Introduction

The foreign exchange (Forex) market is a vast and lucrative financial arena where currencies are traded globally. In India, the Forex market has witnessed significant growth in recent years, attracting numerous individuals and institutions seeking to capitalize on currency fluctuations. To operate legally as a Forex broker in India, obtaining a license from the relevant regulatory authority is imperative. This article provides a comprehensive guide to the process of acquiring a Forex broker license in India, empowering aspiring brokers with the necessary knowledge and insights.

Image: blog.trustfinance.com

Importance of a Forex Broker License in India

Operating a Forex brokerage firm without a valid license is a serious offense in India, attracting penalties and legal consequences. A license not only ensures compliance with regulatory requirements but also provides numerous benefits to brokers and their clients:

- Legal protection: A license shields brokers from legal liabilities and allows them to conduct their operations legitimately.

- Credibility and trust: Licensed Forex brokers enjoy enhanced credibility among clients and other stakeholders, fostering trust and confidence.

- Business stability: Operating with a license ensures business continuity and stability by protecting brokers from regulatory actions against unlicensed entities.

- Client protection: Licensed brokers adhere to strict regulatory standards, ensuring that clients are treated fairly and their funds are protected.

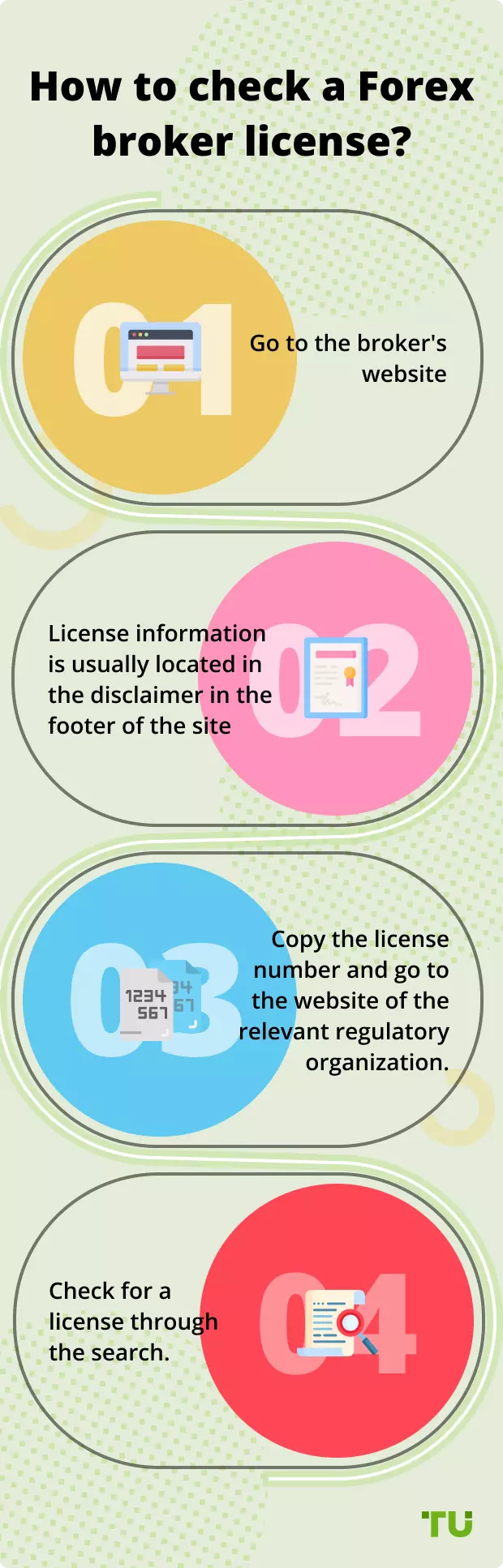

Image: tradersunion.com

How To Get Forex Broker License In India

Regulatory Framework in India

The Forex market in India is primarily regulated by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA) 1999. FEMA outlines the regulations and guidelines governing the trading of foreign currencies and the operation of Forex brokers.

Further clarity was provided by the RBI’s Notification No. FEMA 33/2015 dated June 5, 2015, which specific