Introduction

In the ever-evolving world of finance, the foreign exchange (forex) market presents a lucrative opportunity for potential profits. However, navigating the complexities of forex trading can be daunting, leaving many aspiring traders wondering how to penetrate its enigmatic depths. Fear not, for this comprehensive guide will delve into the realm of forex hacking, revealing the secrets to unlock profitable trading strategies.

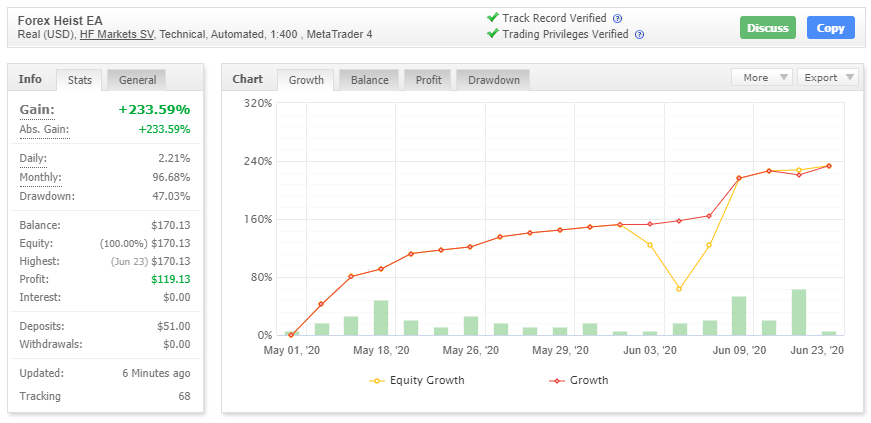

Image: forexeatop.com

Understanding Forex Hacking

Before embarking on this journey, it’s crucial to clarify the concept of “hacking” in forex trading. Unlike malicious cyberattacks, forex hacking refers to the legitimate exploitation of trading systems, market inefficiencies, and psychological factors to gain an edge over other market participants. It’s not about breaking the law but rather using unconventional and innovative approaches to identify trading opportunities.

Unveiling the Matrix: Forex Market Structure

The forex market operates in a decentralized manner, connecting banks, brokers, and individual traders from around the globe. This vast network facilitates the exchange of currencies, creating a highly liquid and volatile market. To understand how to hack the forex market, one must first grasp its underlying structure.

Charting the Path: Technical Analysis and Pattern Recognition

Technical analysis plays a pivotal role in forex hacking. By studying historical price data represented in charts, traders seek to identify patterns and trends that may indicate future market movements. Charting platforms offer a multitude of tools and indicators designed to help traders decipher these patterns, from simple trendlines to complex oscillators.

Image: www.pinterest.com

Deciphering the Code: Fundamental Analysis

While technical analysis focuses on market movements, fundamental analysis looks at the underlying factors influencing currency values. Economic data, political events, and central bank announcements can all have profound impacts on forex rates. By harnessing fundamental analysis, traders gain insights into the global macroeconomic landscape, providing context to their trading decisions.

Slaying the Goliath: Risk Management and Money Management

In the forex arena, risk management reigns supreme. Traders must always be prepared for market volatility and potential losses. Establishing clear risk parameters, utilizing stop-loss orders, and adopting sound money management practices are essential to the art of forex hacking. A disciplined approach protects capital and preserves the potential for long-term profitability.

How To Hacl Ea Forex

https://youtube.com/watch?v=HAcl-zZPvxA

Conclusion

Hacking the forex market is a journey of exploration, learning, and constant adaptation. By mastering technical analysis, leveraging fundamental insights, implementing disciplined risk management strategies, and embracing the boundless opportunities presented by this dynamic market, aspiring traders can unlock the secrets to profitable trading. Remember, forex hacking is not a quick fix but a continuous process of self-discovery and market mastery. Embrace the challenge, persevere in your endeavors, and unlock the vast potential of the forex market.