Introduction: The Allure of Forex

The realm of foreign exchange, commonly known as Forex, is an enthralling domain where the world’s currencies intertwine in a perpetual dance of value fluctuation. Whether you’re a seasoned trader or a novice seeking financial literacy, understanding Forex is paramount to thriving in the global marketplace. This comprehensive guide will unravel the mysteries of Forex, empowering you to make informed decisions and capitalize on its limitless opportunities.

Image: www.bank2home.com

Chapter 1: The Birth of Forex: A Historical Odyssey

The concept of currency exchange dates back to ancient civilizations, when traders exchanged goods and services using physical coins. However, the modern Forex market emerged in the early 20th century with the advent of fixed exchange rates. These rates, pegged to the value of gold, paved the way for global currency trading on a larger scale. The Bretton Woods Agreement of 1944 further solidified the Forex framework, setting fixed exchange rates among major currencies. However, the system collapsed in 1971, leading to the floating exchange rates we witness today, where currencies fluctuate freely based on supply and demand.

Chapter 2: Decoding Forex Basics: Core Concepts Explained

At its core, Forex involves the exchange of currencies between two parties. A currency pair represents the exchange rate between two currencies, such as the Euro (EUR) and the US Dollar (USD). The exchange rate indicates how many units of one currency are needed to buy one unit of another currency. When the EUR/USD exchange rate is 1.20, it means one Euro is worth 1.20 US Dollars.

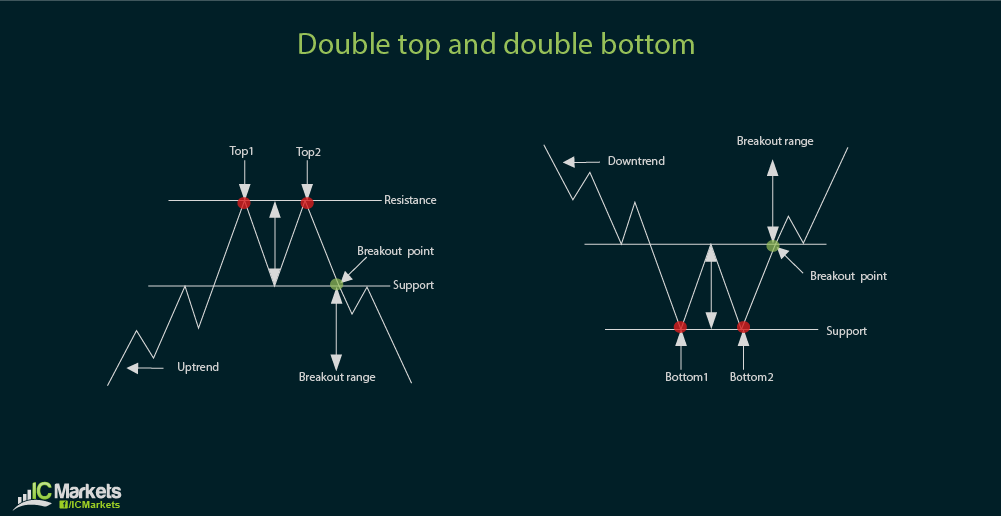

Forex traders speculate on currency price movements, hoping to profit from the fluctuations. The goal is to buy a currency when its value is low and sell it when its value has increased, thereby generating profit. Traders analyze market trends, economic data, and political events to make informed decisions.

Chapter 3: Navigating the Forex Market: A Trader’s Toolkit

Venturing into Forex requires a comprehensive understanding of the different trading platforms, order types, and execution methods. Trading platforms provide the interface to connect with the market, offering various features such as real-time quotes, charting tools, and risk management tools. Order types allow traders to specify the parameters of their trades, including the price, quantity, and conditions for execution. Common order types include market orders, limit orders, and stop-loss orders.

Understanding execution methods is crucial for efficient trade execution. Different brokers offer various execution methods, such as market execution, instant execution, and request for quote (RFQ) execution. Each method has its own advantages and disadvantages, and traders must choose the one that best suits their trading style and risk tolerance.

Image: www.pinterest.com

Chapter 4: Unveiling Forex Terminology: A Glossary Guide

The Forex lexicon is vast and peculiar, but familiarizing yourself with essential terms is crucial. Key terms like bid and ask prices, pips, spread, leverage, and margin call are fundamental to comprehending market dynamics. Bid price refers to the highest price someone is willing to pay for a currency pair, while ask price represents the lowest price someone is willing to sell the same pair. The spread is the difference between the bid and ask prices, representing the broker’s commission. Leverage allows traders to increase their exposure to the market with a smaller initial investment, but it comes with amplified risk. Margin call occurs when a trader’s equity falls below a certain level, triggering a forced closure of open positions.

Chapter 5: Forex as an Asset Class: Exploring Its Merits and Risks

Forex holds its own as a distinct asset class, offering both potential rewards and inherent risks. As the world’s largest financial market, Forex provides unparalleled liquidity, allowing traders to enter and exit trades with ease. Access to a global market means opportunities are available 24 hours a day, five days a week. Additionally, Forex offers the potential for significant returns, especially during periods of high volatility.

However, it’s crucial to recognize the risks associated with Forex. Currency prices can shift rapidly, and without a comprehensive understanding of market dynamics, traders risk substantial losses. Leverage, while amplifying potential profits, can also magnify losses, making it a double-edged sword that requires careful handling.

How To Understand Forex Will Support This Area Or Not

Conclusion: Empowering Your Financial Journey

Understanding Forex opens doors to a world of financial possibilities. Whether you’re an ambitious trader seeking profit-making opportunities or a discerning investor seeking to diversify your portfolio, Forex offers a unique arena for wealth creation. Embrace the insights provided in this comprehensive guide, conduct diligent research, and approach the Forex market with a measured approach, and you’ll be well-equipped to navigate its intricacies and reap the rewards of global currency exchange.