In the tumultuous realm of foreign exchange trading, where fortunes are won and lost in the blink of an eye, the Average True Range (ATR) indicator stands as a beacon of lucidity amidst the market’s chaos. Like a skilled navigator guiding a ship through treacherous waters, the ATR provides traders with invaluable insights into market volatility, the ever-changing force that drives currency prices. Embark on this exhilarating journey as we delve into the depths of Forex trading, unraveling the secrets of the ATR indicator and empowering you to conquer the financial tides.

Image: tradeforexnation.weebly.com

What is the ATR Indicator?

Conceived by the legendary trader J. Welles Wilder, the Average True Range (ATR) is a technical analysis tool that measures the volatility of a financial asset, such as a currency pair. It quantifies the range of price fluctuations over a specified period, typically 14 trading days. The ATR helps traders gauge market sentiment and predict potential price movements, serving as a crucial compass in the turbulent seas of Forex trading.

The Significance of Volatility in Forex Trading

Volatility is to the Forex market what oxygen is to life – an indispensable element that breathes vibrancy into the trading environment. It represents the extent of price fluctuations over time, offering both opportunities and risks to savvy traders. High volatility indicates a rapidly changing market, often accompanied by sharp price swings that can amplify both profits and losses. Conversely, low volatility signifies a more stable market, characterized by relatively predictable price movements. Understanding volatility is paramount for Forex traders, as it can significantly influence trading strategies and risk management decisions.

How the ATR Indicator Works

The ATR indicator is calculated using a three-step process:

1. Calculating the Absolute Price Changes:

The first step involves determining the absolute price changes over the specified period. For a given currency pair, this entails calculating the difference between the high and low prices on each trading day.

2. Calculating the True Range:

The True Range (TR) is calculated for each trading day by considering three price ranges:

-

The current day’s high minus the current day’s low

-

The absolute value of the current day’s high minus the previous day’s close

-

The absolute value of the current day’s low minus the previous day’s close

The TR represents the greatest of these three values, providing a comprehensive measure of price volatility for that particular day.

3. Calculating the Average True Range (ATR):

The final step involves smoothing the True Range values over the specified period (usually 14 days) to obtain the Average True Range.

Image: www.nasdaq.com

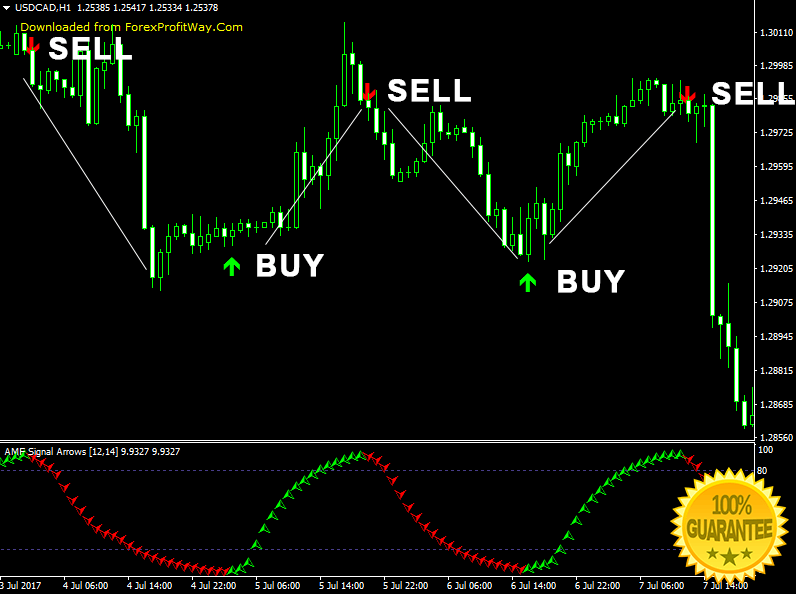

Harnessing the Power of the ATR Indicator

The ATR indicator unveils a treasure trove of insights for Forex traders:

1. Forecasting Market Volatility:

The ATR offers a predictive power, enabling traders to anticipate the future level of market volatility. An increasing ATR value suggests that volatility is on the rise, potentially indicating a more dynamic and potentially lucrative trading environment. Conversely, a decreasing ATR value signals a decline in volatility, foreshadowing a period of relative market stability.

2. Determining Stop-Loss Levels:

The ATR is an instrumental tool for setting stop-loss levels, the safeguards that protect trades from excessive losses. By placing stop-loss orders a specific multiple of the ATR away from the entry price, traders can establish prudent risk management parameters tailored to the prevailing market volatility.

3. Identifying Trading Opportunities:

The ATR indicator serves as a compass for identifying potential trading opportunities. In periods of high volatility, when the ATR is elevated, traders can adopt more aggressive strategies, capitalizing on the increased market fluctuations. Conversely, during periods of low volatility, a conservative approach is often more prudent, with traders seeking steadier, less volatile trading conditions.

Practical Implementation of the ATR Indicator

Embracing the ATR indicator in your Forex trading arsenal is straightforward and highly effective:

1. Choosing the Right ATR Period:

The default ATR period is 14 days, offering a comprehensive view of market volatility. However, traders can customize the period based on their trading style and preferred timeframe. For shorter-term trades, a smaller period (e.g., 7 days) may be more appropriate, while for longer-term trades, a larger period (e.g., 21 days) is recommended.

2. Incorporating the ATR in Trading Strategies:

The ATR can be seamlessly integrated into various trading strategies, including trend following, breakout trading, and mean reversion strategies. By factoring in volatility levels, traders can fine-tune their strategies to suit the prevailing market conditions.

How To Trade Forex Using Atr Indicator

Conclusion

The ATR indicator is an indispensable tool for Forex traders, providing invaluable insights into market volatility and guiding sound trading decisions. By embracing the power of the ATR, traders can navigate the turbulent waters of the Forex market with greater confidence, minimizing risks and maximizing opportunities. As you continue your journey in the world of Forex trading, remember the profound impact that volatility has on market dynamics. May the ATR be your trusted companion, empowering you to harness the market’s ebbs and flows and emerge victorious in the pursuit of financial success.