In the ever-fluctuating world of currency markets, swing trading stands out as a potent strategy for savvy investors seeking to capitalize on price swings within a short to medium-term horizon. Unlike scalping, which focuses on lightning-fast trades, or long-term investing, which entails holding positions for months or years, swing trading bridges the gap, allowing traders to ride the waves of rhythmic price movements for substantial gains.

Image: www.youtube.com

Understanding Swing Trading: A Balancing Act of Patience and Opportunity

Swing traders are patient predators, patiently waiting for price fluctuations to reach suitable levels before striking with precision. They seek to identify trends, capitalizing on the momentum of market swings. Unlike day traders, swing traders do not close positions at the end of each trading day, instead holding them for several days or even weeks to ride the full swing of the trend.

However, the allure of swing trading lies not only in its potential rewards but also in its adaptability to diverse market conditions. Whether novice or seasoned, swing trading caters to different trading styles and risk tolerances. Its versatility makes it an accessible avenue for traders seeking steady growth without the relentless pressure of short-term trading.

The Mechanics of Swing Trading: A Step-by-Step Guide

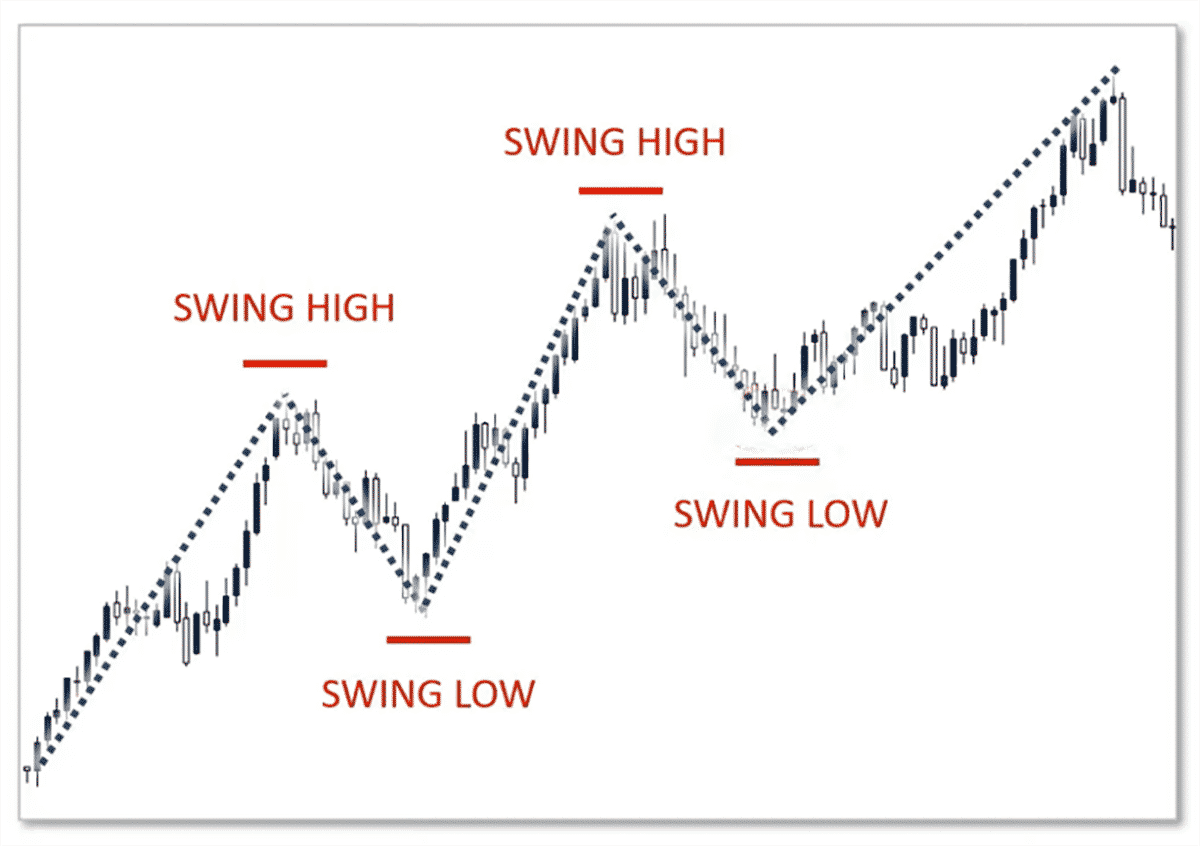

To embark on a swing trading journey, traders must first master the art of technical analysis, deciphering market movements through charts and indicators. Identifying trend reversals, chart patterns, support and resistance levels, and market sentiment lays the foundation for successful trades.

Armed with technical knowledge, traders can execute swing trades with precision. The first step involves pinpointing a trading opportunity, identifying a trend or pattern that signals a potential swing. Next, traders determine the entry point, the precise price at which they initiate the trade, based on technical indicators and risk-reward calculations.

Once in a position, traders ride the swing, monitoring the trade’s progress, and adjusting their position if necessary. Setting stop-loss orders and profit targets is crucial for managing risk and maximizing profit potential. Exiting the trade at the right time is an art form in itself, and traders must strike a balance between greed and caution to secure their gains.

Mastering Swing Trading: Strategies and Techniques for Success

While swing trading offers a framework for capturing market swings, it is an art that demands dedication and continuous learning. Traders who aspire to master swing trading invest time honing their technical analysis skills, exploring different trading strategies, and refining their risk management techniques.

Various swing trading strategies exist, each tailored to specific market conditions and trader preferences. Some popular strategies include:

● Trend-following strategies: Capitalizing on established trends by identifying continuation patterns and riding the wave of momentum.

● Range-bound strategies: Exploiting price movements within a defined range, using support and resistance levels to guide trades.

● Pullback strategies: Waiting for a pullback (temporary price retracement) within a trend to enter at a more favorable price.

● Breakout strategies: Betting on price breakouts from established support or resistance levels to capture significant swings.

Image: 2ndskiesforex.com

The Psychology of Swing Trading: Overcoming the Emotional Roller Coaster

Successful swing trading requires not only technical proficiency but also emotional resilience. The ups and downs of the market can be a rollercoaster ride, testing the trader’s discipline and composure. Greed, fear, and overconfidence can cloud judgment, leading to costly mistakes.

Developing a robust trading psychology is essential for combating these emotional pitfalls. Traders must establish clear trading rules, manage their risk tolerance, and refrain from impulsive decisions. Maintaining a mindset of continuous learning and improvement fosters resilience and enhances trading performance.

How To Trade With Swing Tradeing In Forex

https://youtube.com/watch?v=y9uKypAQZaY

Conclusion: Swing Trading – An Empowering Tool for Market Mastery

Swing trading empowers traders with the ability to ride market swings for profit, fostering financial independence and a deeper understanding of market dynamics. However, it is not a get-rich-quick scheme but rather a demanding discipline that requires a blend of technical acumen, emotional control, and a thirst for knowledge.

By embracing the principles outlined in this guide, traders can equip themselves for successful swing trading, harnessing the power of market swings to achieve their financial goals. Remember, trading involves risk, and it is imperative to invest wisely and seek professional advice when necessary.