In the ever-fluctuating world of forex trading, timing is everything. Knowing when to enter and exit a trade can make the difference between significant success and costly losses. While understanding market trends and technical indicators is crucial, mastering the art of setting target times can elevate your trading strategy to new heights. In this comprehensive guide, we’ll delve into the intricacies of fixing target times in forex trading, empowering you with the knowledge and techniques to seize market opportunities and maximize your profits.

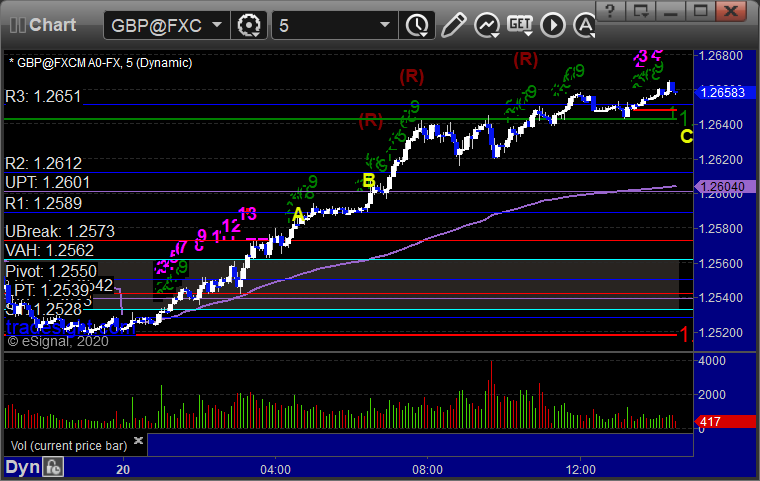

Image: www.tradesight.com

Defining Target Time in Forex Trading🎯

A target time in forex trading refers to the specific point in time when you aim to close your trade. It’s like setting a goal for your trade, determining when you want to take your profits or minimize potential losses. Establishing a clear target time is essential for several reasons:

-

Risk Management: It defines your maximum risk tolerance, ensuring you exit trades before significant losses occur.

-

Profit Maximization: By setting a target time, you lock in profits when the market reaches your desired level.

-

Trade Discipline: It instils a disciplined approach, preventing you from holding onto losing trades in the hope of a turnaround.

Factors to Consider When Fixing Target Times

Determining the optimal target time requires careful consideration of various factors:

-

Market Analysis: Technical analysis, fundamental data, and market sentiment play a significant role in identifying potential turning points or target levels.

-

Trading Strategy: Your specific trading strategy will influence the target times you set. Scalpers, for example, aim for quick profits with short target times, while trend followers may hold trades for longer durations.

-

Risk Tolerance: Your risk appetite determines the amount of potential loss you’re willing to tolerate before exiting a trade.

-

Market Volatility: Forex markets are inherently volatile, so target times should adapt to changing market conditions, such as news releases or economic events.

Setting Target Time Strategies

There are numerous approaches to setting target times in forex trading:

-

Fixed Target Times: Setting specific target times based on market analysis or predetermined profit goals.

-

Trailing Stop Loss: Adjusting the stop loss level as the market moves in your favor, ensuring you lock in profits.

-

Fibonacci Retracements: Using Fibonacci levels to identify potential reversal points or targets.

-

Time-Based Targets: Setting target times based on specific time intervals, such as end of trading sessions or daily highs/lows.

Image: www.tradesight.com

How To Fix The Target Time In Forex Trading

Common Pitfalls to Avoid

Aspiring forex traders should be aware of potential pitfalls when setting target times:

-

Overtrading: Setting unrealistic or ambitious target times can lead to excessive trading, increasing the risk of losses.

-

Lack of Discipline: Failing to adhere to target times can result in emotional trading decisions that compromise your strategy.

-

Ignoring Market Conditions: Setting target times without considering market volatility or news events can lead to missed opportunities or untimely exits.

-

Emotional Trading: Letting emotions cloud your judgment can cause you to hold onto losing trades or exit profitable trades prematurely.

To succeed in forex trading, it’s imperative to embrace a disciplined approach and develop a sound understanding of target times. By incorporating these techniques and strategies into your trading plan, you’ll enhance your risk management, maximize profits, and navigate the forex market with increased confidence. Remember, the key to mastering target times lies in continuous learning, practice, and emotional resilience, ensuring you stay ahead in the ever-evolving world of forex trading.