Title: Unlocking the Secrets of Forex Trading: Your Ultimate Guide to Reading Candlestick Charts

Image: mungfali.com

Introduction:

In the bustling world of Forex trading, candlestick charts emerge as an invaluable tool for discerning market patterns and making informed decisions. These visual representations of price action over time hold a treasure trove of insights for traders seeking to navigate the turbulent waters of the currency markets with precision and profitability. Embark on this educational journey to master the art of reading candlestick charts and elevate your trading prowess to newfound heights.

Chapter 1: Understanding Candlestick Fundamentals

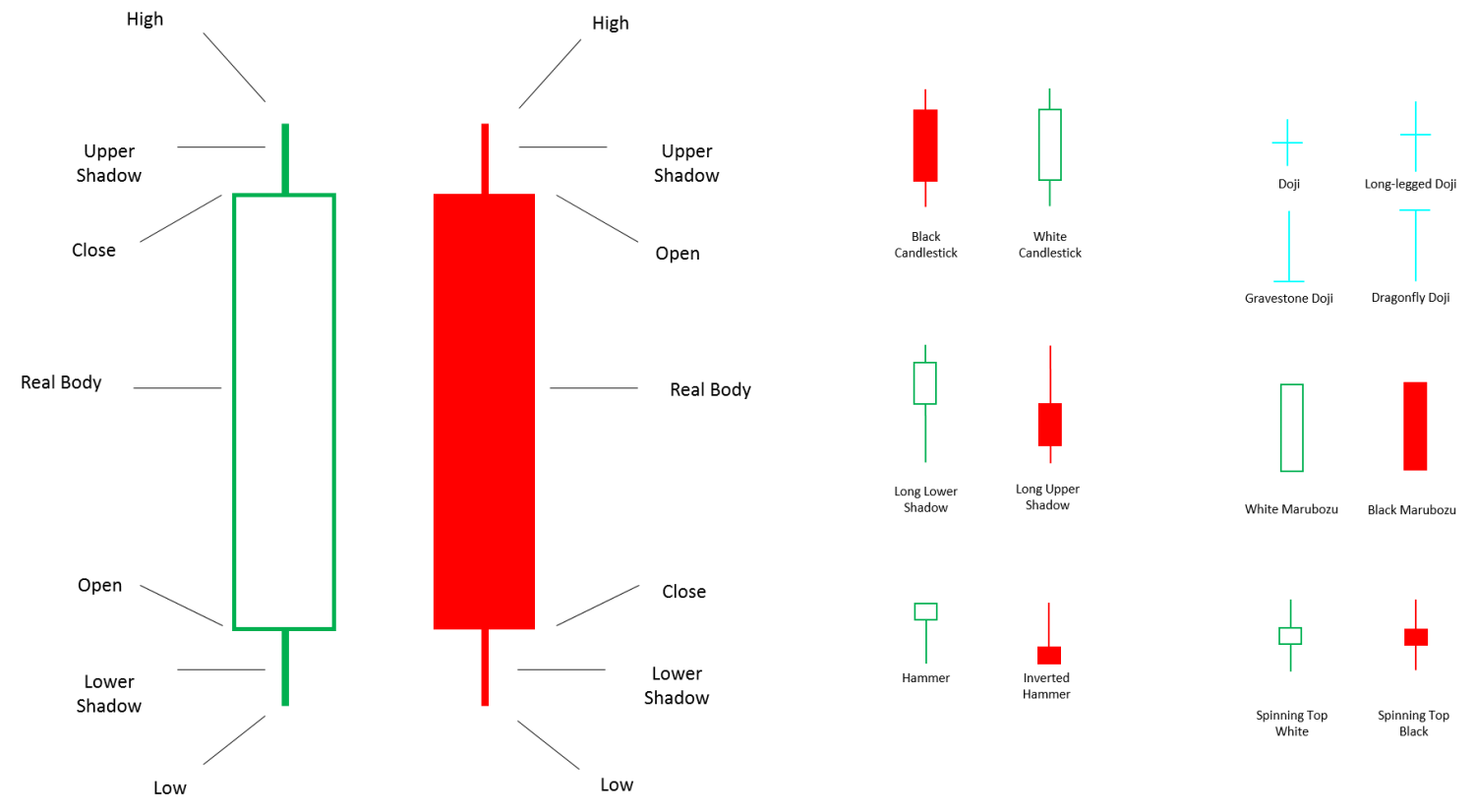

Candlestick charts originated in 18th-century Japan, where rice traders sought to depict market fluctuations with remarkable accuracy. Each candlestick embodies a wealth of information, encapsulating the open, close, high, and low prices of a currency pair within a specified time frame. By discerning the colors, shapes, and patterns formed by these candlesticks, traders can gain a profound understanding of market sentiment, momentum, and support and resistance levels.

