Forex (foreign exchange) trading can be an exciting, fast-paced way to make money. But without the right time frame, it can also be very risky and costly. Choosing the right time frame for your trading activity is vitally important for adapting to the market’s pace and increasing your profit-making potential.

Image: investgrail.com

In this blog post, we’ll share expert tips and proven strategies to help you find the best time frame for your trading style and risk tolerance.

Understanding the Forex Market

The forex market is unique in that it’s a decentralized global marketplace that operates 24-hours a day, 5 days a week. This means that there are trading opportunities available at all times during the trading week. However, not all time frames are created equal.

The most common time frames used by forex traders are the 1-minute, 5-minute, 15-minute, 1-hour, 4-hour, and daily charts. Each time frame offers a different perspective on the market and depends on individual suits and risk tolerance.

Choosing the Right Time Frame

The best time frame for you will depend on several factors like your trading style, risk tolerance, time and capital available, etc. If you are a scalper (a trader who makes many small trades throughout the trading day), you will likely use a short time frame like the 1-minute or 5-minute chart. If you are a day trader (a trader who opens and closes positions within a single trading day), you may use a medium time frame like the 15-minute or 1-hour chart.

If you are a swing trader (a trader who holds positions for several days or weeks), you will likely prefer a longer time frame like the 4-hour or daily chart. Beginners should practice more on a demo or simulator to get the actual understanding before jumping into live trading.

Tips for Choosing a Time Frame

Here are some additional tips for choosing the right time frame.

- Start with a shorter time frame (like the 1-minute or 5-minute chart) and move to longer time frames as you gain experience.

- Experiment with different time frames until you find one that suits your trading goals and comfort zone.

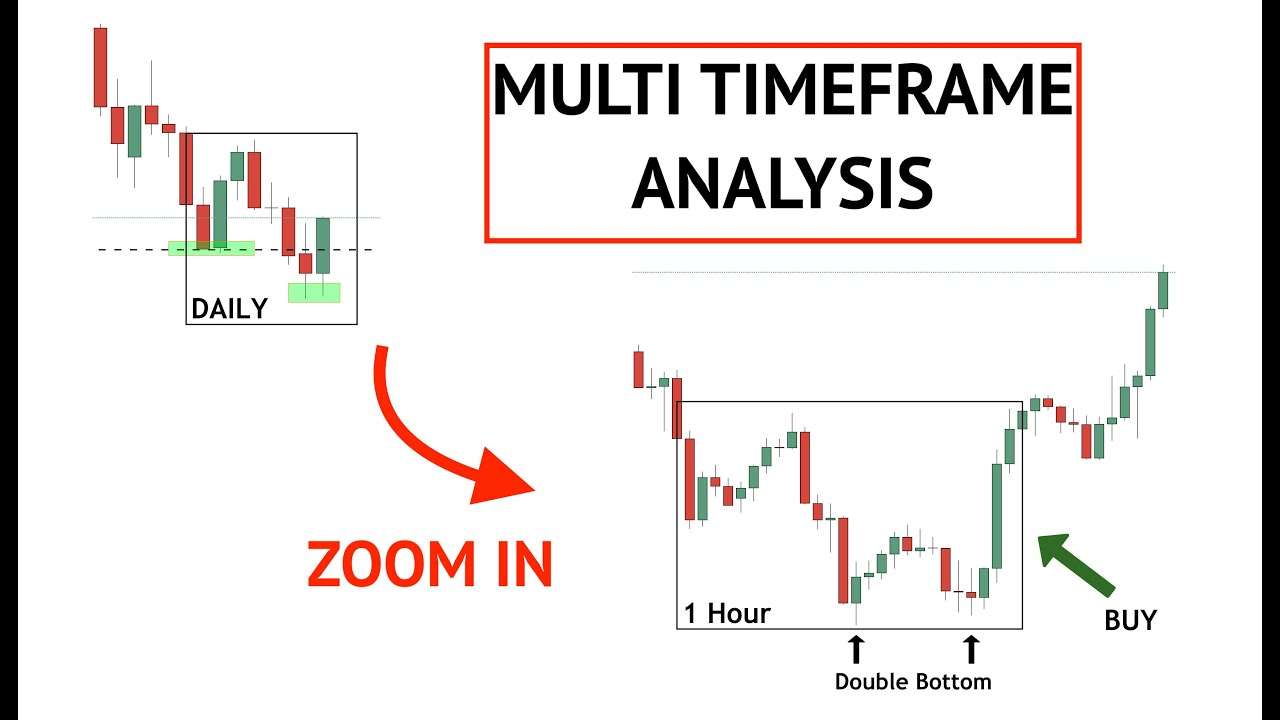

- Use multiple time frames to supplement your trading strategy (e.g., use the daily chart to identify the overall trend and the 1-hour chart to find entry and exit points).

Image: motivation.africa

FAQ

Q: What is the best time frame for trading forex?

A: The best time frame for trading forex depends on your individual trading style and risk tolerance.

Q: What are the most common time frames used by forex traders?

A: The most common time frames used by forex traders are the 1-minute, 5-minute, 15-minute, 1-hour, 4-hour, and daily charts.

Q: Can I use multiple time frames in my trading?

A: Yes, you can use multiple time frames to supplement your trading strategy.

How To Identify Suitable Time Frame In Forex

Conclusion

Choosing the right time frame for forex trading is an important step in developing a successful trading strategy. By taking the time to understand the different time frames available and conducting thorough backtesting, traders can optimize their trading results and increase their chances of success. After reading this article, if you still have any queries or if there is anything out of your understanding, feel free to contact us!