In the burgeoning realm of forex trading, where fortunes are won and lost with lightning speed, the advent of expert advisors (EAs) has revolutionized the game. These automated trading algorithms, powered by sophisticated algorithms and nuanced market analysis, have empowered traders with unprecedented precision and efficiency. If you’re seeking to ascend the ranks of successful traders, mastering the art of creating and utilizing expert advisors is an invaluable skill.

Image: theforexgeek.com

The Genesis of Expert Advisors

The lineage of expert advisors can be traced back to the early days of forex trading, when traders grappled with the arduous task of manually monitoring market fluctuations and executing trades. As technology advanced, the desire for automated systems that could continuously track markets and make trading decisions in real-time began to intensify. In response, the concept of expert advisors was born.

Unveiling the Inner Workings of an Expert Advisor

At the core of every expert advisor lies a sophisticated algorithmic engine. These algorithms are meticulously crafted using a combination of technical indicators, market patterns, and mathematical models. When an EA is deployed, it continuously scans the market, analyzing a multitude of data points in search of trading opportunities that align with its predefined parameters.

Upon identifying a potential trade, the EA evaluates the risk-to-reward ratio, calculates position sizing, and executes the trade autonomously. This process is performed tirelessly, 24 hours a day, 5 days a week, allowing traders to capitalize on market movements even while they sleep.

Advantages of Employing Expert Advisors

The allure of expert advisors stems from their myriad advantages. These automated trading systems offer:

-

Precision and Speed: EAs execute trades with unmatched precision and speed, ensuring that traders never miss an opportune moment.

-

24/7 Market Coverage: Unlike human traders who require rest and respite, EAs work tirelessly, monitoring markets around the clock.

-

Emotionless Trading: EAs are devoid of human emotions, which can often cloud judgment and lead to irrational trading decisions.

-

Backtesting and Optimization: Before deploying an EA, traders can meticulously backtest it on historical market data, fine-tuning its parameters to maximize performance.

Image: psawesustainable.weebly.com

Crafting Your Own Expert Advisor

Creating your own expert advisor is a rewarding endeavor that requires a keen understanding of the forex market and programming skills. If you’re just starting out, consider leveraging pre-built EAs or seeking guidance from experienced traders.

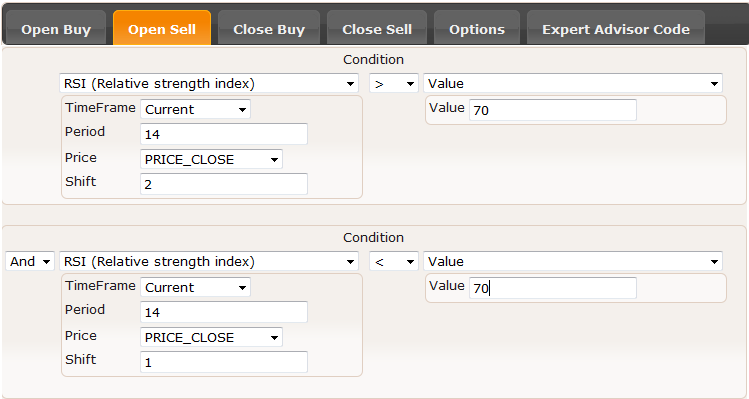

For those who relish the challenge of creating their own EAs, numerous programming languages and platforms are available, such as MetaTrader 4 and MetaTrader 5. These platforms provide a comprehensive suite of tools, enabling you to design, code, and optimize your own trading algorithms.

The Path to Proficiency

Mastering the intricacies of expert advisors is a journey that requires patience, persistence, and a thirst for knowledge. Immerse yourself in the study of technical analysis, market patterns, and algorithmic trading strategies. Practice coding regularly, honing your skills and refining your understanding of how EAs function.

Remember, the path to proficiency is not without its pitfalls. Embrace setbacks as opportunities for learning and growth. Seek mentorship from experienced traders and actively engage in online forums and communities, where you can exchange ideas and glean valuable insights.

How To Make Expert Advisor Forex

Conclusion

As you embark on this journey of creating and mastering expert advisors, remember that knowledge is your most potent weapon. Invest in education, practice diligently, and refine your strategies relentlessly. By embracing the power of expert advisors, you unlock the gateway to automated, profitable forex trading, empowering you to achieve your financial aspirations.