In today’s globalized world, seamless international transactions have become a necessity. HDFC Forex Cards offer an incredibly convenient and secure way to manage your finances abroad. If you’re an HDFC Forex Cardholder, logging into your account online is effortless.

Image: cardinsider.com

By following a few easy steps, you can access your account and manage your forex transactions with ease. Let’s embark on this simple journey.

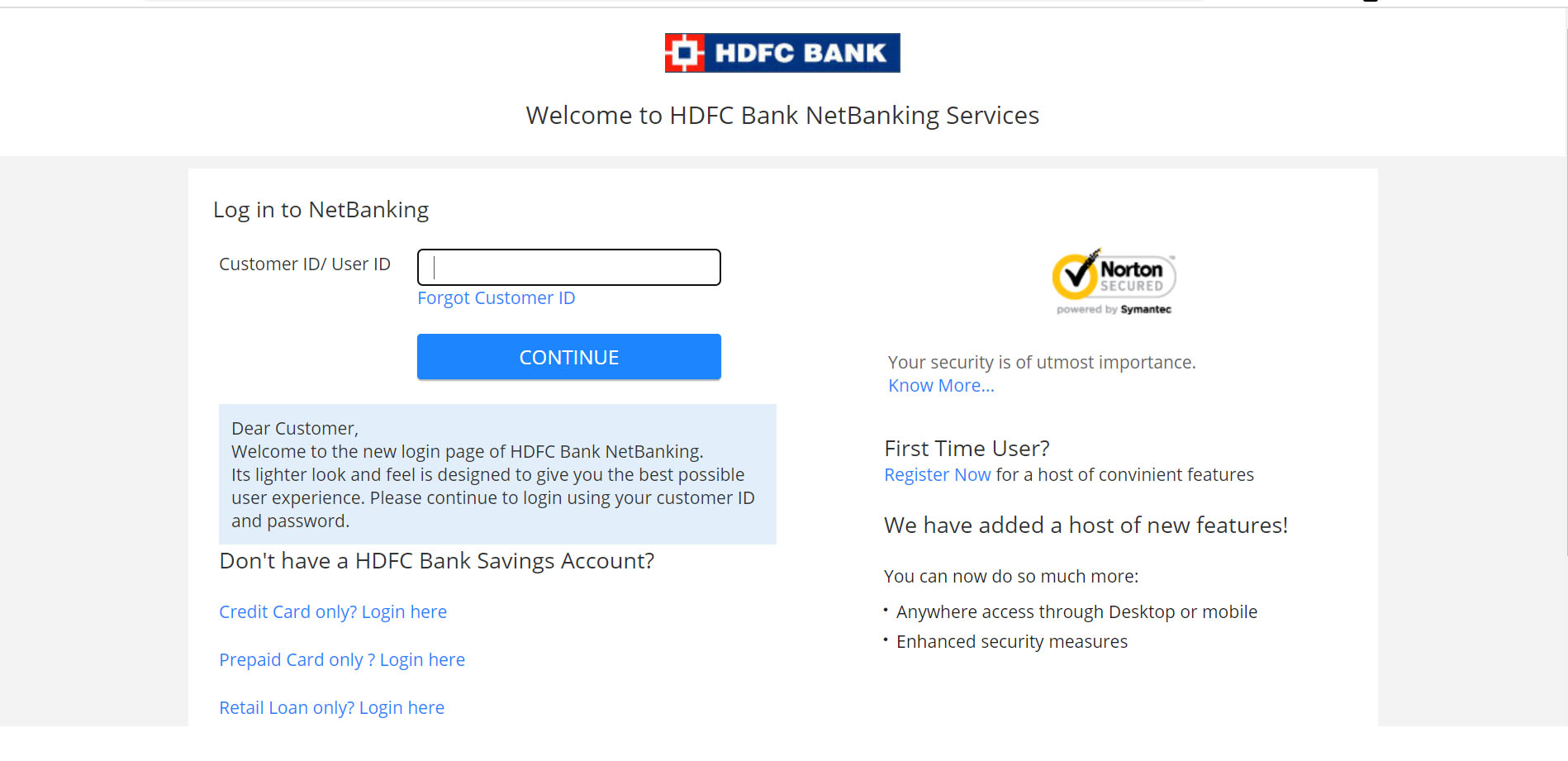

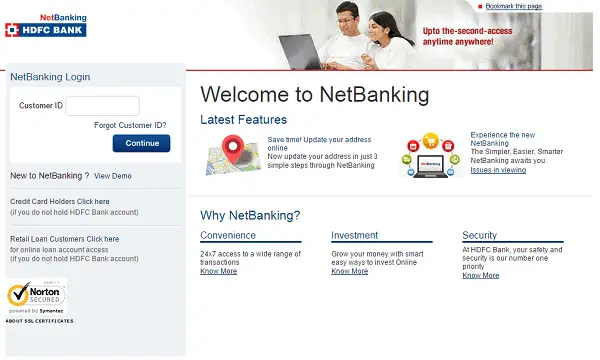

Navigating the HDFC Forex Card Online Platform

HDFC’s online portal for Forex Cards provides a user-friendly interface, making it a breeze to access your account. To get started, you’ll need your HDFC Forex Card Number and PIN. Once you have these details handy, simply visit the official HDFC Forex Card website.

On the homepage, you’ll find a prominent “Login” button. Click on it, and you’ll be redirected to a secure login page. Enter your Forex Card Number and PIN in the designated fields and click on “Login.”

Unleashing the Benefits of Online Forex Card Management

Logging into your HDFC Forex Card online empowers you with an array of benefits that make managing your finances abroad a hassle-free experience.

- Manage Transactions: View, search, and track your forex transactions in real-time.

- Monitor Balances: Keep tabs on your account balance, available credit, and currency details.

- Card Limit Management: Adjust your transaction and withdrawal limits for enhanced security.

- Dispute Handling: Report unauthorized or disputed transactions and initiate chargebacks directly.

- Lost Card Support: Request an emergency replacement card in case of loss or theft.

Expert Tips for a Seamless Forex Card Experience

To make the most of your HDFC Forex Card online, consider these valuable tips from experienced travelers:

