Navigating the world of international finance can be daunting, but a Forex card from Standard Chartered Bank can simplify the process. Designed for frequent travelers and business professionals, a Forex card offers the convenience of cashless transactions, competitive exchange rates, and the security of managing your funds digitally.

Image: suukarenroberts.blogspot.com

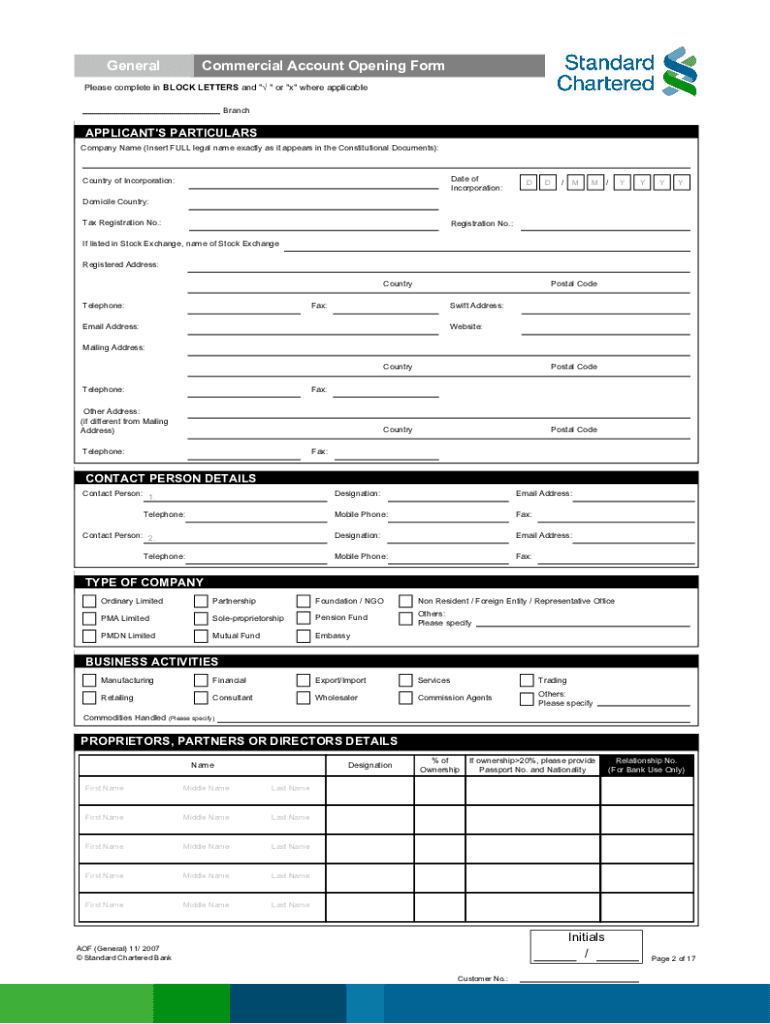

Apply for a Forex Card with Standard Chartered

Applying for a Standard Chartered Forex card is a straightforward process. Simply visit your nearest branch with the following documents:

- Identity proof (original passport or Aadhaar card)

- Address proof (utility bills, rent agreement, or bank statement)

- PAN card

- Income proof (salary slips, Form 16, or bank statement)

The eligibility criteria for a Forex card include being an Indian resident over 18 years of age with a regular source of income. Once your application is approved, your Forex card will be delivered to your registered address within 7-10 business days.

Activate Your Card: Safety Measures

Upon receiving your Standard Chartered Forex card, you’ll need to activate it online or through the Standard Chartered mobile app. For added security, your Forex card will be delivered pre-blocked, so you’ll need to set a PIN to unlock it.

Exploring the Benefits of a Standard Chartered Forex Card

As one of the leading banks in India, Standard Chartered offers its Forex cardholders a range of advantages:

- Cashless Convenience: Make international payments without carrying cash, simplifying your travel experience and minimizing theft risks.

- Competitive Exchange Rates: Get real-time exchange rates with minimal markups, saving on currency conversion fees.

- Wide Acceptance: Use your Standard Chartered Forex card at millions of POS terminals and ATMs worldwide with the convenience of multiple currency load options.

- Travel Essential: Enjoy exclusive benefits like airport lounge access, baggage insurance, and emergency assistance to make your trips hassle-free.

- Manage Your Finances: Track your transactions, monitor your card balance, and view exchange rate updates through the Standard Chartered mobile app.

By opting for a Standard Chartered Forex card, you can save time, money, and enjoy peace of mind while managing your international finances.

Image: www.pdffiller.com

Latest Forex Market Trends and Developments

The Forex market is constantly evolving, and staying informed about the latest trends and developments can help you make informed decisions. Here’s a roundup of some recent updates:

- Rise of Cryptocurrency: The increasing popularity of cryptocurrencies like Bitcoin and Ethereum is impacting the Forex market, with some experts predicting that digital currencies may become mainstream.

- Geopolitical Events: International conflicts, such as the Russia-Ukraine crisis, have a significant impact on currency exchange rates due to their economic consequences.

- Deeper Market Integration: Advanced technology is enabling real-time connections between financial markets, allowing for instant updates on currency fluctuations.

Understanding these trends can help you optimize your use of a Forex card and take advantage of favorable market conditions.

Tips for Optimizing Your Foreign Exchange Experience

Based on my expertise, here are some tips to make the most of your Standard Chartered Forex card:

- Monitor Exchange Rates Regularly: Stay updated on the latest exchange rates using online platforms or mobile apps like XE Currency.

- Plan Your Transactions: Timing your transactions can save you money. Avoid exchanging currencies when the exchange rate is unfavorable.

- Choose the Right Card: Standard Chartered offers different Forex cards tailored to specific needs. Research and choose the card that best suits your travel pattern and usage requirements.

- Withdraw Cash Sparingly: ATM withdrawals may incur higher fees. Use your Forex card primarily for card payments and minimize cash withdrawals.

By following these tips, you can maximize the benefits of your Forex card and manage your international finances efficiently.

FAQs on Forex Cards

- Q: Are Forex cards safe to use?

A: Yes, Standard Chartered Forex cards employ advanced security measures like encryption and PIN protection to safeguard your financial information.

- Q: What is the difference between a travel card and a Forex card?

A: While both cards are suitable for international travel, travel cards often have additional benefits like insurance coverage, whereas Forex cards focus on competitive exchange rates and currency conversion.

- Q: Can I use my Standard Chartered Forex card to withdraw local currency from ATMs abroad?

A: Yes, you can use your Forex card at ATMs to withdraw local currency, but do note that there may be additional charges associated with ATM withdrawals.

- Q: How can I track my Forex card transactions?

A: You can track your transactions through the Standard Chartered mobile app or by logging into your online banking account.

- Q: Can I load multiple currencies onto my Standard Chartered Forex card?

A: Yes, you can load multiple currencies onto your Forex card and switch between them as needed, allowing you to manage your finances seamlessly in different countries.

How To Request For Forex Card In Standard Chartered

Conclusion

Requesting a Forex card from Standard Chartered Bank is a simple process that opens up a world of convenience and savings for frequent travelers and business professionals. With its competitive exchange rates, cashless convenience, and extensive security features, a Standard Chartered Forex card is an essential tool for managing your international finances securely and efficiently.

If you’re planning an international trip or regularly make international payments, consider applying for a Standard Chartered Forex card. Its benefits and ease of use make it an excellent choice for optimizing your foreign exchange experience.