Navigating the world of forex trading can be daunting for beginners, but one aspect that should not add to the complexity is transferring funds to your trading account. With the advent of digital banking platforms like YONO from SBI, transferring money from your domestic bank account to your forex trading account has become a breeze. In this comprehensive guide, we will explore the step-by-step process of transferring money through YONO to your forex account, ensuring a smooth and efficient trading experience.

Image: www.youtube.com

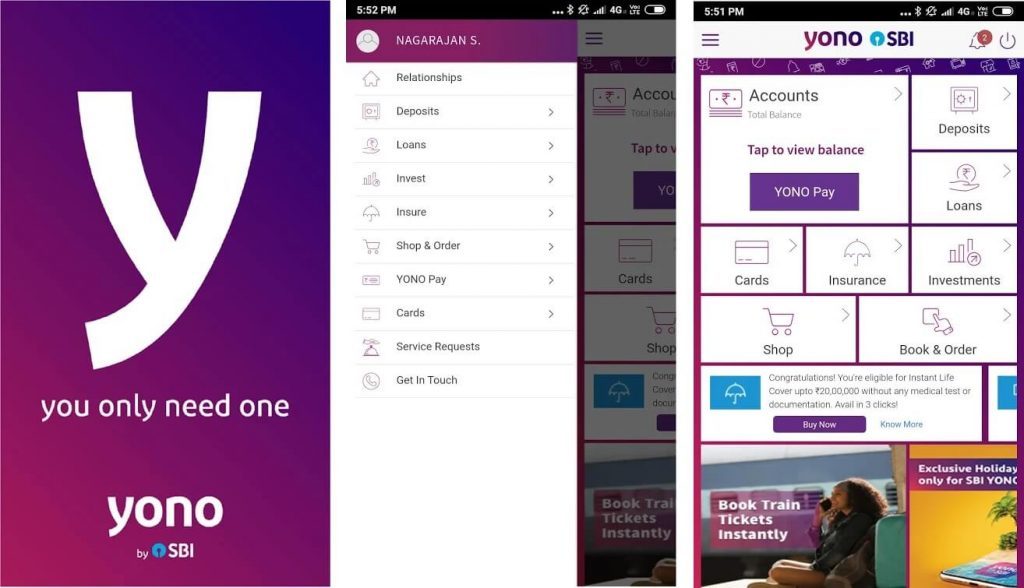

Introduction to YONO

YONO (You Only Need One) is SBI’s flagship digital banking platform that revolutionizes the way you manage your finances. This state-of-the-art application consolidates all your banking needs into a single, user-friendly interface, allowing you to conduct transactions, access account information, and manage investments at your fingertips. The convenience of YONO extends to forex trading, providing a secure and hassle-free way to transfer funds to your forex account.

Benefits of Transferring Money Through YONO

- Seamless Integration: YONO seamlessly integrates with forex trading platforms, eliminating the need for multiple apps or complex payment gateways.

- Swift Transfers: YONO boasts real-time processing, ensuring that your funds are transferred to your forex account promptly, allowing you to seize trading opportunities without delay.

- Secure Transactions: SBI adheres to stringent security protocols to protect your financial information and transactions, providing peace of mind while trading.

- Convenience: Transferring funds through YONO is incredibly convenient. With just a few taps on your smartphone, you can complete the transaction from anywhere, at any time.

- Competitive Rates: YONO offers competitive foreign exchange rates, minimizing the impact of currency conversion on your trades and maximizing your potential profits.

Step-by-Step Guide to Transferring Funds

Step 1: Log In to YONO

- Open the YONO app on your smartphone and log in securely using your credentials.

Step 2: Select “Forex”

- From the YONO homepage, tap on the “Forex” option to access the forex trading services.

Step 3: Link Your Forex Account

- If you haven’t already, link your forex trading account to YONO. Select “Link Account” and follow the on-screen instructions to establish the connection.

Step 4: Initiate Transfer

- Tap on the “Transfer Funds” option and select your linked forex account as the recipient.

Step 5: Enter Transfer Details

- Enter the amount you wish to transfer and the currency of the transfer. Verify the details carefully before proceeding.

Step 6: Confirm Transaction

- Review the transfer details once again and enter your transaction password or use the YONO OTP (One Time Password) for authentication. Confirm the transaction.

Step 7: Track Transfer

- Once the transaction is processed, you will receive a confirmation message on your YONO app. You can also track the status of your transfer within the “Transaction History” section of the app.

Image: moneymint.com

Tips for Seamless Transfers

- Ensure that both your YONO account and your forex trading account are adequately funded before initiating the transfer.

- Double-check the transfer details, including the amount, currency, and recipient account number, to avoid any discrepancies.

- Familiarize yourself with the foreign exchange rates and transfer fees to make informed decisions while transferring funds.

- If you encounter any difficulties while transferring funds, do not hesitate to contact YONO customer support for assistance.

How To Transfer Money Through Yono To Forex Account

Conclusion

Transferring money from YONO to your forex trading account is a straightforward and efficient process that empowers you to take control of your trading experience. By leveraging the convenience, security, and competitive rates offered by YONO, you can seamlessly fund your trades and maximize your potential in the forex market. Whether you