Uncover the Secrets of Identifying Market Reversals for Profitable Trading

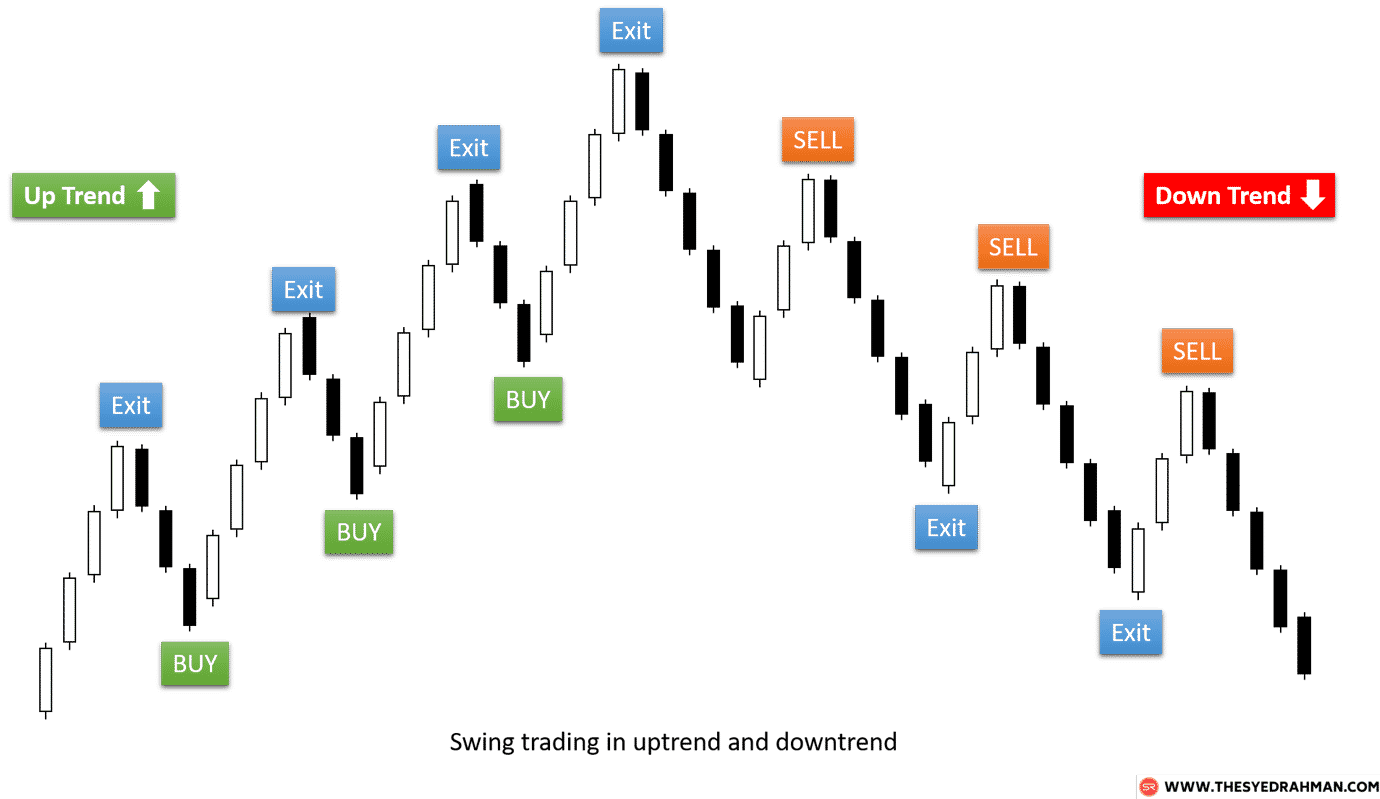

Navigating the ever-changing tides of the forex market can be a daunting task. Yet, with the right knowledge and techniques, traders can harness the market’s volatility to their advantage. One key aspect of successful forex trading lies in identifying swing points – crucial turning points where price momentum shifts, signaling potential market reversals.

Image: www.pinterest.com

In this comprehensive guide, we will delve into the world of swing points, empowering you with the tools and insights to master this fundamental trading concept. Join us as we embark on a journey to uncover the secrets of spotting swing points, maximizing your trading potential, and unlocking the full spectrum of forex market opportunities.

Understanding Swing Points: The Building Blocks of Price Momentum

Swing points are pivotal points on a price chart that mark significant changes in momentum. These points are indicative of underlying shifts in supply and demand dynamics, offering valuable clues about the future direction of price movement.

Swing Highs

Swing highs are peaks in the price chart, signaling the end of an uptrend. They occur when demand weakens, causing sellers to gain dominance in the market, driving prices down.

Swing Lows

Swing lows are troughs in the price chart, marking the conclusion of a downtrend. Buyers regain control at these points, pushing prices higher as demand surges.

Identifying Swing Points: A Step-by-Step Approach

Accurately identifying swing points is crucial for successful trading. Follow these steps to pinpoint these critical market turning points:

-

Establish a Timeframe: Choose a timeframe that suits your trading style and risk tolerance. Swing points are more evident on longer timeframes (e.g., daily, weekly, monthly).

-

Use Candlestick Patterns: Candlestick patterns provide valuable insights into price action. Bearish reversal patterns (e.g., shooting star, bearish engulfing) indicate potential swing highs, while bullish reversal patterns (e.g., hammer, bullish engulfing) suggest swing lows.

-

Look for Volume: Volume plays a significant role in validating swing points. High volume during a swing indicates greater market conviction and a higher likelihood of a reversal.

-

Apply Indicators: Technical indicators such as moving averages, Bollinger Bands, and Stochastic oscillators can help confirm swing points and provide additional trading signals.

Profiting from Swing Points: Unleash the Power of Price Reversals

Once swing points are identified, traders can capitalize on their predictive power to enter and exit trades strategically:

-

Long Positions: When a swing low is identified, traders can consider entering a long position, anticipating an uptrend continuation.

-

Short Positions: On the flip side, spotting a swing high presents an opportunity for traders to open short positions, expecting a downtrend to unfold.

-

Trend Trading: Swing points can also guide trend trading strategies. Traders can ride the prevailing trend by entering positions aligned with the direction indicated by swing highs and lows.

Image: optionstradingiq.com

Expert Insights: Navigating Market Reversals with Confidence

“Identifying swing points is not merely a technical exercise but an art that requires a deep understanding of market dynamics,” says renowned forex trader and market analyst, Dr. Mark Peterson. “The ability to accurately pinpoint these crucial points can empower traders to execute profitable trades and mitigate risks.”

Actionable Tips for Success: Empower Your Forex Trading

-

Practice on a Demo Account: Refine your swing-trading skills in a risk-free environment before deploying real capital.

-

Study Historical Data: Analyze historical charts to identify recurring swing point patterns and improve your predictive capabilities.

-

Risk Management: Always adhere to proper risk management principles, including setting stop-losses and managing your overall trading portfolio.

How To Find The Swing In Forex Market

Conclusion: Mastering the Art of Swing Point Trading

Mastering the art of swing point identification is a transformative skill for forex traders. By embracing the insights and techniques outlined in this guide, you can gain a competitive edge in the market, increase your trading confidence, and unlock the full profit potential of price reversals.

Remember, the forex market is a dynamic and ever-evolving landscape. Continuous learning, practice, and a disciplined approach are key to thriving in this challenging but rewarding arena. Embrace the power of swing point trading and elevate your trading strategies to new heights.