In the fast-paced world of forex trading, timing is everything. Knowing when to take profits can make or break a trading strategy. While setting a single take-profit order is a common practice, savvy traders have discovered the power of placing multiple take-profits simultaneously.

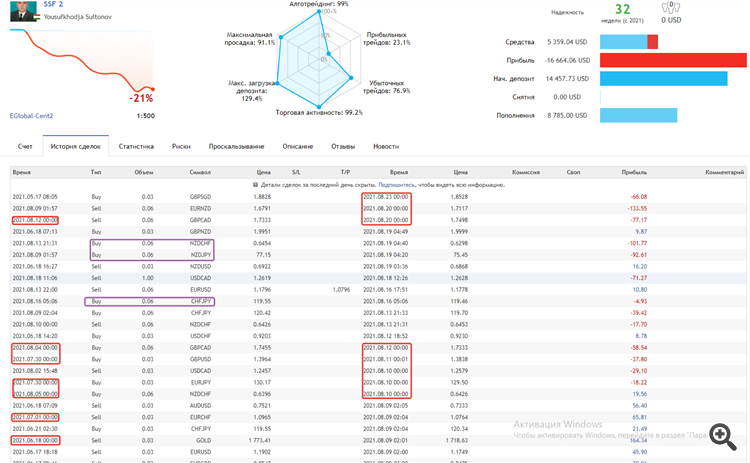

Image: www.mql5.com

Multiple TakeProfits: A Winning Strategy

Placing two or more take-profit orders allows you to take advantage of potential price fluctuations and lock in profits at different levels. This technique can minimize risk and maximize returns. For instance, if you believe the price will continue to rise but are unsure of the exact peak, you can place multiple take-profit orders at incremental price points. As the price rises, your earlier take-profits will execute, securing profits along the way, while the remaining orders continue to target higher levels.

How to Place Multiple TakeProfits in MQL5 Code

To execute this strategy in MQL5, you will need the following code:

int start()

double SL = Ask*0.999;

double TP1 = Bid*1.001;

double TP2 = Bid*1.002;

OrderSend(Symbol(), OP_BUY, 0.1, Ask, 3, SL, TP1, TP2, "MyOrder");

return(0);

In this code, “SL” represents the stop-loss level, “TP1” and “TP2” represent the two take-profit levels, and “MyOrder” is the name of the order. Simply adjust these values to align with your trading strategy.

Latest Trends in Multiple TakeProfit Strategies

Traders are continuously refining their multiple take-profit techniques. One emerging trend involves using trailing stop-losses with each take-profit order. This hybrid approach allows you to protect your profits while giving the market room to breathe. As the price moves in your favor, the trailing stop-loss will automatically adjust, ensuring you secure profits at increasingly advantageous levels.

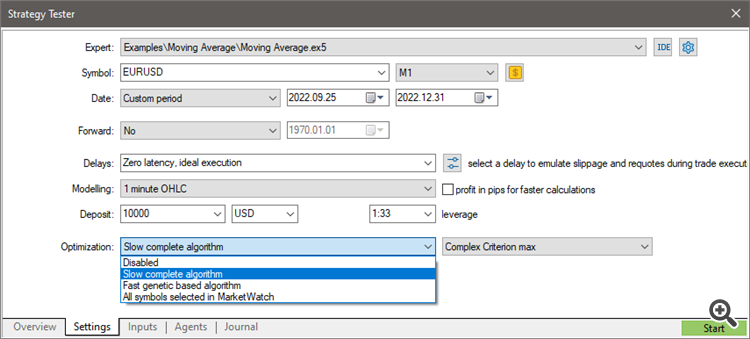

Image: www.mql5.com

Expert Advice: Navigating Multiple TakeProfits Effectively

Veteran traders offer valuable tips for mastering the art of multiple take-profits:

- Test your strategy thoroughly: Simulate your strategy in a demo account before risking real funds.

- Consider market volatility: The number of take-profits you set should align with the expected price volatility of the asset you’re trading.

- Manage your risk: Place your take-profit orders at logical levels that protect your capital.

- Monitor the market continuously: Keep a close eye on price action and market news to make adjustments as needed.

Frequently Asked Questions about Multiple TakeProfits

Q: Why is setting multiple take-profits beneficial?

A: Multiple take-profits allow you to lock in profits at different price levels, minimizing risk and maximizing returns.

Q: Is it possible to set more than two take-profits?

A: Yes, you can place as many take-profit orders as you deem necessary, but it’s important to strike a balance between risk management and profit potential.

Q: How should I manage multiple take-profits during volatile market conditions?

A: In volatile markets, use trailing stop-losses with your take-profit orders to protect your profits while giving the market room to fluctuate.

How To Place Two Takeprofit At Once Mql Forex Codin

Conclusion: Mastering Multiple TakeProfits for Forex Success

Incorporating multiple take-profits into your forex trading strategy can significantly enhance your profitability and risk management capabilities. By understanding the principles and implementing the tips outlined in this article, you can elevate your trading skills and unlock the full potential of the MQL5 coding environment.

Are you ready to take your forex trading to the next level? Start exploring the power of multiple take-profits today and reap the rewards of strategic profit-taking!