As a seasoned forex enthusiast, I often find myself engrossed in analyzing the intricacies of the market, seeking patterns and trends that guide my trading decisions. This journey has instilled in me a deep understanding of the art of trend identification, a skill I’m eager to share with you in this comprehensive guide.

Image: www.learn-forextrading.org

Embarking upon this path, it’s imperative to establish a foundational understanding of the term “trend.” Within the realm of forex, trends represent prevailing movements within the market. These trends can manifest in three primary forms: uptrends, downtrends, and ranging markets. Uptrends are characterized by sustained price increases, while downtrends indicate consistent price declines. Ranging markets, on the other hand, occur when prices fluctuate within a specific range, devoid of any discernible trend.

Recognizing Trend Patterns: Unveiling the Secrets

Discerning forex trends requires an adept eye and a thorough grasp of technical analysis techniques. One of the most widely employed indicators for trend identification is the Moving Average. This tool calculates the average price of a currency pair over a predetermined period, smoothing out price fluctuations and revealing the underlying trend.

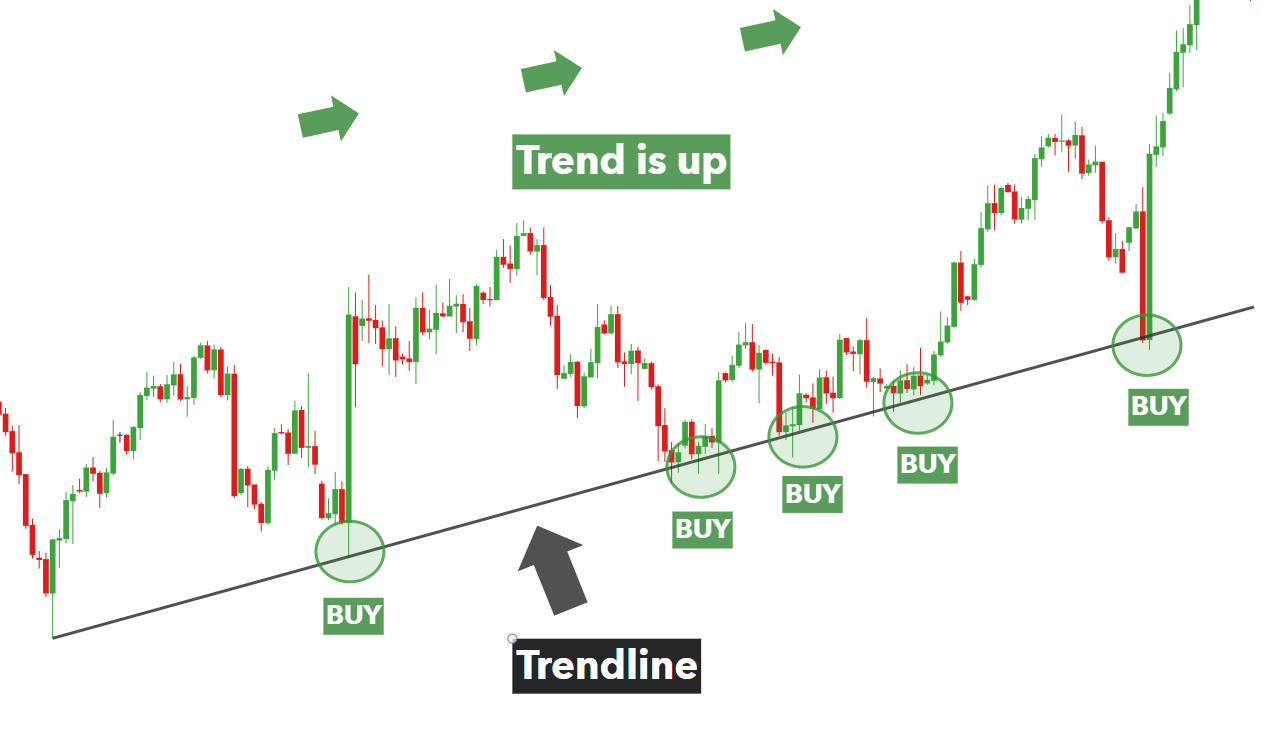

Another invaluable tool for trend analysis is the Bollinger Bands indicator, which creates two bands encasing the Moving Average. These bands provide insights into market volatility, aiding in the recognition of trend breakouts. Trendlines, drawn along price highs or lows, also serve as powerful indicators, signaling the continuation or reversal of a trend.

Pinpointing Forex Trends: A Step-by-Step Guide

- Identify the prevailing trend: Begin by determining the overall market direction using the aforementioned indicators. Assess whether the trend is up, down, or ranging.

- Discern trend strength: Evaluate the slope and duration of the trend. A steep slope indicates a strong trend, while a shallow slope suggests a weaker trend.

- Confirm the trend: Seek confirmation from other technical indicators or chart patterns that corroborate the existence of the trend.

- Anticipate potential reversals: Monitor candlestick patterns, such as engulfing patterns and inside bars, which may signal impending trend reversals.

- Implement a trading strategy: Armed with this knowledge, formulate a trading strategy that aligns with the identified trend. Consider strategies such as trend following, countertrend trading, or range trading.

By mastering these techniques, you will equip yourself with a powerful arsenal for discerning forex trends, empowering you to navigate the complexities of the financial markets with greater confidence and precision.

Expert Insights and Trusted Tips

In addition to the aforementioned technical indicators, experienced forex traders often rely on other strategies to identify and capitalize on trends. These include:

- Trendlines and Support/Resistance Levels: Identifying key support and resistance levels, coupled with trendlines, can provide valuable insights into trend continuation and potential reversal points.

- Price Action Trading: This approach involves meticulously analyzing price movements, without relying heavily on technical indicators, to discern the prevailing trend and make informed trading decisions.

- News and Economic Data: Staying abreast of economic news and events can significantly influence currency values and provide valuable clues on potential trend shifts.

By incorporating these strategies into your trading arsenal, you will enhance your ability to identify and exploit forex trends, increasing your chances of trading success.

Image: asapmaid.blogspot.com

FAQs: Demystifying Forex Trends

- Q: What is the difference between a trend and a trendline?

A: A trend refers to the prevailing market direction, while a trendline is a graphical representation that connects a series of price highs or lows, indicating the continuation or reversal of the trend.

- Q: Can trends last forever?

A: Trends are not perpetual and will eventually reverse. The duration of a trend depends on various factors, including market sentiment, economic conditions, and geopolitical events.

- Q: How do I identify trend reversals?

A: Monitor for candlestick patterns such as double tops/bottoms, head and shoulders patterns, and divergences between price action and technical indicators, which may signal impending trend reversals.

How To Find A Trend In Forex

Conclusion

Unlocking the secrets of forex trends empowers traders with a profound understanding of market movements, enabling them to make informed trading decisions and navigate the financial markets with greater confidence and accuracy. Whether you are a seasoned pro or just starting your forex journey, embracing the techniques outlined in this comprehensive guide will propel your trading endeavors to new heights.

Are you ready to embark on this exciting odyssey of trend identification in the captivating world of forex? Let us delve deeper into the intricacies of this topic. Engage with our experts in the comments section below and share your insights and experiences. Together, let us conquer the forex markets.