Introduction

In the exhilarating world of currency trading, registering with a reliable and trusted platform is critical. Axis Bank, India’s leading private sector bank, has emerged as a formidable player in the foreign exchange (Forex) market. Their eForex platform offers a secure, user-friendly interface, making it an ideal choice for novice and experienced traders alike. This article will guide you through the hassle-free process of registering for eForex with Axis Bank, unlocking the gateway to global currency markets.

Image: www.forex.academy

With eForex, you’ll gain access to a vast array of currency pairs, competitive exchange rates, and real-time market data. Whether you’re seeking to hedge against currency fluctuations or simply want to capitalize on market movements, eForex provides a comprehensive suite of tools and resources to empower your trading strategies.

Navigating eForex Registration

Step 1: Meet the Eligibility Criteria

Before embarking on your eForex registration journey, ensure that you meet the eligibility requirements set by Axis Bank. These include being an Indian resident with a valid PAN card, a savings or current account with Axis Bank, and an e-mail address and mobile number for account setup.

Step 2: Access the eForex Portal

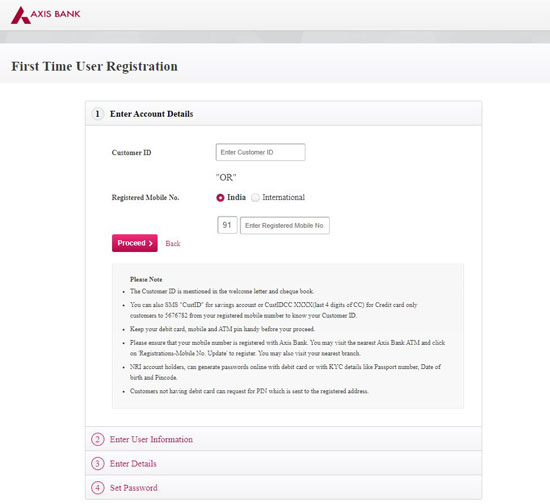

Visit the official Axis Bank website and navigate to the eForex section. Click on the “Register Now” button, which will redirect you to the online registration form. Alternatively, you can directly access the registration portal at https://www.axisbank.com/retail/forex-services/e-forex.

Image: vakilsearch.com

Step 3: Fill in the Registration Form

Carefully fill in the registration form with your personal details, including your name, address, PAN card number, e-mail address, and mobile number. Ensure that all the information provided is accurate and up-to-date.

Step 4: Submit Your Application

After verifying the details you’ve entered, click on the “Submit” button. Axis Bank will review your application and notify you of the registration status within 24 hours via e-mail or SMS.

Step 5: Fund Your Account (Optional)

Once your eForex account is approved, you can fund it using NEFT, RTGS, or IMPS from your Axis Bank account. The minimum deposit amount is INR 10,000.

Benefits of eForex Registration with Axis Bank

- Secure and Reliable Platform: Axis Bank’s eForex platform adheres to stringent security standards, ensuring the confidentiality of your personal and financial data.

- User-Friendly Interface: The platform is designed for ease of use, making it accessible to both novice and experienced traders.

- Competitive Exchange Rates: Axis Bank provides competitive exchange rates, ensuring that you get the best value for your money.

- Real-Time Market Data: Stay updated on the latest market movements with real-time data and customizable charts.

- 24×7 Support: A dedicated customer support team is available 24×7 to assist you with any queries or troubleshooting.

Latest Trends and Developments in Forex Trading

The Forex market is constantly evolving, with new trends and developments shaping the industry. Here are some key insights:

- Rise of Artificial Intelligence (AI): AI algorithms are becoming increasingly used to analyze market data and identify trading opportunities.

- Blockchain Technology: Blockchain-based solutions are being explored to enhance security and transparency in Forex transactions.

- Emerging Market Growth: Currency markets in emerging economies are attracting attention due to potential growth opportunities.

- Central Bank Policies: Monetary policy decisions by major central banks have a significant impact on Forex market fluctuations.

Expert Tips for Successful Forex Trading

Whether you’re a seasoned trader or just starting out, these expert tips can help you maximize your Forex trading success:

- Develop a Trading Plan: Define your trading goals, risk tolerance, and trading strategy before entering the market.

- Manage Risk Effectively: Use stop-loss orders and position sizing to limit potential losses and preserve your capital.

- Stay Updated on Market News: Monitor economic and political events that could impact currency prices.

- Use Technical Analysis: Study historical price data and market indicators to identify trading opportunities.

- Practice Discipline: Emotions can cloud judgment. Stick to your trading plan and avoid impulsive decisions.

Frequently Asked Questions (FAQs)

1. What are the charges for eForex registration with Axis Bank?

There are no registration charges for eForex with Axis Bank.

2. How long does it take to complete the eForex registration process?

The registration process is typically completed within 24 hours after submission of the application.

3. What documents are required for eForex registration?

You will need your PAN card, address proof, and bank account details for eForex registration.

4. Can I trade in multiple currency pairs on eForex?

Yes, eForex offers a wide range of currency pairs for trading.

5. Is there a minimum deposit requirement for eForex trading?

Yes, the minimum deposit amount for eForex trading is INR 10,000.

How To Register E Forex Registration In Axis Bank

Conclusion

Registering for eForex with Axis Bank is a straightforward and secure process. By following the steps outlined in this comprehensive guide, you can unlock access to the global financial markets and start your Forex trading journey today. Whether you’re looking to hedge, speculate, or simply explore the world of currency trading, eForex provides a reliable and user-friendly platform to cater to your needs.

Are you ready to embark on your eForex trading adventure with Axis Bank? Register now and unlock the potential of the global currency markets.