Introduction

The foreign exchange market, commonly known as Forex, is a fast-paced and lucrative arena where traders from all over the globe buy and sell currencies. However, with great potential rewards come significant risks. Unforeseen market movements can wipe out profits and lead to substantial losses in a matter of seconds. To navigate this volatile landscape and protect your capital, understanding and implementing a stop loss order is paramount.

Image: www.litefinance.org

Understanding a Stop Loss Order

At its core, a stop loss order is an instruction given to your broker to automatically sell (or buy, in the case of a short position) your currency pair at a predetermined price if the market moves against you. By setting a stop loss, you establish a threshold beyond which you are no longer willing to tolerate losses. This safeguards your account from catastrophic drawdowns and ensures your trading decisions are based on sound risk management principles.

Benefits of Using a Stop Loss

- Capital Preservation: A stop loss order serves as a safety net that prevents your losses from spiraling out of control. It automatically exits your position when the market reaches your specified threshold, limiting your exposure to adverse price fluctuations.

- Emotional Trading Avoidance: When emotions run high during volatile market conditions, traders often make irrational decisions that lead to significant losses. A stop loss removes the temptation to hold on to losing positions out of hope or fear, allowing you to trade objectively and rationally.

- Predefined Risk Management: By establishing a stop loss, you define your maximum acceptable loss before entering a trade. This predefined risk management strategy helps you maintain discipline and stay within your financial boundaries.

- Trading Psychology: Using a stop loss can improve your trading psychology by instilling a sense of confidence and control. Knowing that you have a safety net in place allows you to focus on identifying profitable opportunities without the constant stress of potential losses.

Calculating Your Stop Loss Level

The optimal stop loss level will vary depending on your trading strategy, risk tolerance, and the volatility of the currency pair you are trading. Three common methods for calculating your stop loss are:

- Fixed Percentage: Set your stop loss at a fixed percentage below the entry price, typically 1-3%.

- Technical Analysis: Determine your stop loss based on technical indicators such as support and resistance levels, moving averages, or Bollinger Bands.

- Volatility-Based: Calculate your stop loss using a multiple of the Average True Range (ATR), which measures market volatility.

Image: niws.in

Types of Stop Loss Orders

There are two main types of stop loss orders:

- Market Order: This is the most common type of stop loss and is executed immediately at the market price when the predetermined threshold is breached.

- Limit Order: Unlike a market order, a limit order only triggers the trade if the specified price or better is available. This provides additional protection against sudden and significant price fluctuations.

Positioning Your Stop Loss

The optimal distance of your stop loss from the entry price depends on various factors, including the market conditions, your trading strategy, and the timeframe of your trades. While a closer stop loss offers greater protection, it may also result in false signals and unnecessary exits. Conversely, a wider stop loss provides more leeway but increases your risk exposure.

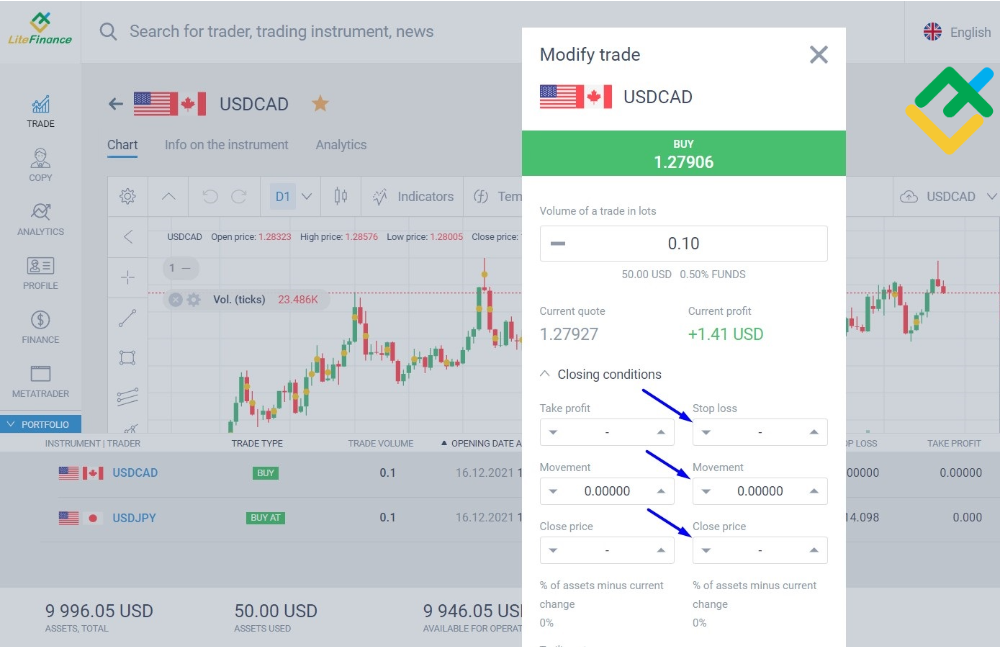

How To Put A Stop Loss In Forex

Conclusion

Harnessing the power of a stop loss order is an indispensable risk management tool for Forex traders. By carefully calculating your stop loss level, utilizing the appropriate type of order, and strategically positioning it, you can safeguard your profits, minimize losses, and enhance your overall trading experience. Remember, the key to successful trading lies in understanding both the opportunities and risks involved, and a well-placed stop loss is an essential part of that equation.