Introduction

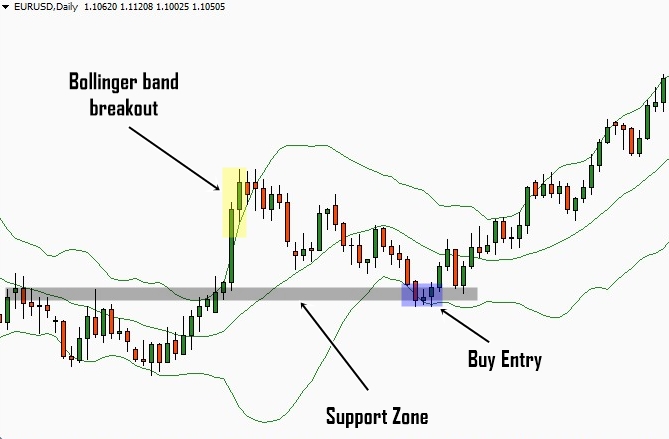

Bollinger Bands are a popular technical trading indicator that helps traders identify profitable trading opportunities by measuring a currency pair’s volatility and price action. The indicator consists of three lines: an upper band, a middle band, and a lower band. The upper and lower bands are set a certain number of standard deviations (typically two) above and below the middle band, which represents the simple moving average (SMA) of the price action. Forex traders often use Bollinger Bands to identify potential breakout trading opportunities, as breakouts above the upper band or below the lower band often signal strong buying or selling pressure, respectively.

Image: forexprofitprotector.com

Identifying Breakout Direction

There are several factors to consider when identifying the direction of a Bollinger Band breakout.

- Relative strength of the breakout: A strong breakout is more likely to be successful than a weak breakout. A strong breakout occurs when the price quickly moves a significant distance away from the Bollinger Band and closes outside of the band.

- Volume: The volume of trading is another important factor to consider. A breakout with high volume is more likely to be successful than a breakout with low volume. This is because weak breakouts are typically short-lived and often accompanied by low volume, while strong breakouts are usually accompanied by high volume, indicating strong buying or selling pressure.

- Support and Resistance Levels: Another important factor to consider is the presence of support and resistance levels. A breakout is more likely to be successful if it occurs near a support or resistance level. This is because support and resistance levels are areas where price action has historically reversed, indicating that there is a strong buying or selling pressure at those levels.

Trading Strategies

There are many different trading strategies that can be used to trade Bollinger Band breakouts, but two of the most popular include:

- Breakout Momentum: This strategy is based on the principle of momentum, which states that a price that is moving in a certain direction is likely to continue moving in that direction. To trade Bollinger Band breakouts using this strategy, traders can enter a trade in the direction of the breakout when the price closes outside of the band, and then hold the trade until the momentum breaks down.

- Pullback: This strategy involves waiting for the price to pull back towards the Bollinger Band after a breakout occurs, and then entering a trade near the band in the same direction for a close. This strategy is based on the assumption that the price is likely to find support or resistance at a major level such as 50% or 61.8% of the breakout move.

Image: forexmt4systems.com

How To Identify Breakout Direction Of Bollinger Bands In Forex

https://youtube.com/watch?v=xI2SbtGZYEg

Conclusion

Bollinger Bands are a powerful trading tool that can help traders identify profitable trading opportunities. By understanding the concept of Bollinger Band breakouts and utilizing real-world trading strategies, forex traders can increase their trading success rate.