Compelling Introduction

Image: tradingstrategyguides.com

Imagine the thrill of predicting the fickle movements of the financial markets like a modern-day Nostradamus. With Forex fundamentals analysis, you can turn this vision into a reality, mastering the art of anticipating market trends and unlocking the path to financial success. This comprehensive guide will empower you with the knowledge and strategies needed to decipher the complexities of the Forex market and make informed decisions that can reap significant returns.

Understanding Forex Fundamentals

Forex or foreign exchange is the global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, making it an attractive avenue for traders of all levels. To effectively predict market trends in Forex, a deep understanding of the fundamental factors that influence currency values is essential. These factors include:

- Economic indicators: Gross Domestic Product (GDP), inflation, unemployment rate

- Monetary policy: Interest rates, quantitative easing

- Political stability: Elections, government policies

- Geopolitical events: Wars, natural disasters

Economic Data Analysis

Central banks, national governments, and international organizations release economic data on a regular basis. This data provides valuable insights into the health of an economy and can significantly impact currency values. For example, a strong GDP growth rate indicates economic expansion, which can lead to an appreciation of the country’s currency. Conversely, high inflation can signal economic weakness and currency devaluation.

Monetary Policy and Interest Rates

Central banks play a pivotal role in managing a country’s economy through monetary policy. By setting interest rates and implementing quantitative easing or tightening measures, they influence the value of their currency relative to others. Interest rate hikes tend to strengthen a currency, while rate cuts can weaken it.

Political and Geopolitical Events

Political stability and geopolitical events can have a profound impact on currency value. Investors tend to flock to currencies from countries perceived as stable and avoid those associated with political instability or unrest. Major events such as wars, natural disasters, or trade disputes can also trigger significant market movements.

Expert Insights and Actionable Tips

Mastering Forex fundamentals analysis requires a combination of knowledge, experience, and a keen eye for market dynamics. Here are some actionable tips to enhance your analytical skills:

- Monitor reputable news sources: Stay updated with the latest economic and political developments around the world.

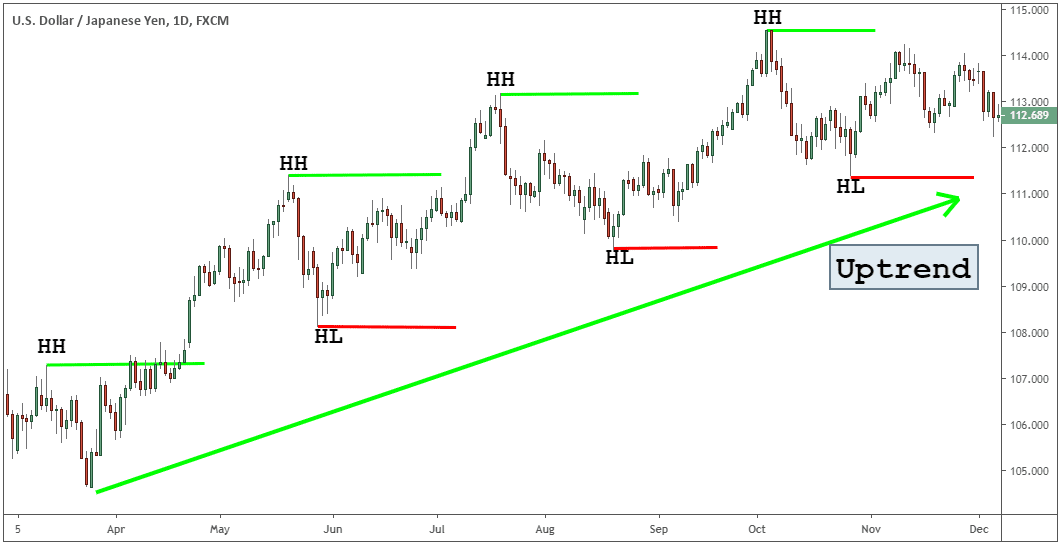

- Track currency performance: Use charts and graphs to visualize currency movements over time and identify patterns or trends.

- Consult economic calendars: Mark your calendar for important economic data releases and prepare for potential market reactions.

- Consider breakout strategies: Breakout trading involves identifying when a currency pair breaks above or below a significant support or resistance level, signaling a potential trend reversal.

Conclusion

Forex fundamentals analysis is an invaluable tool for predicting market trends and making informed trading decisions. By understanding the economic, monetary, political, and geopolitical factors that influence currency values, traders can gain a competitive edge in the dynamic Forex market. Embrace this knowledge, hone your analytical skills, and embark on a journey to financial success through the mastery of Forex fundamentals. Remember, the path to market prediction is a continuous learning process, but with persistence and dedication, you can unlock the secrets of the financial world.

Image: www.mql5.com

How To Predict Market Trend By Fundamentals In Forex