Introduction

FX trading, often referred to as Forex, offers tantalizing opportunities for investors of all experience levels. Whether you’re new to the financial markets or a seasoned pro, the allure of high-yield potential in the world’s largest and most liquid market deserves your attention. Understanding the ins and outs of Easy FX trading is crucial to unlock this potential safely and effectively.

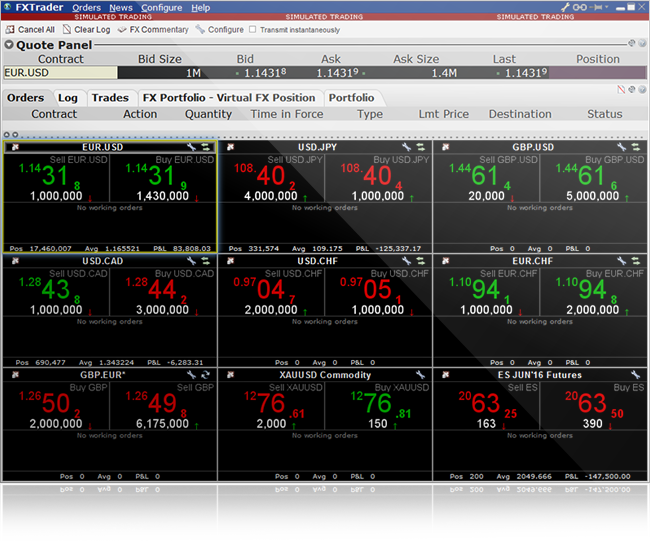

Image: www.interactivebrokers.com

In this comprehensive guide, we’ll delve into the world of Easy FX trading, covering foundational concepts, strategies, and practical tips to help you navigate this exciting financial landscape. Read on to discover how Easy FX trading empowers individuals just like you to embark on a profitable financial journey.

Exploring the Basics of Easy FX Trading

FX trading involves the exchange of currencies between different countries. Unlike stock or bond trading, Forex transactions occur between private parties, making it an over-the-counter (OTC) market. Easy FX trading platforms simplify this process, providing user-friendly interfaces and intuitive tools for both novice and experienced traders.

The accessible nature of Easy FX trading has attracted a broad range of participants, including retail investors, hedge funds, and central banks. With ample liquidity and 24-hour trading hours across multiple global markets, Forex trading offers unparalleled opportunities for capital appreciation. However, it’s important to understand that Easy FX trading, like all financial endeavors, comes with inherent risks.

Key Considerations Before Entering the FX Market

Before embarking on your Easy FX trading journey, it’s essential to assess your financial situation and investment goals carefully. Consider the following key factors:

- Risk Tolerance: FX trading involves fluctuations in currency values that can result in potential losses. Determine your comfort level with risk before investing any funds.

- Investment Horizon: FX trading can be both short-term and long-term. Identify the investment horizon that aligns with your financial objectives.

- Capital Allocation: Allocate a portion of your investment portfolio to FX trading that you’re comfortable losing. Avoid risking more than you can afford.

Leveraging Strategies for Profitable Trading

Success in Easy FX trading hinges on employing effective strategies. Here are a few approaches commonly used by traders:

Image: www.facebook.com

Technical Analysis

Technical analysis involves studying historical price charts to identify patterns that can predict future price movements. Traders use a variety of technical indicators and chart formations to make informed trading decisions.

Fundamental Analysis

Fundamental analysis focuses on economic and political factors that influence currency values. By considering interest rates, GDP growth, and geopolitical events, traders can anticipate potential price movements and adjust their trading strategies accordingly.

Scalping

Scalping is a short-term trading strategy that involves entering and exiting positions quickly, aiming to profit from small price changes. Scalpers often employ automated trading systems to execute numerous trades throughout the trading day.

Enhancing Your Trading Skills

Constant learning and refinement are crucial to becoming a successful FX trader. Here are some tips to enhance your trading skills:

- Education: Invest in books, online courses, and webinars to expand your knowledge of Forex markets and trading strategies.

- Demo Accounts: Practice your trading skills in a simulated environment with demo accounts provided by most FX brokers.

- Market Analysis: Regularly monitor economic news, central bank announcements, and other factors that can impact currency values.

- Risk Management: Implement strict risk management strategies to protect your capital from excessive losses.

Choosing the Right Easy FX Trading Platform

Selecting the appropriate Easy FX trading platform is crucial for a successful trading experience. Consider the following factors when making your choice:

- Regulation and Security: Choose platforms regulated by reputable financial authorities to ensure the safety of your funds.

- User Interface: Opt for platforms with intuitive user interfaces that cater to both novice and experienced traders.

- Spreads and Commissions: Compare the spreads (difference between the bid and ask prices) and commissions charged by different platforms to optimize your trading costs.

- Customer Support: Ensure the platform provides reliable and responsive customer support to assist you whenever needed.

Easy Fx Trading Review

Conclusion

Easy FX trading offers a compelling opportunity to tap into the high-yield potential of the global Forex market. By understanding the basics, implementing effective strategies, and continuously honing your skills, you can increase your chances of success in this exciting financial arena. Remember, knowledge, discipline, and a well-defined financial plan are the cornerstones of a successful Easy FX trading journey.