Introduction

Image: www.equiti.com

In the dynamic world of finance, forex trading has emerged as a lucrative opportunity for investors seeking both profits and the thrill of market action. Foreign exchange (forex) trading involves buying and selling currencies, and the National Stock Exchange of India (NSE) has played a pivotal role in making this exciting avenue accessible to Indian traders. In this comprehensive guide, we will delve into the intricacies of forex trading on NSE, providing you with the knowledge and insights to navigate this exhilarating market successfully.

Forex Trading on NSE

The NSE, India’s leading stock exchange, introduced forex trading in 2008. This move opened up new avenues for investors and traders to participate in the global currency markets. On the NSE, forex trading is conducted through currency pairs, where one currency is bought while another is sold. The exchange offers several currency pairs, including USD/INR, EUR/INR, GBP/INR, and JPY/INR.

Benefits of Forex Trading on NSE

Forex trading on NSE offers numerous advantages for Indian traders:

-

Transparency and Regulation: The NSE is a highly respected and transparent exchange that ensures fair and safe trading practices. It is regulated by the Securities and Exchange Board of India (SEBI), which provides an additional layer of protection for traders.

-

Accessibility: The NSE’s online trading platform makes forex trading convenient and accessible from anywhere in India. Traders can execute orders, monitor market movements, and manage their accounts remotely.

-

Liquidity: The NSE boasts high liquidity in forex pairs, which ensures that traders can enter and exit positions quickly and efficiently. This liquidity reduces the risk of slippage and improves overall trading conditions.

-

Leverage: NSE allows traders to leverage their positions, which means they can take on more significant trades with a smaller amount of capital. However, it is crucial to use leverage responsibly and within one’s risk tolerance.

How to Start Forex Trading on NSE

To start forex trading on NSE, you will need to:

-

Open a Demat and Trading Account: You will need a Demat account to hold your shares and a trading account to execute trades. Several banks and brokers offer these accounts; choose one that meets your trading needs and risk appetite.

-

Choose a Trading Platform: The NSE offers a user-friendly online trading platform that allows you to trade forex pairs and access market data.

-

Understand Currency Pair Analysis: Before entering a trade, it is crucial to analyze the underlying currency pair. Consider factors such as economic data, political events, and technical indicators.

-

Place an Order: Once you have analyzed a currency pair, you can place an order on the NSE platform. You can choose from various order types, including market orders, limit orders, and stop orders.

-

Monitor and Manage Your Positions: Regular monitoring of your forex positions is essential. Adjust your strategy as needed to manage risk and enhance your trading performance.

Expert Insights and Actionable Tips

-

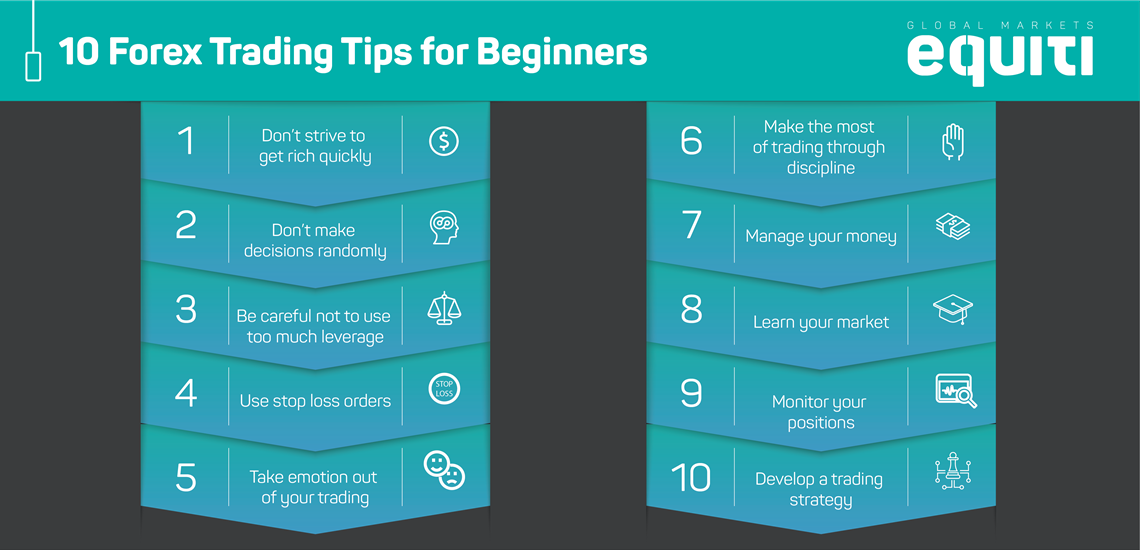

Start Small: Forex trading can be volatile; starting with a small amount of capital allows you to learn and become comfortable with the market before committing larger sums.

-

Educate Yourself: Continuously update your knowledge about forex trading, economic events, and global financial markets. This will improve your decision-making and enhance your overall understanding of the dynamics of forex trading.

-

Manage Risk Effectively: Risk management is paramount in forex trading. Use stop-loss orders to limit potential losses and employ other risk mitigation strategies.

-

Stay Disciplined: Forex trading requires discipline and emotional control. Do not make impulsive or irrational decisions based on fear or greed.

Conclusion

Forex trading on NSE provides an opportunity for traders to capitalize on currency market fluctuations. With the NSE’s transparent platform, high liquidity, and regulatory framework, Indian traders can access a global market from the comfort of their homes. By understanding the market dynamics,

Image: wallpapercave.com

How To Do Forex Trade In Nse