In the enigmatic world of technical analysis, the humble candlestick holds a place of prominence, offering traders a glimpse into the intricate dynamics of the market. These graphical representations of price action, despite their simple appearance, are imbued with profound insights, unraveling the delicate balance between supply and demand. To master the art of candlestick analysis, one must delve into the anatomy of these remarkable tools, deciphering their intricacies to unlock their full potential.

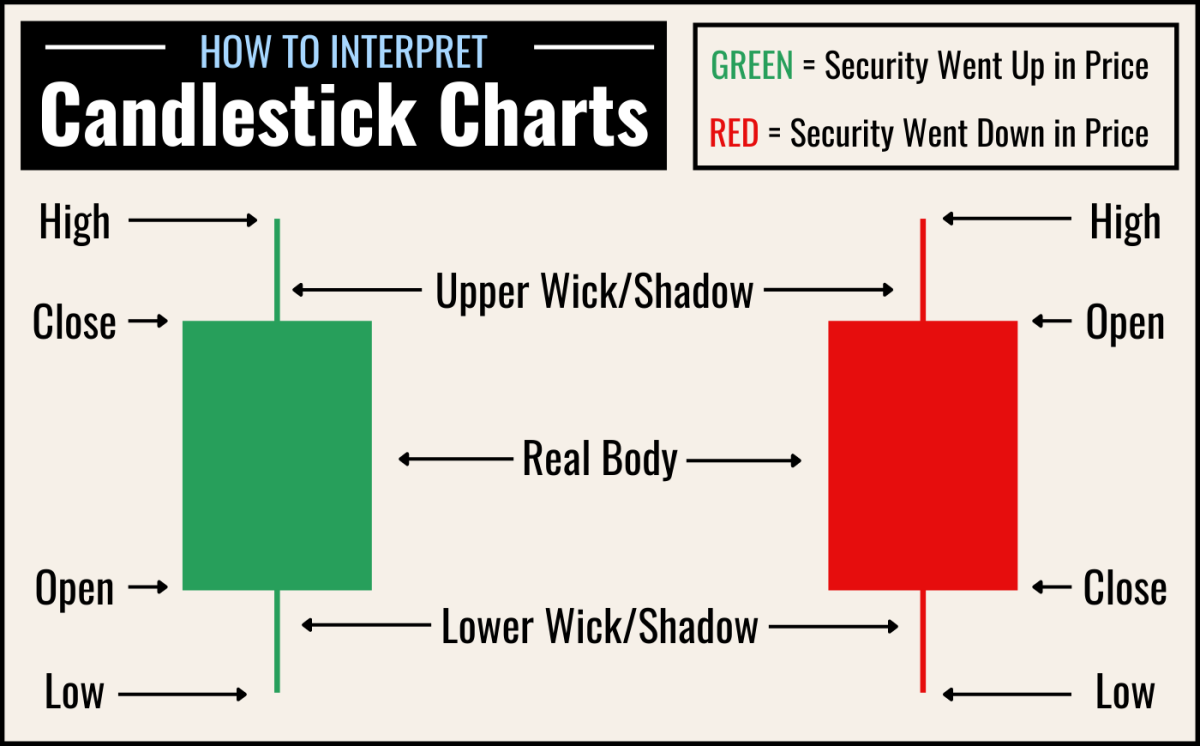

Image: www.thestreet.com

Candlesticks, as their name suggests, resemble candles, featuring a body, an upper wick, and a lower wick. The body, a shaded or filled area, represents the range between the opening and closing prices of a given period, signifying the market’s direction. An uptrend is heralded by a white or green body, while a downtrend is indicated by a black or red body. The wicks, thin lines extending from the body, depict the highest and lowest prices reached during the period, reflecting market volatility.

Beyond their basic components, candlesticks possess a vocabulary of patterns, each with its unique implications. A bull candle, for instance, with a long upper wick and a short or nonexistent lower wick, suggests a strong buying force pushing prices upward. Conversely, a bear candle, featuring a long lower wick and a short or absent upper wick, signals a bearish sentiment, indicating selling pressure pulling prices down.

The world of candlesticks is a vast and multifaceted one. Engulfing patterns, where one candle completely engulfs the body of the previous candle, are indicative of strong market momentum. Doji patterns, characterized by small or absent bodies, hint at indecision and potential reversals. Moreover, candlestick formations occurring within trendlines or at support and resistance levels assume additional significance, providing valuable confirmation of market trends and potential breakouts.

Understanding and interpreting candlestick patterns requires patience and practice. Traders must approach the task with diligence and an open mind, recognizing that the market’s behavior is inherently complex and ever-evolving. Historical data and backtesting can prove invaluable in honing one’s skills, enabling traders to develop a deep understanding of candlestick patterns and their significance.

In the hands of proficient traders, candlestick analysis becomes an art form, offering a profound understanding of market dynamics. The anatomy of a candlestick is a key to unlocking this knowledge, empowering traders with the insights necessary to navigate the ever-changing tides of the market with confidence and precision.

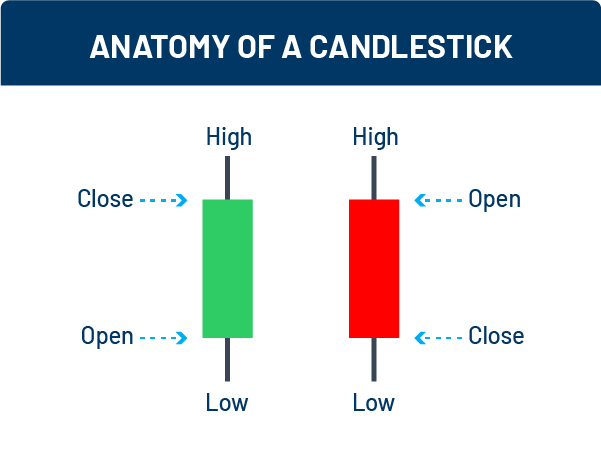

Image: arekkonojp7fmg.blogspot.com

Anatomy Of A Candlestick