As a seasoned Forex trader, understanding the market’s daily movements is crucial for making informed decisions. The daily high and low percentage values provide valuable insights into the volatility and potential direction of currency pairs.

Image: www.best-metatrader-indicators.com

Checking the daily high and low percentage allows you to gauge the market’s overall sentiment and identify potential trading opportunities. Whether you’re a beginner or an experienced trader, this guide will equip you with the knowledge to effectively monitor and analyze these key indicators.

Understanding Daily High and Low Percentage

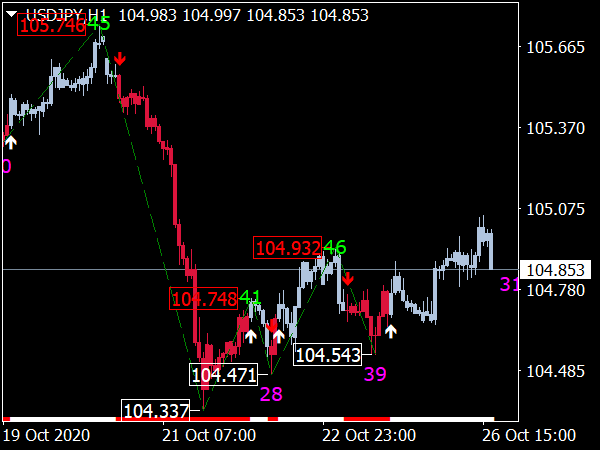

The daily high and low percentage represents the maximum and minimum values that a currency pair reaches within a trading day. It’s calculated as a percentage change from the closing price of the previous day:

- Daily High Percentage = ((Highest Price – Previous Close) / Previous Close) x 100

- Daily Low Percentage = ((Lowest Price – Previous Close) / Previous Close) x 100

These percentages indicate the extent of price movement in either direction during the day.

How to Check Forex Daily High and Low Percentage

There are several ways to check the daily high and low percentage for Forex pairs:

- Trading platforms: Most online trading platforms provide real-time data, including daily high and low percentages.

- Forex websites: Dedicated Forex websites offer comprehensive market data, including historical and real-time daily high and low percentages.

- Currency charts: Forex charts typically display the daily high and low values for a specified time period, allowing you to track historical price movements.

Tips for Analyzing Daily High and Low Percentage

When analyzing the daily high and low percentage, consider the following tips:

- Context is key: Always interpret the percentage values within the context of the overall market sentiment and economic news.

- Identify volatility: High percentage values indicate significant price fluctuations, while low percentages suggest a more stable market.

- Look for trends: Consecutive days with high or low percentage values can signal a trend.

- Confirm with other indicators: Combine the daily high and low percentage with other technical indicators for a more comprehensive analysis.

Image: nihoyuyipe.web.fc2.com

FAQs on Forex Daily High and Low Percentage

- Why is it important to check daily high and low percentage?

Daily high and low percentage provides insights into market volatility and potential trading opportunities.

- How often does the daily high and low percentage change?

Daily high and low percentage is calculated for each trading day and updates in real-time.

- What are some common trading strategies that use daily high and low percentage?

Range trading, breakout trading, and trend following strategies incorporate the daily high and low percentage to identify trading opportunities.

How To Check Forex Daily High And Low Percentage

Conclusion

Monitoring and understanding the daily high and low percentage is an essential skill for successful Forex trading. By utilizing the tips and techniques discussed in this article, you can effectively check and analyze these key indicators to make more informed trading decisions. Remember, the topic we are reading is “how to check forex daily high and low percentage,” are you interested in this topic?