Navigating the intricate world of foreign exchange (forex) trading can be a daunting task, particularly when it comes to accounting for unrealized gains and losses. Tally, a robust accounting software, offers a comprehensive solution to streamline this process. Understanding how to pass these entries accurately is crucial for maintaining financial transparency and ensuring compliance.

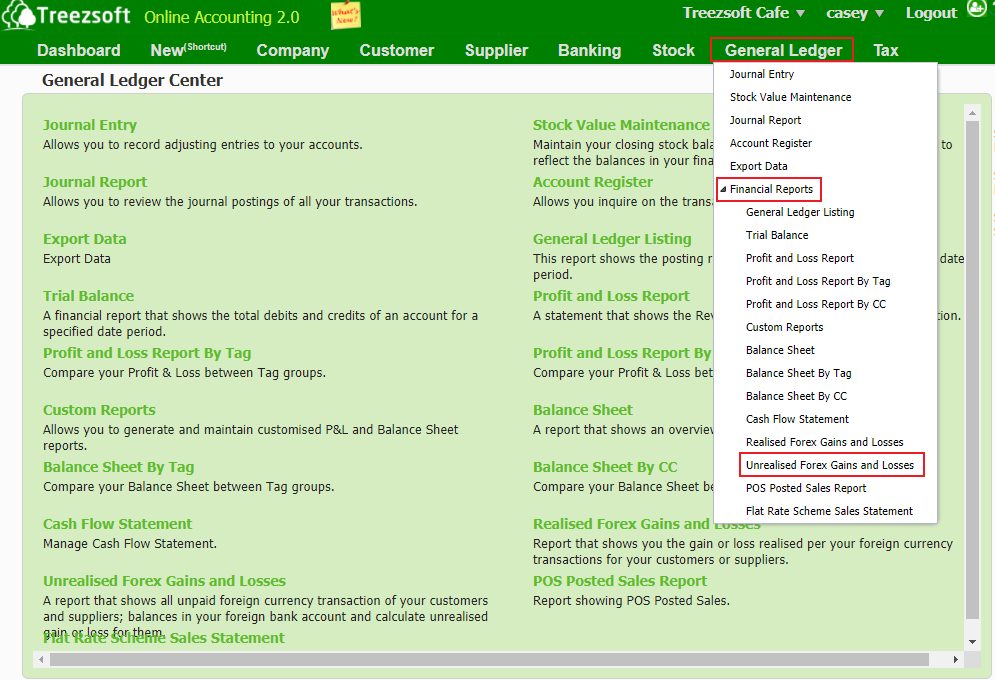

Image: blog.treezsoft.com

The Essence of Forex Transactions

Forex transactions involve the exchange of currencies between two parties at an agreed-upon rate. These transactions may result in either gains or losses, depending on the fluctuations in currency values. Unrealized gains or losses refer to the difference between the initial transaction price and the current market price, which are not yet realized until the position is closed.

Recording Unrealized Forex Gains

To record unrealized forex gains in Tally, follow these steps:

- Create a ledger account named “Unrealized Forex Gain” under the “Current Assets” group.

- Pass a journal entry to debit the “Unrealized Forex Gain” account and credit the relevant income account.

For example, if the unrealized gain on a foreign currency transaction is $1,000:

Journal Entry:

- Debit “Unrealized Forex Gain” $1,000

- Credit “Forex Income” $1,000

Recording Unrealized Forex Losses

Similarly, to record unrealized forex losses, follow these steps:

- Create a ledger account named “Unrealized Forex Loss” under the “Current Liabilities” group.

- Pass a journal entry to debit the relevant expense account and credit the “Unrealized Forex Loss” account.

For example, if the unrealized loss on a foreign currency transaction is $1,000:

Journal Entry:

