Introduction

Foreign exchange (forex) trading has become increasingly popular in recent years, offering traders potential opportunities to profit from currency fluctuations. However, when it comes to closing inventory, recognizing forex can be a complex task. This article provides a comprehensive guide to recognizing forex on closing inventory, equipping you with the knowledge and techniques to accurately account for forex transactions and enhance your financial reporting. By understanding the principles and practices of forex recognition, you can minimize errors and maintain compliance with applicable regulations.

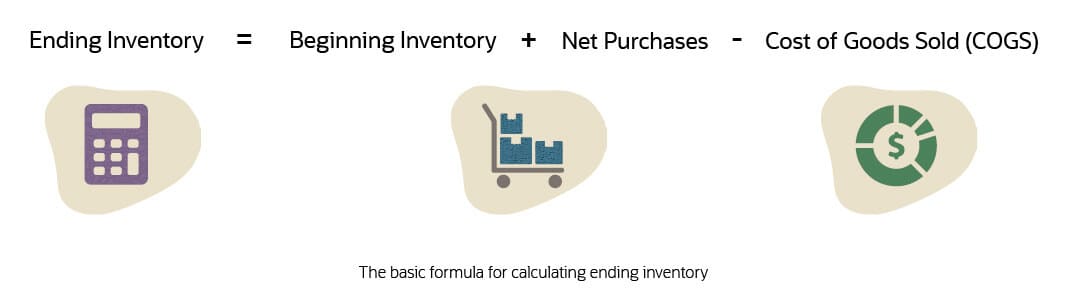

Image: www.unleashedsoftware.com

Basic Concepts of Forex Recognition

Forex recognition involves accounting for the gains or losses arising from the differences in currency exchange rates between the transaction date and the closing date. When you purchase or sell goods or services in a foreign currency, the value of the transaction will fluctuate with changes in exchange rates. These fluctuations can result in either a foreign exchange gain or loss, which must be recorded on your closing inventory.

Recording Foreign Exchange Gains and Losses

To record forex gains and losses on closing inventory, you need to establish a clear accounting policy that outlines the procedures for recognizing and measuring these transactions. The most common methods include:

Balancing Inventory Valuation

The method you choose for forex recognition will impact the carrying value of your inventory. Realized gains and losses are recognized in the income statement, while unrealized gains and losses are reflected in the inventory valuation on the balance sheet. Ensuring accuracy in forex recognition is essential for maintaining proper inventory balances and financial reporting.

Image: www.netsuite.com

Example

Let’s consider an example to illustrate the recognition of forex on closing inventory. Assume that a company purchases inventory from a foreign supplier for $100,000 on January 5th, when the exchange rate is $1 = €1. At the end of the month on January 31st, the closing exchange rate is €1 = $1.10. If the company accounts for only realized gains and losses, no forex gain would be recognized since the settlement has not yet occurred. However, under unrealized gains and losses accounting, the company would recognize a foreign exchange loss of $10,000 (100,000 * (1.10 – 1.00)).

How To Recognise Forex On Closing Inventory

Conclusion

Recognizing forex on closing inventory is an important aspect of financial accounting. By understanding the principles and practices outlined in this article, you can effectively account for foreign exchange transactions, minimize accounting errors, and ensure accurate financial reporting. A clear understanding of forex recognition will contribute to the transparency and reliability of your financial statements. For further guidance, it is always advisable to consult with a qualified accountant or financial advisor to ensure compliance and adherence to best practices in your specific situation.