As a brokerage company or financial institution, seeking to establish or expand your forex trading offerings, opting for a white label forex trading platform presents an exceptional solution. Dive into this comprehensive guide as we delve into the intricacies of acquiring a top-notch white label platform, empowering you to launch your brokerage business with confidence.

Image: xopenhub.pro

Understanding White Label Forex Trading Platforms

A white label forex trading platform serves as an outsourced solution, featuring a fully customizable trading interface where your clients can access financial markets seamlessly. Partnering with reputable white label providers grants you access to essential trading components without the need for significant upfront investments or technical expertise.

Leveraging white label platforms enables you to swiftly establish your own branded forex trading environment, seamlessly integrated with your existing infrastructure. By leveraging the expertise of a dedicated provider, you effectively streamline the operational setup and focus your resources on driving client acquisition and business growth.

Selecting a Reliable White Label Forex Trading Platform Provider

Embarking on the journey to secure a white label forex trading platform necessitates meticulous research and due diligence. Begin by identifying providers who align with your specific requirements, whether it be regulated jurisdictions, bespoke functionality, or competitive pricing. Thoroughly evaluate the provider’s track record, reputation within the industry, and customer support capabilities.

Meeting with potential providers for in-depth discussions and platform demonstrations proves invaluable. Utilize this opportunity to assess the platform’s functionality, customization options, and overall user-friendliness. Scrutinize the provider’s approach to risk management, fraud prevention measures, and data security protocols.

Market Analysis and Trends

Stay abreast of the latest technological advancements and evolving trends within the fintech and forex trading landscape. Explore industry reports, attend online webinars, and engage with industry experts to acquire invaluable insights into emerging opportunities and challenges.

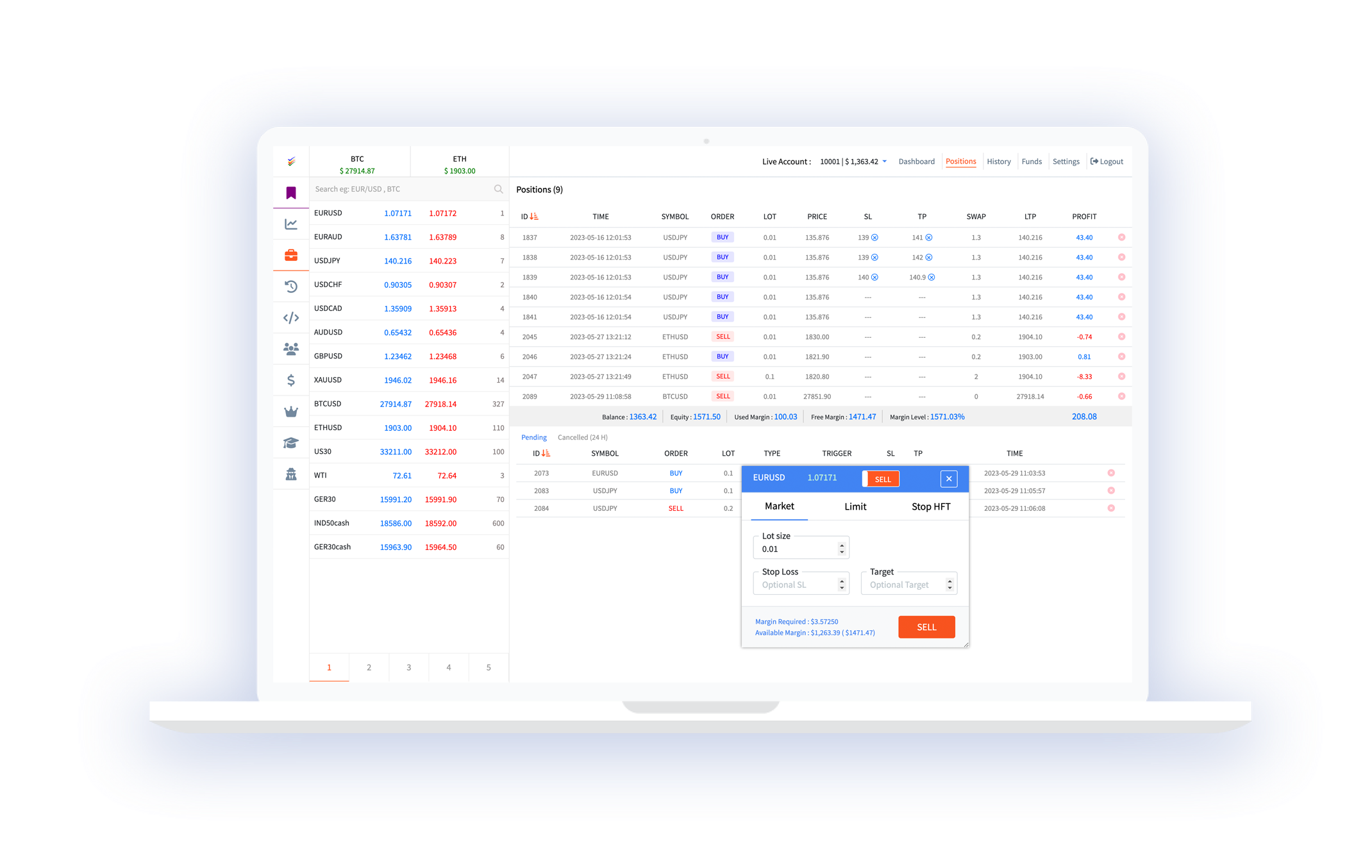

Image: xtremealgo.com

Expert Advice for Choosing the Ideal White Label Forex Trading Platform

Maximize your success in selecting the ideal white label forex trading platform by implementing these expert tips:

- Prioritize regulation and licensing to ensure compliance with your target market’s regulatory framework.

- Evaluate the platform’s trading tools, charting capabilities, and ease of use to cater to diverse trader preferences.

- Assess the liquidity providers integrated with the platform to ensure competitive spreads and execution speeds.

- Seek platforms with robust risk management features to safeguard trader funds and mitigate market volatility.

By diligently following these guidelines, you can confidently select a white label forex trading platform that meets your unique business needs.

Commonly Asked Questions and Answers

-

What is the average cost of a white label forex trading platform?

- White label forex trading platforms come with varying pricing models; however, the cost can range from several thousand dollars to tens of thousands, depending on features, customization, and provider reputation.

-

What is the minimum investment required to become a forex broker?

- The minimum investment to become a forex broker varies depending on, legal and regulatory requirements, but typically ranges from several thousand dollars to well over a million dollars.

How To Get A White Label Forex Trading Platform

Conclusion

The acquisition of a white label forex trading platform represents a strategic investment, empowering you to establish a reputable and profitable forex brokerage business. By implementing the strategies outlined in this comprehensive guide, you can confidently navigate the process of selecting a reliable provider and tailoring the platform to your specific business requirements.

We encourage you to conduct further research and engage in thorough discussions with potential providers to make an informed decision. Capitalize on this opportunity to propel your brokerage business to unparalleled heights by leveraging the benefits of a customizable, state-of-the-art white label forex trading platform.