Title: Swing Trading in Forex: A Journey to Consistent Profits

Image: dogpoliz.weebly.com

Introduction:

In the bustling realm of financial markets, where fortunes are made and lost in a matter of seconds, there exists a trading strategy that empowers the patient and the discerning: swing trading. With its ability to harness price fluctuations over multiple days or weeks, swing trading has emerged as a powerful tool for traders seeking consistent profits. Embark on this journey, and empower yourself to conquer the complexities of forex trading and unlock the financial freedom that awaits.

Understanding Swing Trading

Swing trading, unlike its fast-paced counterparts like scalping or day trading, adopts a more measured approach. Traders identify market trends and ride the wave of price swings, holding positions for periods ranging from a few days to several weeks. By capitalizing on the ebb and flow of market cycles, swing traders strive to maximize profits while minimizing risks.

Fundamental Concepts of Swing Trading

The first step towards mastering swing trading lies in grasping its fundamental concepts. Technical analysis, the art of interpreting chart patterns and indicators to predict future price behavior, forms the backbone of a swing trader’s arsenal. Indicators like moving averages, support and resistance levels, and candlestick patterns provide valuable insights into market sentiment and potential price reversals.

Market Analysis for Swing Traders

Before placing any trades, swing traders conduct thorough market analysis to assess market trends and identify potential swing opportunities. By studying charts and considering fundamental factors, such as economic data and global events, traders gain a comprehensive understanding of the market landscape and can make informed trading decisions.

Risk Management in Swing Trading

Managing risk is paramount to long-term success in swing trading. Swing traders employ various strategies to minimize potential losses, including placing stop-loss orders to limit downside risks and using leverage cautiously. By understanding and implementing effective risk management techniques, traders can safeguard their capital and preserve their hard-earned profits.

Expert Insights: Mastering Swing Trading

Seasoned swing traders have honed their skills through years of experience and countless trades. Seek their wisdom to accelerate your own trading journey. Attend webinars, study expert strategies, and engage in online forums to gain valuable insights from those who have navigated the markets with success.

Actionable Tips for Swing Trading

-

Identify market trends: Use technical analysis to determine overall market direction and align your trades accordingly.

-

Plan your trades: Define clear entry and exit points for each trade based on technical signals and market analysis.

-

Manage your risk: Implement stop-loss orders and use leverage responsibly to protect your capital.

-

Trade with patience: Swing trading requires patience and discipline. Avoid chasing after every move and stay focused on your long-term trading plan.

Conclusion:

Swing trading in forex presents a tremendous opportunity for those who seek financial success. By embracing the concepts outlined in this guide, you can unlock the potential of this powerful trading strategy. Remember, the path to consistent profits is paved with knowledge, discipline, and a relentless pursuit of excellence. Embrace the journey, master the art of swing trading, and let the markets guide you towards financial freedom.

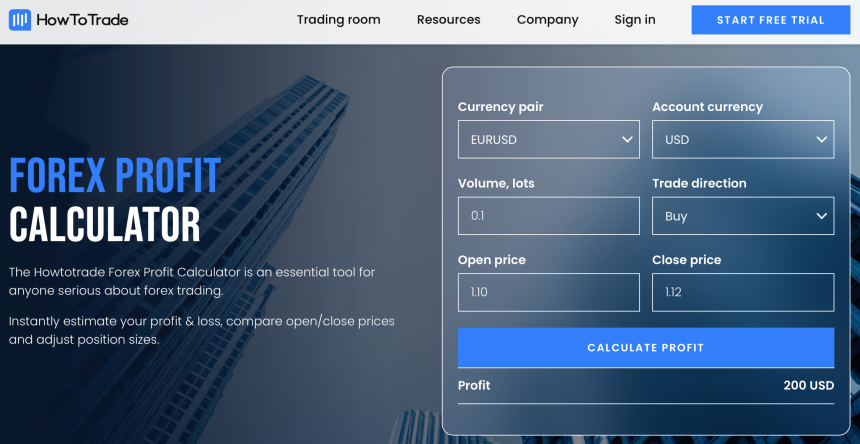

Image: howtotrade.com

How To Do Swing Trading In Forex Pdf