As a seasoned entrepreneur, navigating the complexities of forex transactions in TallyERP 9 can be a daunting task. However, mastering the art of passing forex entries accurately can empower you to streamline your accounting processes and ensure compliance with accounting standards. In this comprehensive guide, we will unravel the intricacies of forex entry in Tally, equipping you to handle these transactions with ease.

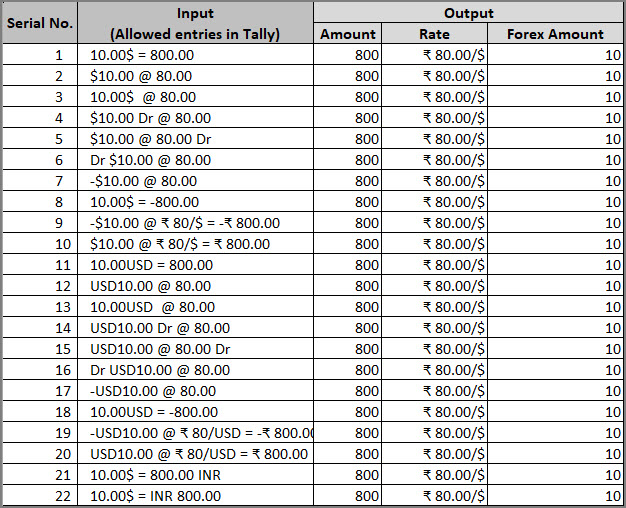

Image: help.tallysolutions.com

Understanding Forex Transactions in Tally

Before delving into the mechanics of passing forex entries, it’s crucial to understand the fundamentals of forex transactions and their relevance within Tally. Forex, or foreign exchange, refers to the process of converting one currency into another. In Tally, these transactions are classified as types of receipts or payments depending on whether foreign currency is being received or paid.

Creating Forex Ledgers in Tally

To accommodate forex transactions effectively, Tally necessitates the creation of separate ledgers for each foreign currency. These ledgers serve as dedicated accounts for recording transactions denominated in foreign currencies, ensuring clarity and segregation of forex-related entries. To create a forex ledger, navigate to Gateway of Tally > Accounts Info > Ledgers.

Passing Forex Receipts in Tally

When receiving foreign currency, a receipt entry must be passed in Tally. Begin by selecting the appropriate forex ledger created earlier. In the voucher type, choose “Receipt”. Enter the transaction details, including the date, amount, and rate of exchange. Select the party’s account to credit and specify the relevant cost center, if applicable. Finally, provide a brief description of the transaction and save the voucher.

Image: honeypips.com

Passing Forex Payments in Tally

Similarly, when making payments in foreign currency, a payment entry needs to be passed. Select the forex ledger, choose “Payment” as the voucher type, and proceed to enter the transaction particulars. Select the party’s account to debit, mention the cost center, and provide a clear description of the payment. Remember to reconcile the payment amount against the corresponding invoice or document.

Accounting for Exchange Rate Fluctuations

Fluctuations in foreign currency exchange rates are an inevitable aspect of forex transactions. In Tally, exchange rate gains or losses are recorded through journal entries. When the value of the foreign currency increases against the base currency, an exchange gain is recognized. Conversely, a decrease in the foreign currency’s value results in an exchange loss. These adjustments ensure that the carrying value of foreign currency assets and liabilities reflects their current market value.

Tips and Expert Advice for Passing Forex Entries

- Maintain meticulous records of all forex transactions, including invoices, bank statements, and supporting documentation.

- Regularly review exchange rates and consider using forward contracts to mitigate currency risk.

- Leverage Tally’s built-in functionality for forex accounting, such as the “Foreign Currency Revaluation” feature.

- Seek guidance from a qualified accountant or financial expert for complex or high-value forex transactions.

Frequently Asked Questions (FAQs)

Q: Can I pass forex entries in Tally without creating a forex ledger?

A: No, creating a separate forex ledger is mandatory in Tally to segregate foreign currency transactions.

Q: How do I handle exchange rate differences in Tally?

A: Exchange rate differences are recorded through journal entries using the “Foreign Currency Revaluation” feature.

Q: Is it important to reconcile forex transactions?

A: Yes, regular reconciliation of forex transactions against bank statements is crucial for ensuring accuracy and preventing errors.

How To Pass Forex Entry In Tally

Conclusion

Mastering the intricacies of forex entries in TallyERP 9 is essential for businesses engaging in international transactions. By following the best practices outlined in this guide, you can effectively record, track, and report forex transactions while mitigating currency risk and ensuring compliance. Remember, accuracy and attention to detail are paramount when dealing with forex entries. Are you ready to elevate your forex accounting skills and streamline your business operations? Embrace the knowledge shared in this article and unlock the full potential of TallyERP 9 for your forex accounting needs.