- Debit “Forex Expense” $1,000

- Credit “Unrealized Forex Loss” $1,000

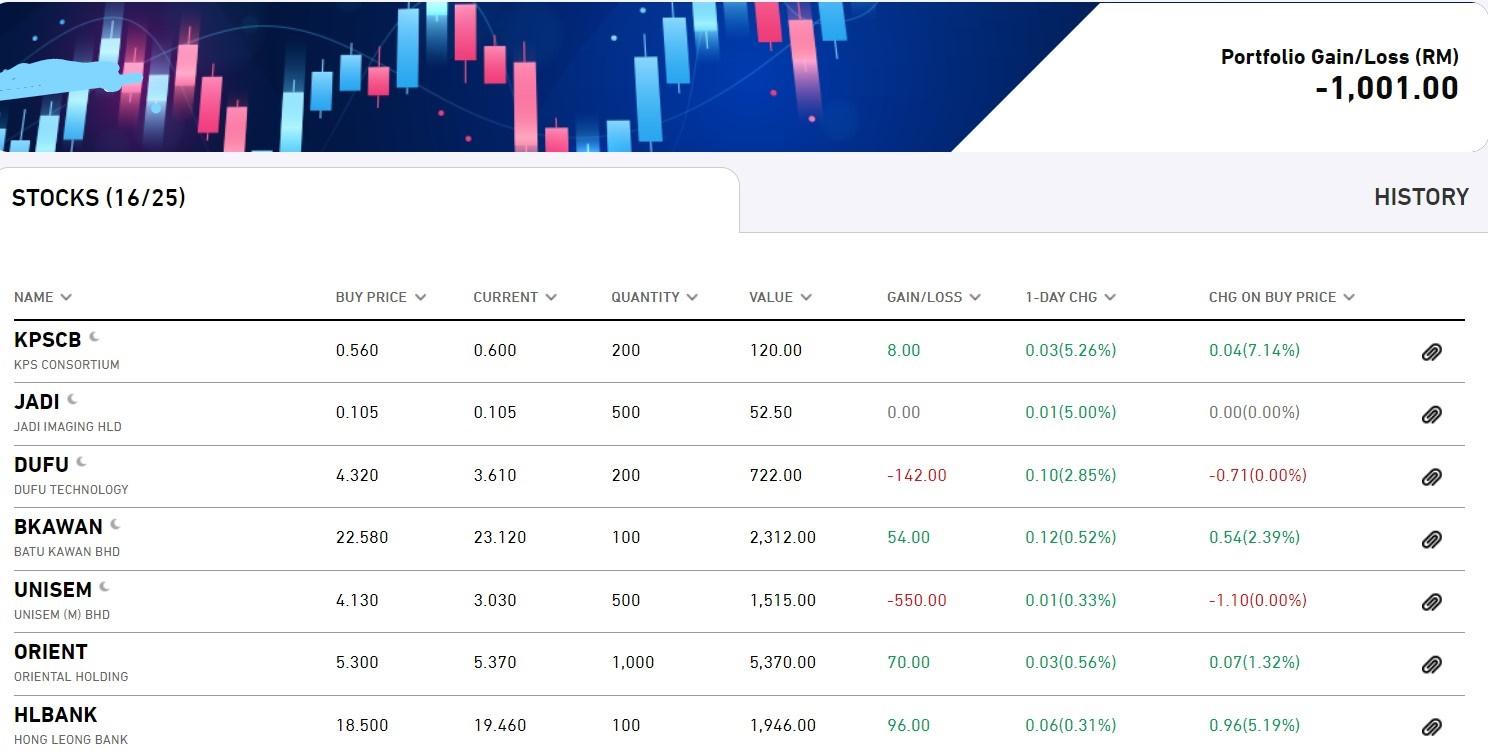

Image: www.chegg.com

Closing the Gaps: Realizing Forex Gains and Losses

Unrealized gains or losses are realized when the open forex position is closed. If realized gains or losses differ from unrealized gains or losses, the difference must be adjusted to reflect the actual outcome.

- For realized gains, debit the “Unrealized Forex Gain” account and credit the “Forex Income” account with the realized gain.

- For realized losses, debit the “Forex Expense” account and credit the “Unrealized Forex Loss” account with the realized loss.

Harnessing Tally’s Potential

Tally’s intuitive interface and comprehensive features simplify the process of passing unrealized forex gain and loss entries. By leveraging Tally’s capabilities, you can:

- Establish separate ledger accounts to track unrealized gains and losses.

- Effortlessly create journal entries to record these transactions.

- Easily close open forex positions and adjust unrealized gains or losses.

- Generate reports to analyze forex performance and identify potential risks.

How To Pass Unrealized Forex Gain Losses Entries In Tally

Conclusion

Navigating the subtleties of unrealized forex gain and loss entries is essential for maintaining accurate financial records. By understanding the concepts behind these entries and utilizing the capabilities of Tally, you can streamline the process and enhance your financial management. Whether you are a forex trader or managing a business with international transactions, passing unrealized forex gain and loss entries in Tally can empower you with greater transparency and control over your finances.