Imagine this: the market opens after a long weekend or holiday, and suddenly, there’s a wide gap between the closing price on Friday and the opening price on Monday. This is known as a forex gap, and it’s a trader’s bread and butter. Understanding how to identify and trade these gaps can give you the edge in the forex market. In this comprehensive guide, we’ll dive deep into the world of forex gaps, empowering you to seize these opportunities and unlock hidden market potential.

Image: investworld.net

Understanding Forex Gaps: The Missing Link

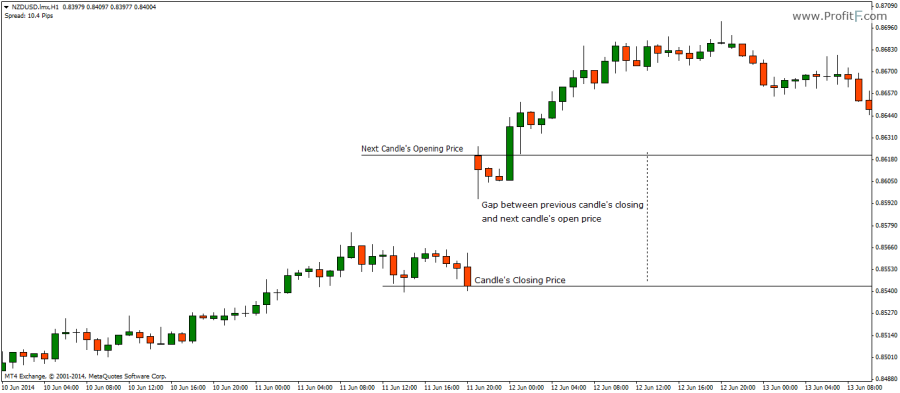

A forex gap occurs when the price of a currency pair skips a range of values, creating a visible break in the chart. This gap can be bullish or bearish, indicating a sudden move in price. The key to successful gap trading lies in understanding the underlying cause behind these gaps, as they often reflect significant market events like news releases, economic data, or geopolitical shifts.

Bullish Gaps vs. Bearish Gaps: The Price Action Decoded

Bullish gaps, characterized by price moving up from its previous close, signal a sudden increase in demand for the base currency. These are often caused by positive news or events boosting the strength of the base currency, leading to a rapid appreciation in its value. On the other hand, bearish gaps occur when price moves down, indicating a decline in demand. They’re often triggered by negative news or events that erode the base currency’s value.

Gap Candlesticks: Visual Clues for Spotting Opportunities

Gap candlesticks are special candlestick patterns that provide a visual representation of price gaps. These patterns can be characterized by a noticeable gap between the high and low of the previous candle and the open or close of the current candle. Identifying these gap candlestick patterns is a crucial aspect of gap trading, as they often indicate potential breakout or reversal scenarios.

Image: forexretro.blogspot.com

8 Strategies for Trading Forex Gaps: A Trader’s Toolkit

1. Trading Breakouts from Gap Areas

Breakouts from gap areas can present profitable opportunities for traders. When price moves outside of the gap range, it’s a sign of strong momentum, indicating a potential continuation of the trend.

2. Waiting for Retests of Gap Fill

After a gap occurs, it’s not uncommon for price to return and “fill” the gap. Traders can capitalize on this by placing orders near the gap area and waiting for the price to retest the gap support or resistance zone.

3. Utilizing Gap Extensions

Gap extensions occur when price continues to move in the same direction as the initial gap. This is a strong indication of a sustained trend and provides a chance for traders to ride the wave and maximize profits.

4. Fading Gaps

Contrary to gap extensions, fading gaps involves taking a position against the direction of the gap. This strategy is based on the assumption that the gap is likely to close as price reverts to its previous level.

5. Gap Scalping

This technique involves taking quick profits from small price movements within a gap area. Gap scalping thrives on the volatility of the market and requires sharp execution and precise risk management.

6. Combining Gaps with Technical Indicators

Merging gap analysis with technical indicators can significantly enhance your trading strategy and increase your chances of success. Indicators like moving averages, support/resistance levels, and oscillators can provide additional confirmation and refine your trade entries and exits.

7. Risk Management for Gap Trading

Remember, gap trading involves higher risk due to the large gaps. It’s imperative to implement proper risk management measures such as stop orders, limits, and risk-to-reward ratios to mitigate potential losses.

How To Trade Gaps Forex

https://youtube.com/watch?v=Sf_uYZBWTrA

8. Demo Trading Before Going Live

Before risking real capital, hone your gap trading skills on a demo trading account. This simulated environment allows you to test your strategies, refine your approach, and gain confidence before entering the live market.