conversion fees.

- Use ATMs in safe locations: Withdraw cash from ATMs located in well-populated areas or inside banks to ensure your safety.

- Protect your card: Never share your forex card PIN with anyone and keep your card in a secure location to prevent unauthorized access.

Image: www.sableinternational.com

How To Withdraw Money From Forex Card Travelled From Company

Conclusion

Withdrawing cash from a forex card while traveling abroad is a simple process that allows you to access funds conveniently. By following the steps outlined in this guide and keeping in mind the tips provided, you can ensure a smooth and secure financial experience throughout your journey. Remember to stay informed about withdrawal fees and exchange rates, and take necessary precautions to protect your card and cash. With a forex card in hand, you can explore new destinations with peace of mind, knowing that you have easy access to your financial resources.