In the labyrinthine world of forex trading, navigating the ever-shifting market trends can feel like traversing a treacherous path. But fear not, for trend lines emerge as your guiding light, illuminating the direction in which currency pairs are likely to surge or decline. Identifying these lines empowers traders with invaluable insights, unlocking a gateway to more informed decision-making and heightened profitability.

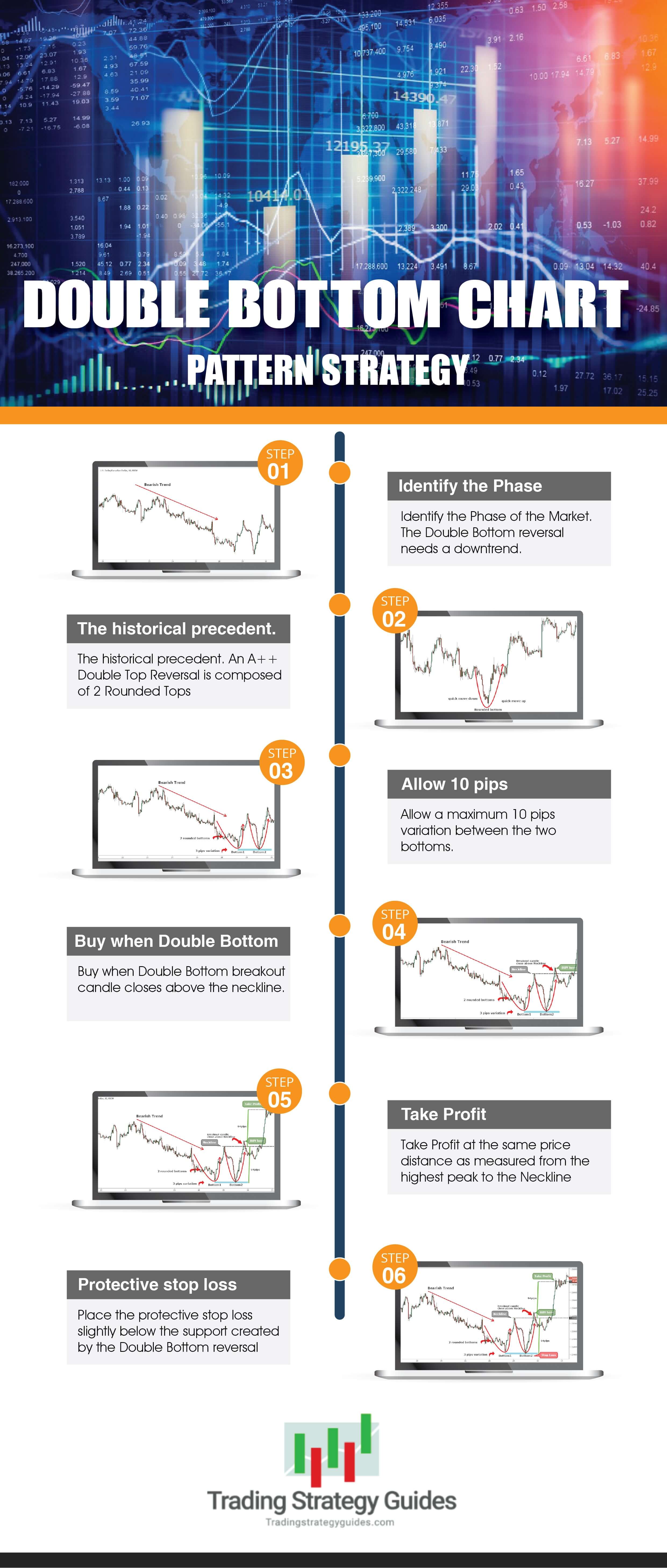

Image: tradingstrategyguides.com

A Compass in the Currency Chaos

Envision trend lines as the footprints left behind by the market’s cyclical dance. They connect a sequence of price highs or lows, revealing the underlying momentum driving currency movements. By discerning these lines, traders gain a profound understanding of market sentiment and can anticipate future price fluctuations with greater accuracy.

Mastering the Art of Trend Line Identification

The art of trend line identification hinges upon meticulous observation and analytical prowess. Here’s a step-by-step guide to illuminate their presence:

- Unveiling Uptrends: Connect the lows of an ascending market to trace an upward-sloping trend line, indicating a bullish sentiment.

- Discerning Downtrends: Join the peaks of a descending market to establish a downward-sloping trend line, signaling a bearish market outlook.

- Horizontal Havens: Horizontal trend lines arise when prices fluctuate within a specific range, marking potential areas of support or resistance.

Harnessing the Power of Trend Lines

Once you possess the ability to identify trend lines, their potential becomes boundless. These multifaceted tools offer a symphony of benefits:

- Predicting Future Movements: Trend lines provide a glimpse into the future path of currency pairs, allowing traders to position themselves strategically.

- Identifying Support and Resistance Levels: Support and resistance levels are the battlegrounds where prices encounter obstacles. Trend lines pinpoint these crucial levels, aiding traders in risk management and entry/exit strategy formulation.

- Timing Market Entries and Exits: By anticipating trend reversals through trend line analysis, traders can optimize their entries and exits, maximizing profit potential.

Image: www.vrogue.co

Supercharging Your Trading with Expert Insights

Trading Guru, Martha Sears, Unravels Her Secrets: “By embracing trend lines, I’ve transformed my trading strategy. They empower me to identify market biases, gauge risk tolerance, and seize lucrative opportunities.”

Forex Visionary, William Jones, Shares His Wisdom: “Trend lines are the backbone of my trading approach. They provide an unparalleled perspective on market dynamics, empowering me to make informed decisions in the face of market turbulence.”

How To Identify Trend Line In Forex Trading

Conclusion: Embracing Trend Lines for Trading Success

In the fast-paced, ever-evolving world of forex trading, trend lines emerge as indispensable tools, granting traders the foresight to navigate market intricacies. By mastering the art of identifying these lines, you unlock the gateway to heightened profitability, informed decision-making, and a trading experience characterized by confidence and clarity. Embrace the power of trend lines and watch your trading journey transform into a path paved with success.