Title: Empowering Traders: Unveiling the Secrets of Forex Calculator Validation

Image: erokytumak.web.fc2.com

Introduction:

In the dynamic realm of forex trading, precision is paramount. Every decision can lead to profit or loss, making it crucial to have tools you can rely on. Among the most essential instruments is the forex calculator, a valuable companion that helps traders calculate profits, losses, and risk-to-reward ratios. However, how do you know if your forex calculator is providing accurate and reliable results? Enter this comprehensive guide to testing and validating your forex calculator, ensuring your financial decisions are guided by precision.

Understanding the Forex Calculator

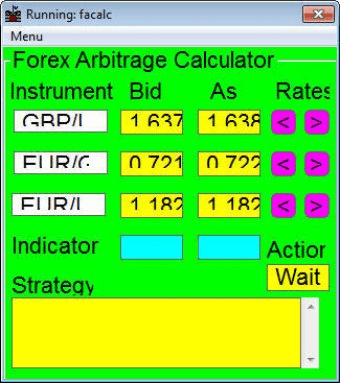

A forex calculator is a specialized software or online tool that enables traders to make complex calculations related to currency conversions, profit/loss analysis, and more. These calculators incorporate factors such as exchange rates, leverage, and contract size to deliver tailored insights. They streamline trading activities, saving traders time and minimizing errors.

The Importance of Calculator Validation

Inconsistent or inaccurate calculations can derail trading strategies and lead to costly mistakes. A validated forex calculator provides peace of mind, ensuring your trading decisions are based on solid numerical foundations. By corroborating the calculator’s results with independent methods, you can eliminate uncertainty and enhance your trading confidence.

Step-by-Step Calculator Testing

-

Cross-Check with Online Resources: Compare the calculator’s results with those obtained from reputable online forex converters or independent trading platforms. Identify any discrepancies and note the calculator’s accuracy level.

-

Leverage Sample Calculations: Use a series of standardized calculations covering various scenarios. Test for consistency in outcomes to assess the calculator’s stability. Consider different currency pairs, leverage amounts, and trade volumes.

-

Perform Reverse Calculations: Calculate results using the calculator, then manually perform the same calculations using pen and paper. This exercise verifies the calculator’s precision and reveals any calculation errors or inconsistencies.

-

Analyze Sensitivity: Study how the calculator’s results vary with changes in input parameters. Monitor the percentage change and assess the calculator’s response to fluctuations in exchange rates and leverage ratios. This reveals the calculator’s robustness and applicability to a range of trading scenarios.

-

Investigate Advanced Features: Explore the calculator’s additional functions, such as profit/loss forecasting, what-if analysis, and charting capabilities. Test these features to ensure they align with your trading needs and provide meaningful insights into market dynamics.

Expert Insights for Enhanced Precision

-

Seek Expert Validation: Engage with trading mentors, financial advisors, or seasoned traders who can provide insights into reputable forex calculators and their validation techniques. Their knowledge and experience are invaluable in refining your testing approach.

-

Stay Updated: Monitor updates and improvements made to the forex calculator. Regularly validate the calculator to ensure it incorporates the latest market data and industry best practices. Advances in technology and trading methodologies may necessitate periodic re-testing and validation.

Conclusion:

A validated forex calculator is an indispensable tool for traders seeking accuracy and confidence in their financial decisions. By implementing the testing strategies outlined above, you can ensure that your calculator delivers precise and reliable results. Remember, precision in forex trading is the cornerstone of success. Seize the opportunity to test your forex calculator today and empower yourself with the clarity and confidence to navigate the ever-changing currency markets with confidence.

Image: mappingmemories.ca

How To Test Forex Calculator