In the dynamic world of forex trading, determining the top and bottom of a market is crucial for making informed trading decisions. These points represent potential reversal zones, offering opportunities for both profit and loss. Understanding how to identify these crucial levels can give traders a significant edge in the market.

Image: traderevenuepro.com

In this exhaustive guide, we will delve into the intricacies of finding top and bottom in forex trading. We will explore various techniques, analyze real-world examples, and provide invaluable tips to enhance your trading strategies. Whether you’re a seasoned trader or just starting your journey in forex, this article will equip you with the knowledge and tools to navigate the ever-changing market landscape.

Understanding Trend Psychology

Identifying market tops and bottoms is closely intertwined with understanding trend psychology. Markets tend to move in predictable patterns, known as trends, which can be either uptrends or downtrends. During an uptrend, buyers are in control, driving prices higher. Conversely, in a downtrend, sellers dominate, pushing prices lower.

Traders need to recognize that tops and bottoms represent potential trend reversals. A market top suggests that the uptrend is losing momentum and a reversal to a downtrend may be imminent. Similarly, a market bottom indicates a potential shift from a downtrend to an uptrend.

Technical Indicators

Technical indicators are powerful tools that can help traders identify tops and bottoms in forex trading. These indicators analyze price action and market data to generate signals or patterns that can help traders make informed decisions. Some commonly used technical indicators include:

- Moving Averages: Moving averages smooth out price data to reveal underlying trends and potential turning points.

- Bollinger Bands: Bollinger Bands create a channel around the price action, with the upper and lower bands indicating potential overbought and oversold conditions.

- Relative Strength Index (RSI): RSI measures the strength of the trend and can identify potential tops and bottoms by signaling overbought (above 70) and oversold (below 30) conditions.

- Stochastic Oscillator: The Stochastic Oscillator is similar to RSI but focuses on the relationship between the closing price and the high-low range.

Chart Patterns

Chart patterns are another valuable tool for finding tops and bottoms in forex trading. These patterns represent distinct price formations that often indicate potential reversals. Some common chart patterns include:

- Double Top: A double top pattern forms when the price reaches a high point, pulls back, and then rallies to the same or a slightly lower high before reversing.

