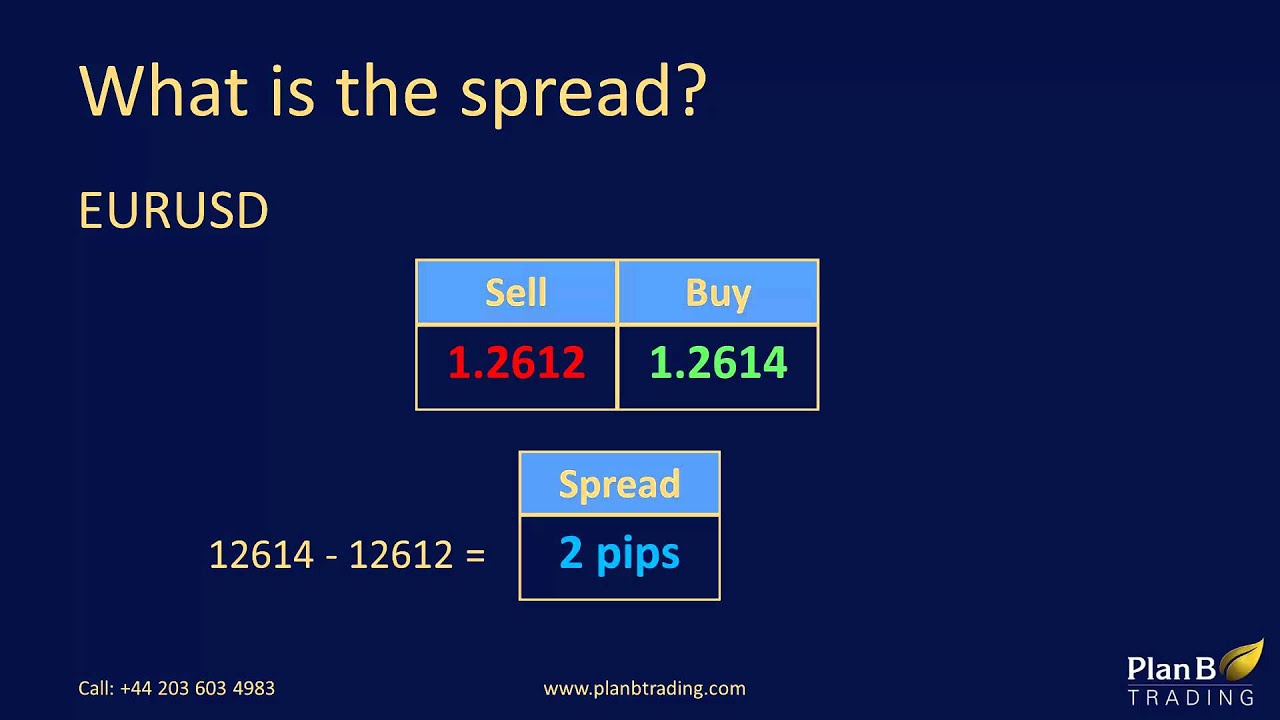

Forex trading is a thrilling and potentially lucrative venture, yet it’s often overshadowed by the specter of high spreads. These spreads, the difference between the bid and ask prices, can silently eat into your profits over time.

Image: imagens1280.blogspot.com

However, with the right strategies and a thorough understanding of market dynamics, you can effectively navigate the complexities of high spread forex trading and emerge victorious.

Factors Contributing to High Spreads

Market Volatility

When the market is experiencing significant volatility, liquidity dwindles. Spreads widen as market makers adjust prices to reflect the increased uncertainty.

Trading Hours

During off-hours or periods of low trading activity, liquidity declines, leading to wider spreads. For optimal conditions, trade during peak trading hours.

Image: cloudzy.com

Currency Pairs

Less popular currency pairs tend to have wider spreads due to their lower liquidity. Opting for highly traded pairs like EUR/USD or GBP/USD offers tighter spreads.

Account Funding

Using accounts with minimal funding can result in higher spreads. Forex brokers often offer more favorable spreads to traders with larger account balances.

Navigating High Spreads

Choosing the Right Broker

Selecting a reputable broker with low spreads is paramount. Compare multiple brokers and choose the one that aligns with your trading style and spread requirements.

Trading Strategies

Scalping, a short-term trading strategy that capitalizes on small price movements, can be effective in high spread environments. Avoid holding positions for extended periods to minimize spread costs.

Market Analysis

Keep abreast of market conditions. By understanding market trends and volatility levels, you can anticipate potential spread movements and plan your trades accordingly.

News and Events

Monitor economic indicators, central bank announcements, and political events that may impact currency prices. Trading during these times can result in wider spreads.

FAQ

Q: Why are spreads different for different currency pairs?

A: Liquidity plays a crucial role. Popular pairs, such as EUR/USD, have higher liquidity, leading to tighter spreads.

Q: What is the impact of trading hours on spreads?

A: Trading during peak trading hours ensures greater liquidity and narrower spreads.

Q: Can I negotiate spreads with my broker?

A: In some cases, yes. Contact your broker to inquire about their spread negotiation policies.

How To Deal With High Spread Forex

Conclusion

Dealing with high spread forex poses challenges, but armed with the right strategies, you can overcome these obstacles and boost your trading performance. Remember to choose the appropriate broker, implement effective trading strategies, and stay informed about market conditions.

Are you interested in further exploring the dynamics of high spread forex trading? Share your thoughts and questions in the comments below.