Chapter 2: The Anatomy of a Candlestick

Unveiling the anatomy of a candlestick reveals its integral components: body, wicks, and shadows. The body, denoted by a solid or hollow rectangle, represents the trading range between the open and close prices. Wicks, extending from the body’s extremities, indicate the highest and lowest prices reached during the period. Shadows, also known as tails, extend from the body’s base, depicting the range between the open or close price and the lowest or highest point achieved within the time frame.

Chapter 3: Interpreting Candlestick Colors

Candlestick colors play a pivotal role in discerning market sentiment. Green or white candlesticks signify a bullish market, where the closing price is higher than the opening price. Conversely, red or black candlesticks indicate a bearish market, signaling a decline in prices. This simple yet powerful color coding empowers traders with a quick visual assessment of market direction.

Chapter 4: Dissecting Candlestick Shapes

Beyond colors, candlestick shapes convey invaluable insights into market dynamics. Hammer and hanging man candlesticks, with long lower wicks and short bodies, often signal a bullish reversal in downward trends. Conversely, shooting stars and inverted hammer candlesticks, characterized by long upper wicks and short bodies, hint at a bearish reversal in upward trends. Recognizing these patterns equips traders with the foresight to anticipate potential market shifts.

Chapter 5: Mastering Candlestick Patterns

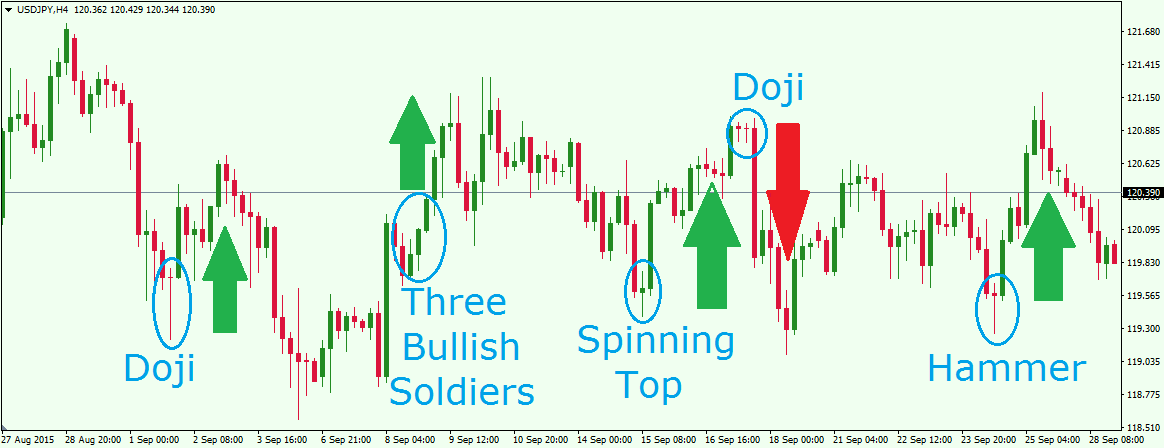

Candlestick patterns, formed by the arrangement of multiple candlesticks, provide a deeper level of market analysis. Bullish patterns such as the three white soldiers and the rising three methods signal strong upward momentum, whereas bearish patterns such as the three black crows and the evening star foreshadow a downtrend. Interpreting these patterns empowers traders to make informed decisions based on historical price action.

Chapter 6: Real-World Applications in Forex Trading

Equipped with a firm grasp of candlestick chart reading, traders can harness this knowledge to excel in Forex trading. Identifying bullish and bearish reversals enables timely entry and exit points, maximizing profit potential. Recognizing support and resistance levels based on candlestick patterns allows for strategic position sizing and risk management.

Chapter 7: Insights from Expert Traders

Delving into the secrets of successful traders uncovers the invaluable insights they have gleaned from candlestick chart reading. Case studies, interviews, and firsthand accounts provide a practical understanding of how experts utilize these charts to enhance their trading strategies.

Conclusion:

Mastering the intricacies of candlestick chart reading unveils a gateway to understanding market dynamics and making informed trading decisions in the volatile Forex market. By embracing this powerful tool, aspiring traders can elevate their skills, mitigate risks, and unlock the full potential of their trading endeavors. Embark on this educational journey today and empower yourself with the knowledge to navigate the currency markets with confidence and success.

Image: forextraininggroup.com

How To Read Candlestick Charts In Forex Trading Pdf