Introduction:

Image: tradingstrategyguides.com

The foreign exchange (forex) market presents traders with a vast array of currency pairs to choose from, each with its own unique characteristics and trending patterns. Identifying the right currency pair for your trading strategy is crucial for success in the forex market. This article will provide insights into selecting trending currency pairs, empowering you to make informed decisions and maximize your trading potential.

Navigating the Forex Market

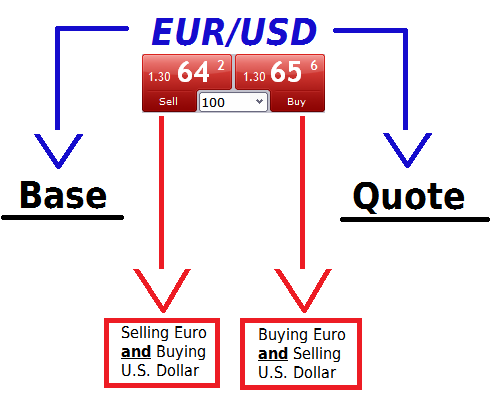

The forex market operates 24/5, facilitating the exchange of currencies around the globe. Its decentralized nature and high liquidity make it an attractive destination for traders seeking profit in the dynamic currency exchange ecosystem. Currencies are quoted in pairs, indicating the relative value of one currency against another. For instance, the EUR/USD pair represents the exchange rate between the euro and the US dollar.

Choosing the Right Currency Pair

Selecting the right currency pair for trading requires consideration of several factors. Volatility, liquidity, and news events can significantly impact currency pair behavior and ultimately determine your trading success.

-

Volatility: The volatility of a currency pair refers to its price fluctuations over time. Pairs with high volatility offer significant profit potential but also carry increased risk. Traders seeking quick gains may prefer volatile pairs, while those seeking steady returns might opt for less volatile options.

-

Liquidity: Liquidity measures the ease with which a currency pair can be bought or sold without affecting its price. High liquidity pairs experience steady flows of trades and minimal price slippage, making them suitable for both short-term and long-term trading strategies.

-

News Events: Economic and political news events can significantly impact currency pair trends. Traders should monitor financial news sources and economic indicators that may influence their chosen pairs. Major events such as central bank announcements, economic reports, and political instability can trigger rapid price movements.

Identifying Trending Currency Pairs

Identifying trending currency pairs involves analyzing their historical and real-time behavior. Technical and fundamental analysis tools can provide insights into potential trends.

-

Technical Analysis: Traders use technical analysis to identify patterns, trends, and support and resistance levels within currency pair price charts. Indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) can help identify trending pairs and predict their future direction.

-

Fundamental Analysis: Fundamental analysis examines economic and political factors that may influence currency pair values. Interest rates, GDP growth, trade imbalances, and inflation rate are key economic indicators that affect currency values. Traders should consider fundamental factors alongside technical analysis for a comprehensive understanding of trending currency pairs.

Image: financeillustrated.com

Top Trending Currency Pairs

Based on historical and current market conditions, the following currency pairs are frequently observed to exhibit strong trending patterns:

-

EUR/USD: The euro and the US dollar are the most traded currencies globally, creating a highly liquid and volatile pair. This pair offers ample opportunities for both scalping and long-term trading.

-

USD/JPY: The US dollar and the Japanese yen are subject to economic and geopolitical factors, making it a potentially rewarding pair for trend traders. The USD/JPY’s lower volatility compared to other major pairs suits conservative traders.

-

GBP/USD: The British pound and the US dollar pair is influenced by political and economic events in the UK and US. Brexit’s impact on the GBP/USD has made it a popular choice for trend following traders.

-

AUD/USD: The Australian dollar and the US dollar pair are influenced by the Australian economy and commodity prices. Australia’s strong trade ties with China make the AUD/USD sensitive to global economic developments.

-

USD/CAD: The US dollar and the Canadian dollar pair is impacted by oil prices and economic data from both countries. This pair offers moderate volatility and is suitable for medium-term trading strategies.

How To Choose Currency Pair Trending On Forex

Conclusion

Choosing the right currency pair for trending is essential for maximizing success in the forex market. By considering volatility, liquidity, news events, and technical and fundamental analysis, traders can identify currency pairs that align with their trading goals and risk tolerance. The top trending currency pairs discussed in this article provide a starting point for further research and analysis. Remember, market conditions can change rapidly, and traders should constantly monitor and adapt their currency pair choices accordingly.