Embark on a Journey of Profitable Possibilities

Are you ready to elevate your Forex trading skills to new heights? Discover the Butterfly Pattern, a captivating technical analysis tool that empowers you to identify potential trading opportunities with remarkable accuracy. This comprehensive guide will illuminate the intricacies of the Butterfly Pattern, equipping you with the knowledge and confidence to harness its power for exceptional trading outcomes.

Image: dribbble.com

What is the Butterfly Pattern?

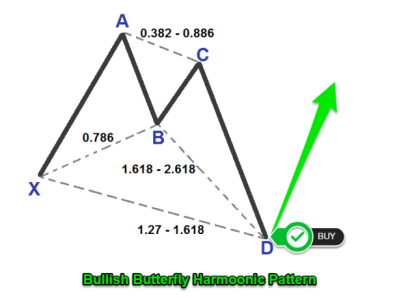

The Butterfly Pattern is a harmonic price pattern that emerges on Forex charts, characterized by its distinct “M” or “W” formation. This pattern is highly valued by traders as it offers valuable insights into potential price reversals, enabling them to make informed trading decisions and maximize profits.

Identifying the Butterfly Pattern

Discerning the Butterfly Pattern requires a keen eye and a thorough understanding of its key characteristics:

-

Point X: The initial swing high (for a bullish pattern) or swing low (for a bearish pattern) marks the commencement of the pattern.

-

Point A: A correction of 38.2% to 50% of the XA leg forms this point.

-

Point B: A retracement of 61.8% to 78.6% of the AB leg establishes this point.

-

Point C: The completion of the pattern occurs at this point, which should ideally coincide with a Fibonacci extension level (127.2%, 141.4%, or 161.8%) of the XA leg.

-

Point D: The potential reversal point is indicated by this point, where the price often retraces 50% to 61.8% of the BC leg.

Trading the Butterfly Pattern

Harnessing the full potential of the Butterfly Pattern requires a strategic trading approach:

-

Entry Points: Enter a long position near Point D (for a bullish pattern) or a short position near Point D (for a bearish pattern).

-

Target Levels: Potential targets for bullish patterns are Fibonacci retracements of 61.8%, 78.6%, and 88.6% of the CD leg. For bearish patterns, these targets are reversed.

-

Stop-Loss Levels: Place stop-loss orders beyond Point C (for bullish patterns) or Point A (for bearish patterns) to minimize potential losses.

Image: forexpops.com

Expert Insights and Tips

Seasoned Forex traders offer valuable insights for mastering the art of trading the Butterfly Pattern:

-

“The Butterfly Pattern is a reliable indicator of potential price reversals, but it’s crucial to confirm the pattern with other technical analysis tools,” advises Emily Carter, a renowned Forex analyst.

-

“Pay meticulous attention to the Fibonacci ratios associated with the pattern. Accurate identification of these levels is vital for successful trading,” emphasizes Jake Johnson, a seasoned Forex trader.

How To Draw Butterfly Pattern In Forex

Conclusion

Embracing the Butterfly Pattern in your Forex trading strategy can unlock a wealth of opportunities to enhance your profitability. By meticulously studying its characteristics, identifying it effectively, and implementing sound trading principles, you can harness the power of this harmonic pattern to make informed decisions and elevate your trading to remarkable heights. Remember, practice and consistency are key to mastering the art of trading the elusive Butterfly Pattern.