“Trading extreme points in forex is like navigating a treacherous mountain pass – every step brings heightened risk and potential reward.”

Image: atozmarkets.com

In the volatile world of foreign exchange, identifying and trading extreme points can be a daunting yet lucrative endeavor. These market extremities, often marked by sharp spikes or plunges in currency pairs, present both opportunities and pitfalls for traders.

Identifying Extreme Points: A Keen Observer’s Guide

Extreme points are fleeting moments when a currency pair reaches its peak or trough within a specific time frame. They can arise due to various market forces, including economic news, political events, or supply and demand imbalances.

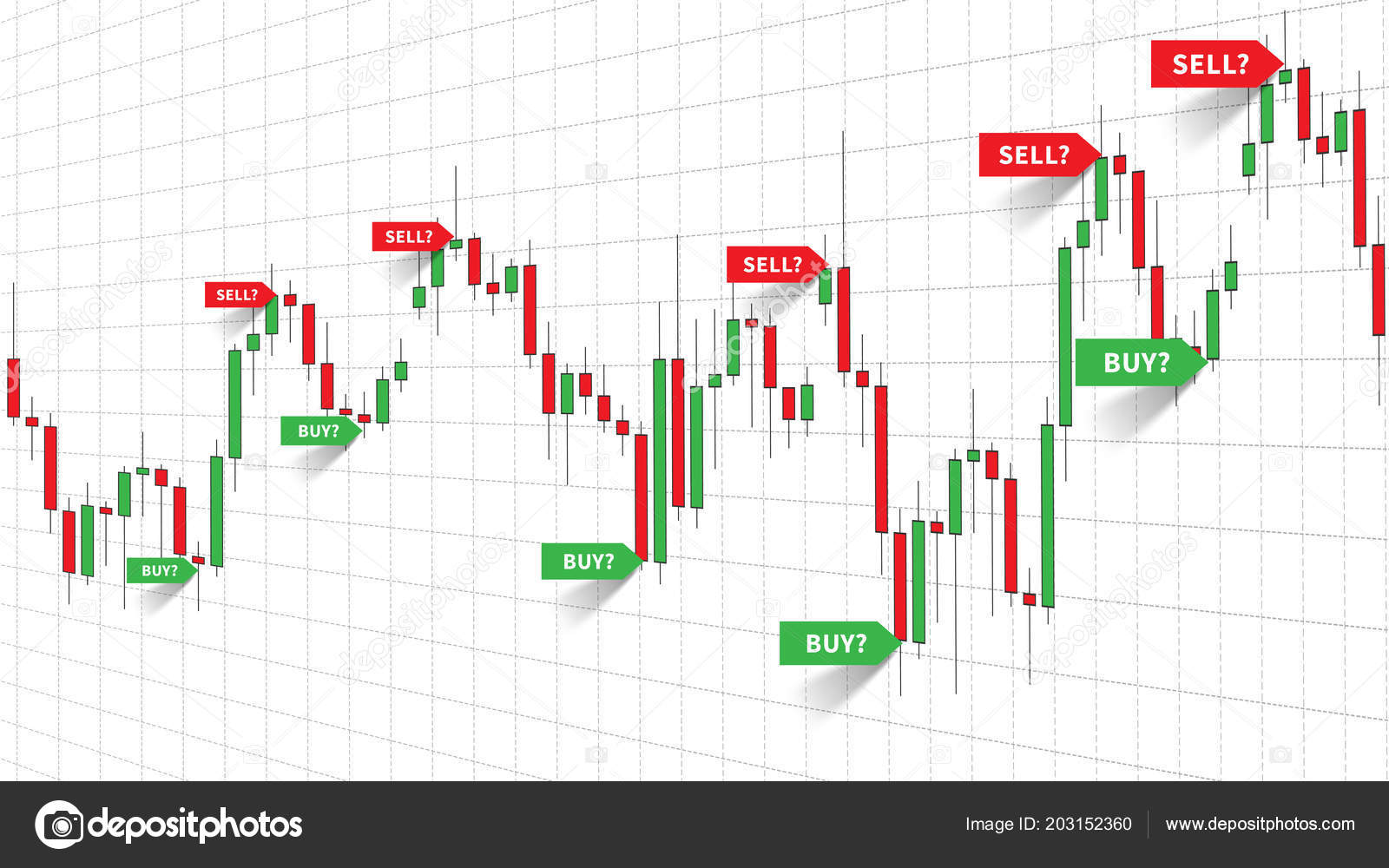

Recognizing extreme points requires a keen eye for technical analysis. Traders often rely on indicators such as moving averages, Bollinger Bands, and Fibonacci retracements to identify areas of potential reversal and overextension.

When a currency pair reaches an extreme point, it often signals a breakout or reversal. These breakouts can provide significant trading opportunities, but it’s crucial to exercise caution and assess the risk-reward ratio thoroughly.

Chart Patterns: A Visual Guide to Extreme Points

Chart patterns can provide valuable insights into potential extreme points. Some common patterns to watch for include:

- Double Tops and Bottoms: These patterns indicate a potential trend reversal. A double top forms when a currency pair tests the same high point twice, while a double bottom occurs when it tests the same low point twice.

- Head and Shoulders: This pattern signals a potential downward trend reversal. It consists of a central peak (the head), followed by two smaller peaks (the shoulders). The neckline is a horizontal line connecting the two lows.

- Triangles: Triangles can be symmetrical, ascending, or descending. They indicate a consolidation or indecision in the market. A breakout from a triangle can often lead to a strong trend.

Expert Advice: Navigating Extreme Points Safely

Trading extreme points requires a combination of technical expertise and risk management strategies. Here are some tips from experienced traders:

- Trend is your friend: Trade in line with the prevailing trend. Extreme points are more likely to occur during periods of trend continuation.

- Set stop-loss orders: Protect your capital by placing stop-loss orders below extreme lows (for long trades) and above extreme highs (for short trades).

- Manage your risk: Calculate your risk-reward ratio and trade with a size that aligns with your trading plan.

- Wait for confirmation: Don’t rush into trades. Wait for the price action to break out of the extreme point and confirm the trend before entering a position.

- Practice discipline: Stick to your trading plan and avoid emotional decision-making. Consistency and discipline are key in extreme point trading.

Image: garrynutri.weebly.com

How To Trade Extreme Points In Forex

FAQs: Questions Unraveled

Q: What is the best way to identify extreme points?

A: Technical analysis tools such as moving averages, Bollinger Bands, and chart patterns can assist in recognizing extreme points.

Q: How do I avoid false breakouts?

A: Look for confirmation from multiple indicators and wait for the price action to break out and hold the extreme point.

Q: Is it risky to trade extreme points?

A: Extreme points carry high risk due to the potential for sharp reversals. Protect yourself with stop-loss orders and manage your risk carefully.