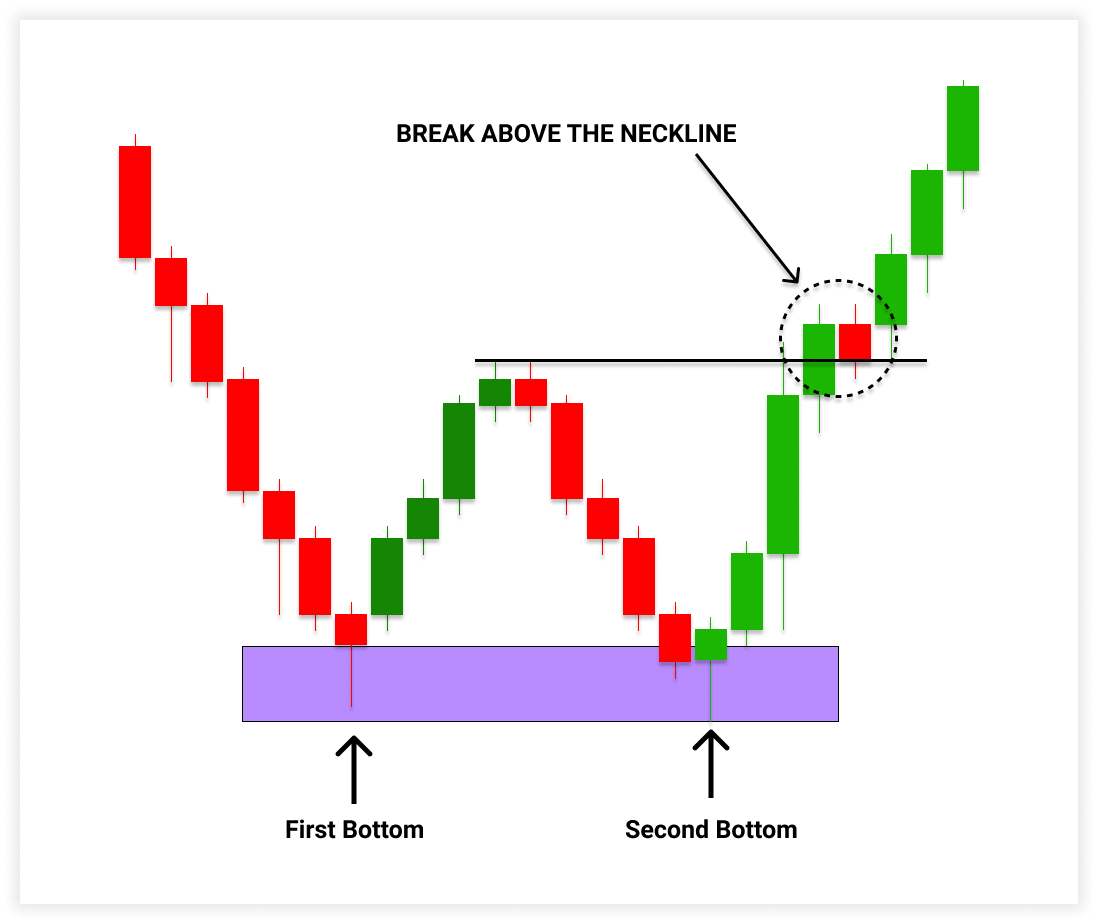

- Double Bottom: A double bottom pattern is the inverse of a double top, with the price falling to a low point, bouncing, and then falling to the same or a slightly higher low before reversing.

- Head and Shoulders: A head and shoulders pattern consists of a high point (the head), followed by two lower highs (the shoulders), with a neckline connecting the troughs. A break below the neckline typically indicates a downtrend.

- Inverse Head and Shoulders: An inverse head and shoulders pattern is the inverse of the head and shoulders pattern, with the price forming a low point (the head), followed by two higher lows (the shoulders), with a neckline connecting the peaks. A break above the neckline often signals an uptrend.

Image: assolea.org

Price Action Reversals

Price action reversals are significant price changes that indicate a potential shift in trend. These reversals can take many forms, including:

- Pin Bars: Pin bars are candlesticks with long shadows and small bodies. A pin bar with a long upper shadow and a small lower body suggests a potential market top, while a pin bar with a long lower shadow and a small upper body indicates a possible market bottom.

