In the dynamic world of forex trading, traders seek every advantage to make informed decisions. Bollinger Bands, developed by legendary trader John Bollinger, stand as a valuable tool that provides insights into market volatility and price action. When combined with the Simple Moving Average (SMA), traders gain an even more potent weapon in their arsenal. Embark on a journey to understand how to use Bollinger Bands with SMA in forex trading, unlocking the secrets that can elevate your trading strategy.

Image: freeforexcoach.com

A Primer on Bollinger Bands: A Vessel for Volatility Analysis

Bollinger Bands consist of three lines plotted around a price chart: an upper band, a lower band, and a middle band. The middle band serves as the SMA, indicating the average price over a specified period. The upper and lower bands are calculated using a multiple of the standard deviation, providing a dynamic representation of market volatility. When volatility increases, the bands widen, and when volatility decreases, the bands narrow.

The Symphony of Bollinger Bands and SMA: A Harmonic Insight into Trends

Combining Bollinger Bands with SMA creates a powerful synergy for trend identification and potential trading opportunities. Here’s how they work in harmony:

a) Identifying Trends:

When the price remains within the Bollinger Bands and above the SMA, it signifies an uptrend. Conversely, if the price remains within the bands and below the SMA, a downtrend is indicated.

Image: www.pinterest.com

b) Volatility Assessment:

Bollinger Bands help gauge market volatility. Wide bands suggest high volatility, which can present opportunities for high-risk, high-reward trades. Narrow bands indicate low volatility, often signaling a period of consolidation or indecision.

c) Price Reversal Signals:

When the price breaches the upper or lower Bollinger Bands, it can indicate a potential price reversal. Traders should be cautious, however, as false signals can occur during periods of high volatility.

Trading Strategies with Bollinger Bands and SMA: A Toolkit for Success

Empowering traders with practical insights, Bollinger Bands and SMA enable the development of effective trading strategies. Here are two widely used approaches:

a) Bollinger Bounce Strategy:

This strategy capitalizes on price reversals from Bollinger Bands. Traders enter long positions when the price bounces off the lower band and short positions when it bounces off the upper band.

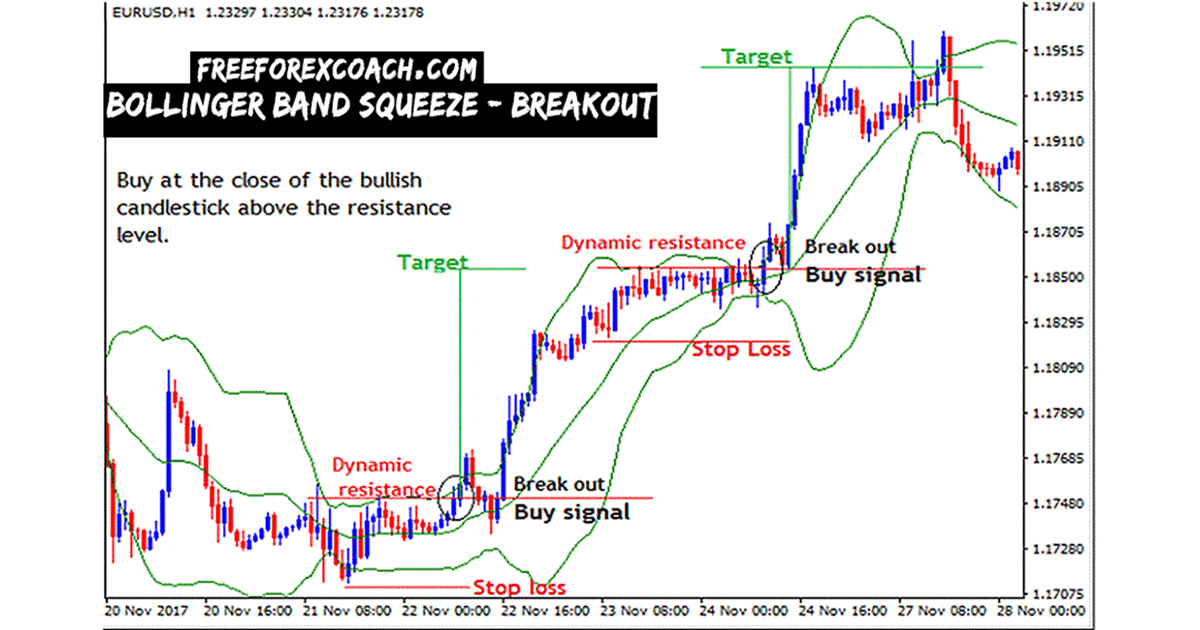

b) Bollinger Breakout Strategy:

Traders use this strategy to identify potential breakouts. When the price breaks through either the upper or lower Bollinger Band, it indicates a potential trend continuation or reversal. Traders should exercise caution and consider other market factors before making any trading decisions.

Expert Insights: Guidance from Trading Masters

“Bollinger Bands provide a clear visual representation of market volatility, enabling traders to make informed decisions,” says renowned forex trader Alexander Elder. “When combined with the SMA, they offer a comprehensive view of market trends and potential trading opportunities.”

“The Bollinger Bounce Strategy has proven effective in capturing short-term price reversals, especially during periods of high volatility,” adds technical analyst Kathy Lien. “However, it’s crucial to manage risk carefully and avoid trading against the prevailing trend.”

How To Use Bollinger Bands Forex With Sma

Conclusion: A Path to Informed Trading Decisions

Harnessing the power of Bollinger Bands with SMA can provide forex traders with valuable insights into market volatility, trends, and potential trading opportunities. Understanding the concepts, embracing the synergistic relationship between these tools, and incorporating expert advice empowers traders to navigate the dynamic forex market with increased confidence.

Remember, while Bollinger Bands and SMA offer valuable assistance, they are not infallible. Traders should always consider other market factors, employ sound risk management practices, and continuously seek knowledge to make informed trading decisions. By incorporating these powerful tools into your trading strategy, you can unlock the potential for enhanced trading outcomes in the ever-evolving realm of forex.