Introduction: Unlocking the Financial Potential of Forex Trading

In the ever-evolving world of finance, forex trading stands as a formidable opportunity for ambitious individuals seeking to harness the power of global currency markets. Forex, short for foreign exchange, involves the buying and selling of currencies in pairs, capitalizing on fluctuations in their exchange rates. The time-sensitive nature of these transactions demands a keen understanding of market dynamics and strategic execution. This comprehensive guide delves into the intricacies of forex time trading, empowering you with the knowledge and techniques to navigate this lucrative realm with confidence.

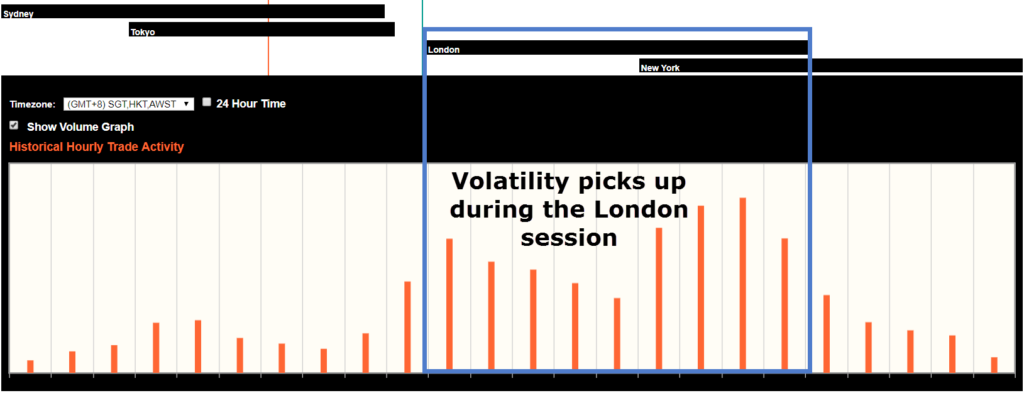

Image: www.ainfosolutions.com

Understanding Forex Time Trading Basics

Forex time trading revolves around leveraging the time-based fluctuations in currency pairs. Unlike traditional investment approaches that focus on long-term market trends, time trading exploits short-term price movements over minutes, hours, or even seconds. By capturing these fleeting opportunities, traders aim to maximize their profits while mitigating risks. This dynamic approach requires a fast-paced mindset, the ability to analyze market patterns rapidly, and a mastery of trading tools.

Essential Concepts: Trading Pairs, Pip Values, and Spread

In forex time trading, all transactions involve the exchange of a currency pair, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second is called the quote currency. Understanding the relationship between these currencies and their respective countries’ economic indicators is crucial for informed trading decisions. Pip (percentage in point) is the smallest price increment in forex trading, representing the last decimal place of a currency’s exchange rate. Pip values vary depending on the currency pair and can significantly impact profit margins. The spread is the difference between the bid price (the price at which you can sell the base currency) and the ask price (the price at which you can buy it). This spread is the broker’s commission and must be considered in your trading strategies.

Trading Strategies: Scalping, Day Trading, and Swing Trading

The forex time trading landscape offers various trading strategies suited to different risk appetites and time commitments. Scalping involves executing multiple trades within a short timeframe, often seconds or minutes, to profit from small price movements. Day trading involves opening and closing positions within a single trading day, taking advantage of short-term market fluctuations. Swing trading, on the other hand, focuses on capturing larger price movements over several days or weeks. Choosing the right strategy depends on your personal trading style, risk tolerance, and available time.

Image: tradenation.com

Technical Analysis: Deciphering Market Behavior

Technical analysis is a cornerstone of forex time trading, empowering traders to identify patterns and predict future price movements. By studying historical price data, traders employ technical indicators, chart patterns, and trendlines to anticipate market direction. Common technical indicators include moving averages, Bollinger bands, and the relative strength index (RSI), each providing valuable insights into market momentum, volatility, and overbought/oversold conditions. Understanding these technical tools and their nuances is paramount for making informed trading choices.

Managing Risk: Forex Trading Responsibly

Risk management is an integral part of successful forex time trading. Careful analysis and proper risk mitigation strategies are essential to minimize potential losses and preserve your trading capital. Identifying your risk tolerance and setting appropriate stop-loss orders are crucial steps in managing risk. Stop-loss orders automatically close your trades at a predetermined loss level, preventing further losses if the market moves against your position. Additionally, controlling your trading leverage and maintaining a diversified portfolio can enhance your overall risk management strategy.

Choosing a Forex Broker: Trustworthy and Reliable

Selecting a reputable and reliable forex broker is vital for a successful trading experience. Consider factors such as the broker’s regulatory compliance, spreads, fees, trading platform, and customer support. Ensure that your broker offers competitive trading conditions and ample educational resources to support your trading journey. Reading reviews and conducting thorough research on potential brokers is highly recommended before committing your funds.

How To Trade Forex Time

Conclusion: Embark on Your Forex Time Trading Success

Forex time trading presents a formidable opportunity for those willing to invest time, effort, and discipline. By mastering the intricacies of forex time trading, traders can potentially capitalize on the dynamic nature of currency markets and generate substantial profits. Embark on this trading journey with confidence, embracing the concepts, strategies, risk management techniques, and fundamental analysis outlined in this comprehensive guide. Your commitment to knowledge, skill development, and unwavering perseverance will pave the path to forex time trading success.