Unleash the World’s Financial Frontiers: Your Ultimate Guide to Acquiring an HDFC Forex Card

Image: fipocuqofe.web.fc2.com

Introduction:

In today’s interconnected world, where global travel and international transactions have become commonplace, access to convenient and secure financial tools is paramount. Among the most indispensable of these tools is a foreign exchange card, a gateway to seamless financial management abroad. While a plethora of forex cards exist, one name stands out as a beacon of reliability and innovation: HDFC Bank. In this comprehensive guide, we embark on a journey to unravel the intricacies of obtaining an HDFC Forex Card, empowering you to transcend financial boundaries with ease.

Understanding the HDFC Forex Card

An HDFC Forex Card is a prepaid card that allows you to load multiple foreign currencies and make purchases or withdrawals in over 100 countries worldwide. Its key advantages lie in its competitive exchange rates, multi-currency capability, and advanced security features, ensuring a worry-free travel experience. Whether you’re a seasoned globetrotter or embarking on your first international adventure, an HDFC Forex Card is your indispensable financial companion.

Embarking on the Acquisition Journey

Acquiring an HDFC Forex Card is a straightforward process that can be completed in a few simple steps. First, you’ll need to visit the nearest HDFC Bank branch with the following documents:

- Government-issued photo ID (PAN Card, Passport, or Aadhaar Card)

- Proof of address (utility bill, rental agreement, etc.)

- Application form duly filled and signed

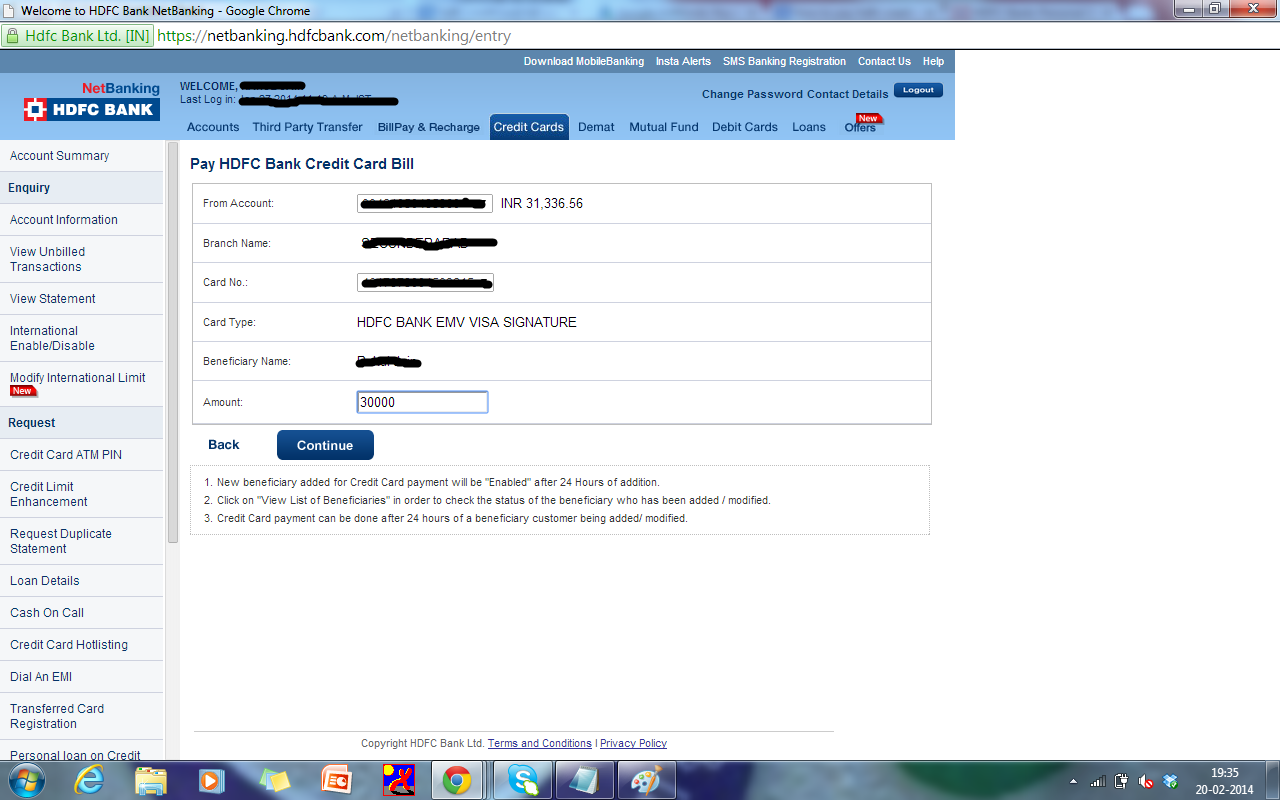

Once your application is submitted, it typically takes between 2-5 business days for your HDFC Forex Card to be processed. After receiving the card, you can load it with foreign currency at any HDFC Bank branch or through online banking.

Accessing Your Forex Card User ID

Upon receiving your HDFC Forex Card, you’ll need to activate it and retrieve your unique User ID to manage your account online. Here’s a step-by-step guide to doing so:

- Call HDFC Bank’s 24×7 Customer Care at 1800 270 3333.

- Provide your card number and personal details for verification.

- Set your desired User ID and Secure PIN for online access.

- Confirm the details and complete the activation process.

Advantages of an HDFC Forex Card

-

Competitive Exchange Rates: HDFC Bank offers competitive exchange rates, ensuring you get the most out of your foreign currency transactions.

-

Multi-Currency Support: Load multiple foreign currencies onto your card and avoid the hassle of carrying cash or exchanging money at exorbitant rates.

-

Global Acceptance: Access over 100 countries worldwide, making your HDFC Forex Card your global financial bridge.

-

Advanced Security Features: HDFC Forex Cards employ chip-and-PIN technology and fraud monitoring systems, providing peace of mind.

-

Convenience of Online Management: Access your HDFC Forex Card account online or through the mobile app to check balances, view transactions, and load currencies.

Conclusion:

An HDFC Forex Card is the ultimate financial companion for globetrotters and international travelers alike. Its competitive exchange rates, multi-currency capability, and advanced security features empower you to explore the world with confidence. By following the steps outlined in this guide, you can easily acquire an HDFC Forex Card and unlock a world of financial freedom and convenience. Embrace the limitless opportunities of global travel and embrace the transformative power of an HDFC Forex Card.

Image: www.forex.academy

How To Get Hdfc Forex Card User Id