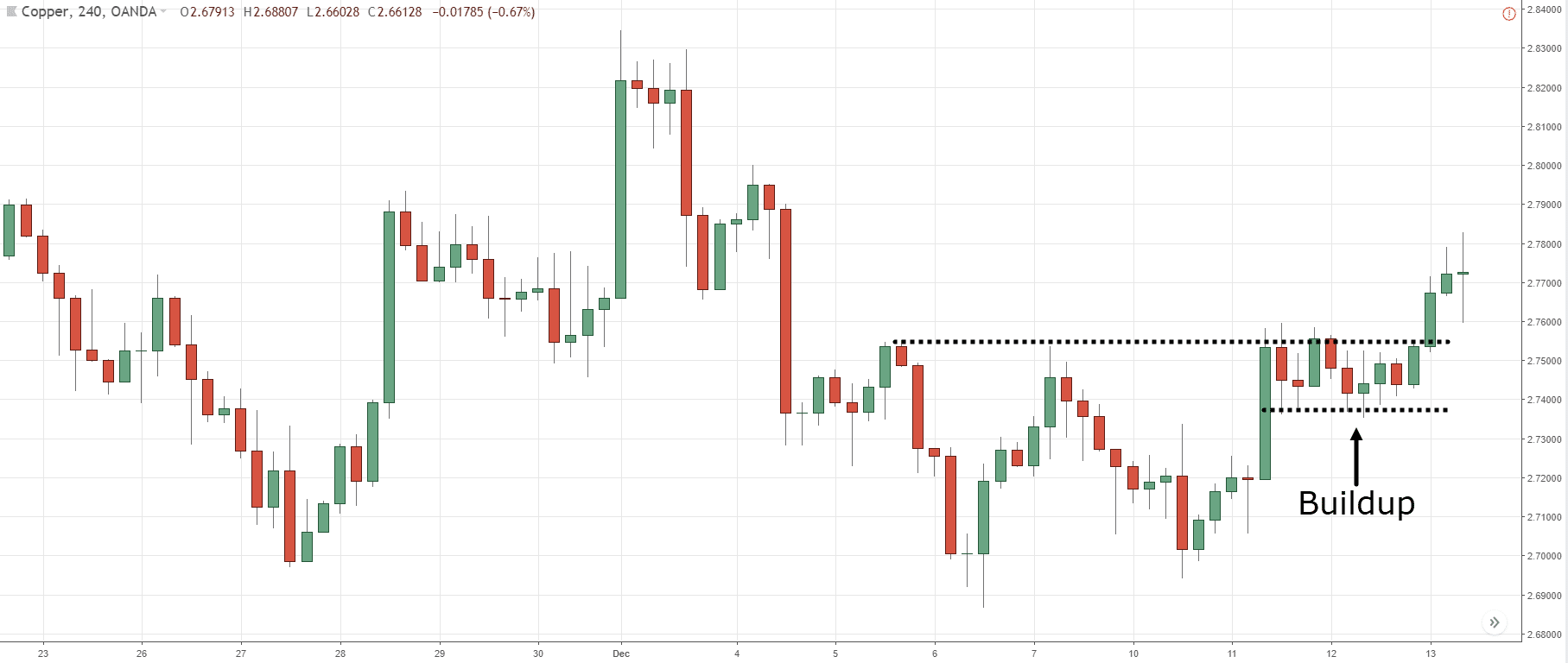

- Inside Bar Patterns: An inside bar pattern occurs when the high and low of the current candlestick are within the high and low of the previous candlestick. A bullish inside bar pattern with a green body and higher close can signal a potential market bottom, while a bearish inside bar pattern with a red body and lower close may indicate a market top.

- Engulfing Patterns: An engulfing pattern occurs when the current candle completely engulfs the previous candle. A bullish engulfing pattern with a green body and higher close suggests a potential market bottom, while a bearish engulfing pattern with a red body and lower close can indicate a market top.

Expert Advice

In addition to these technical indicators and chart patterns, it’s essential to seek expert advice when analyzing tops and bottoms in forex trading. Experienced traders can provide invaluable insights, strategies, and risk management techniques that can enhance your trading performance. Consider joining online forums, attending webinars, and connecting with experienced mentors to gain a deeper understanding of the market and refine your trading skills.

It’s important to note that there is no foolproof method for predicting tops and bottoms with perfect accuracy. However, by utilizing the techniques described in this article, traders can increase their chances of identifying potential turning points in the market and making informed trading decisions.

Frequently Asked Questions

Q: Can I use technical indicators to find tops and bottoms with certainty?

A: While technical indicators can be valuable tools for identifying potential tops and bottoms, they are not foolproof. It’s essential to combine technical analysis with a comprehensive understanding of market dynamics and risk management strategies.

Q: Is it possible to identify tops and bottoms in all market conditions?

A: Not all markets exhibit clear tops and bottoms. In volatile and trending markets, identifying turning points can be challenging. It’s important to adapt your trading strategies to the prevailing market conditions.

Q: Should I trade at the exact top or bottom?

A: Attempting to trade at the exact top or bottom is not recommended. Instead, traders should focus on identifying potential reversal zones and trade within a range, allowing the market to confirm the trend reversal before committing to a position.

How To Find Top And Bottom In Forex

Conclusion

Finding tops and bottoms in forex trading is a crucial skill that can significantly improve profitability. By understanding trend psychology, utilizing technical indicators, analyzing chart patterns, and recognizing price action reversals, traders can position themselves to capitalize on potential trend reversals. Additionally, seeking advice from experienced traders can provide valuable insights and help refine trading strategies.

Remember, trading in financial markets carries inherent risks. It’s essential to thoroughly understand the risks involved and trade within a manageable risk tolerance. With the information provided in this guide, you can enhance your trading knowledge and increase your chances of achieving success in the dynamic world of forex trading.

Are you ready to embark on your trading journey and learn more about finding tops and bottoms in forex? Explore our website for additional resources, educational materials, and personalized training opportunities designed to equip you for success.