- Check Balances Regularly: Stay informed about your account balances to avoid overdrawing.

- Track Transactions Closely: Monitor your spending patterns and identify any suspicious activity.

- Utilize Card Limit Management: Optimize your spending limits to suit your travel needs and enhance security.

- Report Issues Promptly: Don’t hesitate to contact HDFC if you encounter any problems with your card.

- Protect Your PIN: Keep your PIN confidential and never share it with anyone.

Image: forexscalpingforum.blogspot.com

Addressing Common FAQs on HDFC Forex Cards

Here are answers to some frequently asked questions about HDFC Forex Cards:

- Q: Can I use my HDFC Forex Card in all countries?

A: Yes, HDFC Forex Cards are accepted in over 200 countries and territories. - Q: Are there any fees associated with using my HDFC Forex Card?

A: Yes, there may be transaction fees and currency conversion charges applicable. - Q: How do I access funds while traveling?

A: You can withdraw cash at ATMs, make POS purchases, and use online banking. - Q: What should I do if my Forex Card is lost or stolen?

A: Report it immediately to HDFC and request an emergency replacement card. - Q: Can I use my HDFC Forex Card to load foreign currency?

A: Yes, you can load foreign currency onto your card at HDFC branches.

How To Login To Hdfc Forex Card Online

Conclusion

Unlocking the convenience of HDFC Forex Card online access is a breeze. By following the simple steps outlined in this guide, you can manage your international finances with ease and confidence. Remember to practice due diligence in handling your card and stay informed about the latest tips and trends to enhance your travel experience.

Are you eager to explore the countless benefits of using your HDFC Forex Card online? Log in today and experience the world of seamless international finance!