The world of forex trading is a captivating realm where quick-witted investors navigate the ebb and flow of global currencies. Amidst the plethora of tools at their disposal, timing charts stand out as an invaluable guide, offering a window into the intricate dynamics that drive market movements. In this comprehensive guide, we will embark on a transformative journey, elucidating the secrets of using timing charts to elevate your forex trading endeavors.

Image: howtotradeonforex.github.io

A Tapestry of Time and Price: Unveiling the Essence of Timing Charts

Timing charts, also known as time and sales charts, provide a visual representation of the intricate interplay between time and price in the forex market. Each bar on the chart depicts a single trade, revealing the exact moment of its execution and the prevailing price. By scrutinizing the arrangement of these bars, traders can discern profound insights into market sentiment, supply and demand imbalances, and the prevailing market structure.

Delving into the Nuances of Timing Charts: A Blueprint for Success

Timing charts encompass a wealth of information that discerning traders can exploit to make informed decisions. Key elements to consider include:

-

Volume: The number of units traded during a specific timeframe, serving as a proxy for market activity and liquidity. High volume can indicate strong buying or selling pressure, while low volume suggests uncertainty or consolidation.

-

Tick Count: The frequency of price changes within a specified period, often used to gauge the intensity of market volatility. A high tick count signifies rapid price movements, while a low tick count indicates a more subdued market environment.

-

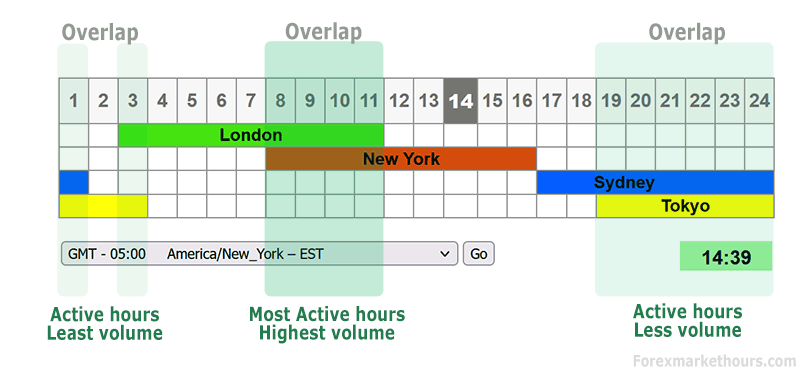

Time Zones: Visual representation of different time zones, enabling traders to analyze market behavior during specific global trading sessions. Understanding the impact of each session on currency pairs can provide valuable insights.

Strategies to Harness the Potential of Timing Charts in Forex Trading

By mastering the nuances of timing charts, traders can unlock a treasure trove of strategies to enhance their trading prowess. Prominent techniques include:

-

Volume Analysis: Identifying areas of high and low volume to determine potential trading opportunities. High volume often signals strong market momentum, while low volume can indicate indecision or a potential reversal.

-

Tick Analysis: Utilizing tick count to identify periods of high volatility and low volatility. Trading during high volatility can be risky but offers the potential for substantial profits, while low volatility periods may be more suitable for scalping or range-bound trading strategies.

-

Time Zone Trading: Exploiting the unique characteristics of different global trading sessions to capitalize on market inefficiencies. For instance, the London session is often characterized by higher liquidity and volatility, while the Asian session may present opportunities for range-bound trading.

Image: www.forexmarkethours.com

Embark on Your Transformation: Empowered Trading with Timing Charts

By meticulously implementing the knowledge and techniques outlined in this guide, you will be well-equipped to elevate your forex trading journey. Timing charts will become an indispensable tool in your arsenal, providing you with the clarity and confidence to navigate the ever-changing market landscape effectively.

How To Use Timingchart To Trade Forex

Step into the Trading Arena, Embracing the Power of Timing Charts

Dare to embrace the world of forex trading, fortified with the knowledge and empowerment that timing charts bestow upon you. Every trade you execute, every profit you reap, will be a testament to your commitment to understanding the market’s intricate dance. So, cast off your hesitations, seize the opportunities that await, and embrace the transformative power of timing charts in your quest for trading excellence.